Andrew Forrest’s big green hydrogen play – Fortescue Future Industries – has been armed with a billion-dollar budget in 2022/23 as it seek to lock down a series of major deals that can lay the groundwork for the company’s hugely ambitious 2030 goals.

Forrest has committed to a stretch target of producing 15 million tonnes of green hydrogen a year by 2030, from a technology that has been barely deployed around the world till now. And despite a whole series of MoUs and project proposals and announcements, little has been set in concrete.

The most tangible asset is the hydrogen electrolyser factory that is being built in Gladstone, Queensland, in partnership with the US-based Plug Power, and captures both the soaring ambition of the group, and the uncertainty.

It will be the biggest factory of its type in the world, and will in effect double global production when it reaches its full capacity of 2GW a year. But like so much of the green hydrogen world, no contracts have been signed, although Fortescue is expected to be a major customer as it turns its other projects into reality.

Elizabeth Gaines, the CEO of FFI’s parent company Fortescue Metals, the massive and hugely profitable iron ore producer, said construction of the electrolyser factory at the Green Energy Manufacturing Centre in Gladstone should be complete by the end of the year.

“I think there’s going to be a relatively steady ramp (of production), it might be probably about 25 to 40% of that of that ultimate capacity, and there is demand for electrolysers,” she told media in response to a question from RenewEconomy on Thursday.

“They haven’t actually locked in the marketing of those electrolyzers yet, but as you know, we’ve already got seeing strong demand for renewable energy and green hydrogen as evidenced by the MOU with E.ON in Germany, and ultimately Fortescue will be a customer as we build out and develop those projects.”

The E.ON agreement is possibly the most significant to date of the FFI announcements, and is looking to deliver five million tonnes of green hydrogen to Germany, anxious for an alternatives to replace the Russian gas it had previously relied upon.

“The chief operating officer from E.OM was here recently and the message from E.ON is ‘can we do this quicker’. So there’s strong demand for green energy, and green hydrogen and the team are working hard to identify and advance those projects.”

Fortescue also revealed on Thursday that FFI will have a budget of $US600 million to $US700 million ($A1 billion) in 2022/23 to do just that, mostly made up of operating expenditure (up to $US600 million) that includes wages and project analysis, and $US100 million of capital expenditure.

The group already has a rapidly expanding team of more than 500, now led by the former head of GE Europe, Mark Hutchinson, with former RBA deputy governor Guy Debelle as CFO and AGL’s Andy Vesey in another major executive role.

Fortescue is also working on other key projects, including a possible 200MW electrolyser facility in Bell Bay in Tasmania, where other players including Origin and Grange Resources are also considering projects.

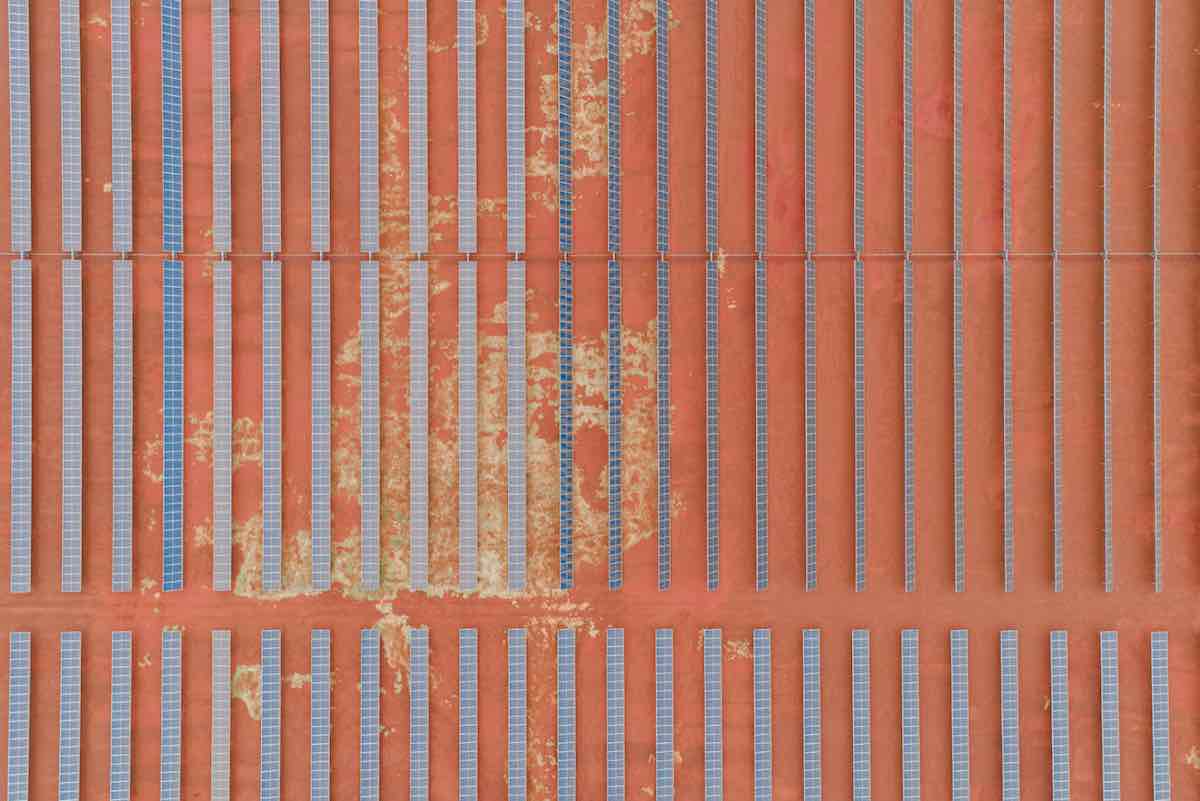

Work is also continuing on the Pilbara Energy Connectd project, which includes transmission infrastructure, the new 60MW solar plant at Chichester, battery storage and gas generation.

Gaines said 78 million litres of diesel had already been saved in the last financial year, including since the Chichester solar farm came online.

Fortescue is also working on other electrification projects, including its heavy haulage trucking fleet, and with the so-called Infinity train, which will use batteries, charged by the huge trains rolling down the hill from mine site to port, putting enough charge in the batteries to take the empty train back to the mine site.