ISP is the key

Whatever the pro coal lobby thinks about the National Energy Guarantee (NEG), it’s going to work itself into a full lather when it realises the implications of the forthcoming Integrated System Plan (ISP).

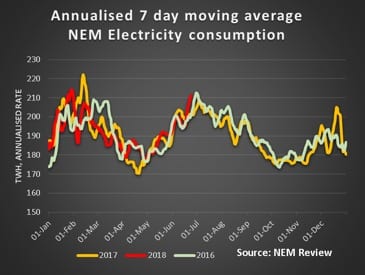

That’s due to be released in the next week or so. It has many, many implications, but perhaps the most critical will be how to manage the investment in an era of flat consumption.

Of course, electric vehicles could, over time, boost consumption and thereby make all the required investment easier, but – naturally – we don’t have an EV policy.

To put a dimension on this, Australian vehicles travel about 250 billion kms per year. If we work on 19 kilowatt hours per 100 km for an EV, that implies 100% replacement would be around 130TWh. Since that includes West Australia, it’s about 45% of current electricity demand.

Looked at another way, there are about 450,000 new vehicle sales a year driving on average 13.5 000km each per year for about 3TWh of electricity if they were all electric. So at our current pace its going to take a while ….

So, leaving that aside we need to manage the transmission investment and the new plants to meet the Queensland and Victorian renewable targets, and the coal replacement in NSW against flat demand.

That’s even after we agree on the ISP. Fortunately, the ISP won’t require COAG to come on board, but it will required the AEMC to dump its antiquated RIT-1 test for new interconnectors.

Let’s hope the new AEMC commissioners can help AEMC chairman John Pierce finally join the 21stcentury.

China

May statistics were released for China last week. The investment banks are divided about the outlook for China. There is tightness in the China banking sector but there is ongoing property growth. Even in China you can’t have both for an extended period of time.

Your analyst’s focus remains on one key indicator. New floorspace started. When this is growing China’s industrial economy will continue to move forward, cement, aluminium, petrochemicals all find markets in construction. Meanwhile thermal electricity production is growing and carbon emissions with it.

The market action

We have made changes to our data:

FY22 base load futures have been added to the summary table. As Liddell closes in FY22 you probably want to keep an eye out for the NSW futures price that year.

It’s been in our chart for a while and what we notice is that the NSW price is now just $4/MWh below the South Australian price.

We plan to write more about energy v capacity market designs. As a first step now publish the weekly cap prices for the NEM regions.

In the interests of space this is just a chart to start with. The chart speaks for itself, at least to start with.

We will add some interpretation later. Caps are only quoted by the ASX out to 2021 but baseload futures are to 2022. Go figure.

We have added spot LNG prices, to the extent that Factset carries them.

These seem to represent the Japanese LNG import price. We are still learning what this data actually represents but it’s safe to say that adjusted for transport costs (the net-back price) this is what domestic gas users in Australia have to compete with to get an LNG manufacturer’s attention.

These kind of prices would not fill me with joy if I was looking to buy from an Australian LNG importer.

Gas prices rising

The main feature of a colder week has been rising spot gas prices. These are now at last year’s levels (fig 15). Despite some low spot prices in QLD overall the spot market was above last year’s level driven by higher consumption across each region in the NEM.

As we remark else where futures and cap prices in the out years in South Australia, traditionally the expensive State are now very close to NSW and that’s despite NSW’s ability to import cheap power from QLD.

REC prices are still being quoted for the out years but you would have to be an optimist to think you could trade much in those years.

The gap between US and Australian bond rates has widened marginally. It’s the coal price though, particularly in A$ that is most relevant to electricity markets.

The spot price is more than 2.5X higher than the numbers used by AEMO in its ISP assumptions work sheet.

Think about it….. The AEMO numbers are quoted in $/GJ, whereas we show Japan quality (higher than South Korean, and signicantly higher than Australia) in $/t. How many GJ per ton? Answers on a postcard please.

Share Prices

We’ll be adding in some listed solar fund(s) here soon. However, being infrastructure yield based investments share prices will tend to mostly move with interest rates and deal flow. Ie the prices won’t change much of the time.

Of course, keen readers will appreciate that the 7.6% yield quoted by New Energy Solar as the acquisition metric for the Manildra PV farm is not its internal rate of return [IRR] The yield is the short term project yield defined as revenue less opex.

It excludes depreciation, interest and tax.

However, it only goes out to 2030. To get to the value of the project you really need to factor in your estimate of the post 2030 revenue.

We very much doubt that this project will be getting $80 MWh in real terms post 2030.

Volumes

Baseload futures, $MWh

REC prices

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.