ITK sincerely wishes the Federal Government would grab the near term fruit just waiting to be picked in terms of electrification of transport, and even more importantly building the social license and providing the helping hand required to make the transition outlined in the draft 2022 Integrated System Plan stay on track.

But this apparently is not a task worthy of the “smarter than Turnbull” talents of the Minister for Energy and Emissions Reduction, Angus Taylor. No, he is reserved for promoting various forms of hydrogen, speculating on oil in the US with taxpayer money, and other tasks known mainly to his chosen circle.

And so it is to hydrogen we turn.

Joe Aston, who is, along with Adele Ferguson, in my unlikely to be widespread opinion, the finest investigative financial journalist working in Australia today, wrote of Andrew Forrest’s green hydrogen vision:

“Forrest’s plan to save the world by turning Fortescue Metals into the world’s largest producer of green hydrogen energy, which doesn’t exist today, is right out there on the fringes of plausible aspiration.

“The Fortescue founder announced more than $200 billion of projects in developing countries with no committed funding and no regulatory or planning approvals. Then he announced the sale of the non-existent energy from these potential projects to customers who’ve signed nothing but a press release.”

Inadvertently, Aston revealed the dilemma of green hydrogen to an analyst.

Hydrogen has the backing of luminaries like Alan Finkel, of governments all over the world and there is a massive rush to build spreadsheets and demos by many large companies and entrepreneurs alike.

On the other hand the economics look presently hopelessly out of the money. Sure, solar and wind are also out of the money but the whole world didn’t rush in. Still fools rush in where angels fear too tread.

Having seen the success of solar and wind and now batteries, the hydrogen industry believes, probably with good reason, that costs will come down a lot. They will need to.

So when ITK looks at hydrogen the most important thing is the credibility of the consortium. And the most credible consortium is one with buyers of hydrogen and deep pockets hopefully backed by governments.

And that is what makes the Stanwell consortium with its plans for a hydrogen plant in the Gladstone area so interesting.

Queensland has a lot riding on renewable hydrogen

ITK suspects that Queensland has a lot riding on its hydrogen strategy. Recently, in response to a question, the Energy and Hydrogen Minister Mick de Brenni said in Parliament:

“I reiterate our commitment that there is no plan to close coal-fired power stations in Queensland. We will deliver on our commitment to achieve 50 per cent renewable energy by 2030. We will meet the target in the energy plan that we have announced to the House and outline exactly how we do that”

For the past 12 months Queensland is running at 19 per cent renewable energy, up about 3 per cent on the year before. Demand of about 62 TWh is flat.

Queensland has traditionally exported 3-4TWh, ie about 5% of production, to NSW, yet NSW is likely to reduce its imports as its 12GW (about 35 TWh) renewable energy plan kicks in. Despite coal closures in NSW there is a good chance NSW will, on balance, need less imports.

In simple arithmetic terms if Queensland demand is flat, then about 45 per cent of current coal fuelled electricity would have to go away to meet the 50 per cent renewable target.

But if we invoke say 30TWh of electricity demand to support green hydrogen and assume it’s all working by 2030, then that’s it, job done.

That 30TWh of electricity makes about 0.6 million tonnes of green hydrogen at 50 KWh/Kg, if I’ve done my sums right, and I’d advise readers to check.

Put another way that requires over 10,000 MW of renewable energy ($20 billion, give or take, plus a 4000MW electrolyser operating at something like 85 per cent capacity factor. And the point is there is an arguably credible consortium to do it.

Queensland has maybe the only bankable hydrogen project in Australia

The Stanwell consortium consists of Kawasaki, Marubeni, Kansai electric power, Iwatani, APA and Stanwell iself.

In this consortium Stanwell is the upstream VRE producer and operates the electrolyser, Iwatani likely does the hydrogen liquefaction, Kawasaki does the transport and the product goes to Marubeni and Kansai Electric Power.

Kawasaki and Iwatani have also signed MOUs with Fortescue, but it seems to me Stanwell, with the state government behind it, is likely in the strongest position.

The addition of Kansai, one of the biggest producers of electricity in Japan, is likely the final piece of the puzzle

If this consortium can meet its cost targets, the demand will be there. In my opinion this puts it in the box seat for renewable hydrogen projects in Australia.

This strength is further abetted by the relative closeness of central Queensland to Japan and the long history of Queensland supplying coal and some gas to Japan. It’s a tried and true relationship.

The Stanwell project timetable has a Final Investment Decision [FID] in 2022, with construction in the 2024-2026 time frame and startup in 2026.

Phase 1: 1 gigawatt of wind and solar

The first phase of the project is small in terms of changing the overall Queensland electricity situation with a 320MW electrolyser and 36.5kt of hydrogen. It’s also likely that to make the economics work this phase will be grid connected and the electricity will be grid electricity, i.e a significant portion coal provided.

Everyone understands that this is completely pointless in the medium term, after all no one is going to replace coal which has a cost in Japan of say A$5/GJ with hydrogen that has a cost of A$30/GJ unless there is a compelling reason.

And that reason is carbon. So as the renewable energy becomes available it replaces the grid electricity. But to make it happen initially some grid electricity is used. That keeps cost down because it gets the electrolyser capacity utilization high.

Phase 2: Starting 2030, a 3,500 MW electrolyser

This phase requires about 9GW of renewable energy. Clearly that’s a big, but attainable ask for Queensland in the Gladstone area, given its bound to require associated transmission support. Even so, Japan has a 2030 target of 3 million tonnes per year, so this project would be about 10%.

Then there is a phase 3 post 2030, which would double the whole thing.

Hydrogen transport

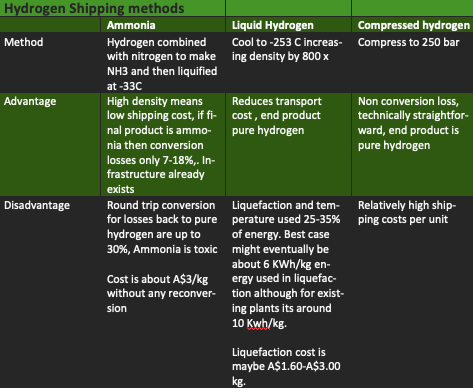

Green hydrogen is such a new business that the best way to use and transport it is still up for debate. It’s generally accepted that like almost everything to do with green hydrogen, transport is still very expensive. Never mind the embrittlement problem, the underlying issue is the low energy to volume ratio.

To remind readers the basic arithmetic is:

50 kWh of electricity to produce 1 kg of hydrogen

7 kg hydrogen to produce 1 GJ of energy

7 kg of hydrogen is about 80 cubic metres of gas volume.

When liquefied the density of hydrogen increases to about 71 kg/m3 which would allow a 120,000 m3 carrier to transport about 8500 metric tonnes of hydrogen or about 1200 TJ of energy before boil off losses.

Shipping hydrogen 4000 km to Japan

Kawasaki is building the world’s first purpose built liquid hydrogen carrier expected to be operational in a couple of years with a capacity of 120,000 m3. Cubic metres you say, I already have to deal with kg, TWh and metric tonnes and now you want to use cubic metres.

The internet tells me 1 kg of hydrogen is 11 m3. So basically 80 m3/gj, but liquefaction turns that on its head to be 70 kg/m3. A feature of the Suiso Frontier a 125,000 m3 liquid hydrogen carrier, is that the boil off hydrogen gas will be used to power the boat.

Japan offshore wind fuelled green hydrogen v Australian hydrogen

Any comparison requires many strong assumptions. We can look at the fuel cost:

On a fuel cost basis there is about a US$2/KG margin that Australia (QLD) has over domestic Japanese green hydrogen, on the assumption that Japan eventually gets its offshore wind act into full motion.

However, Queensland has to get its electrolyser capacity factor up, or have high unit capital costs at the electrolyser and potentially balance of plant level. So, in my opinion, you need wind as well as solar.

Stanwell has signed a “supply deal” with Acciona for the Aldoga 600MW solar farm. That’s tangible evidence of how real this project is.

One question for me is whether Japan domestically produced hydrogen needs to be liquified? If it was to be used for transport maybe it does.

If it was to be used in power production and steel production maybe it does not. If domestic produced hydrogen does not need to be liquified it will be cheaper than Australian hydrogen for consumption in Japan.

It is true that liquefaction in Japan is likely to have double the input fuel cost in Japan as it does in Australia. That’s because the 6-10 KWh of liquefaction energy required is going to be cheaper using US$25/MWh solar than US$70/MWh offshore wind.

If hydrogen costs can come down, imagine how much faster offshore wind costs in Japan could reduce

Japan’s energy costs have always been high relative to the world. Perhaps less so when using imported oil, but certainly the coal and gas energy is expensive. Nuclear must have been attractive but clearly is less so these days.

Electricity at the generator gate (busbar) in Japan is generally somewhere between A$110 /MWh and A$150/ MWh depending on coal and gas prices.

The best case for hydrogen in Japan when used as a fuel to replace either gas or coal is about US$4 (very optimistic) to US $5/Kg.

That’s around US$28/gj – US$35/gJ as energy, well over double the cost of gas, maybe 10X the price of coal and more importantly also likely to be well above the cost competitor countries are paying for energy.

A gas generator is about 7 GJ of energy/MWh and that works to over US$200/MWh for hydrogen fuel. Not a pleasant prospect.

By contrast offshore wind both fixed and floating will likely be under US$70/MWh and maybe under US$60/MWh by 2030. There is enough resource to solve a lot of Japan’s future energy needs.

There is enough offshore wind resource to supply Japan’s total energy needs many times over. As every resource investor should know, for any commodity from lithium to gold the potential resource invariably is a multiple of what can be produced in practice.

Even so, in ITK’s opinion Japan is staring energy independence in the face, and a potentially more relatively competitive energy cost than at any time in the past 100 years. If hydrogen costs can come down as much as the industry believes, how much could offshore wind costs come down?

A few thanks

2021 was yet another busy year in the energy transition. I sit in the privileged position of making a contribution in RenewEconomy and would like to thank Giles Parkinson for his editing efforts.

Over more than 40 years of professional analysis no one has successfully edited my work to remove all the typos, unfinished sentences, grammar errors and that’s even before we get to the logic and spreadsheet issues. But thanks to Giles the product is better than it might have been.

I would also like to thank the many industry executives who answer the phone, or respond to emails. No-one has a mortgage on industry knowledge and many have things of value to contribute.

The Renewable energy industry is an industry which perhaps provides rewards beyond the financial, although we still have to eat. Its nice to think we are all striving to make the world a better place for those that come after us. We in the industry, I like to think, take our job to make a difference and be good custodians seriously.

Most of all though I would like to thank Paul McArdle and the team at Global Roam. The most basic requirement of analysis is not an idea, rather its access and availability of quality data. Global Roam has electricity data as well organised and as accessible as its possible to get in Australia.