#1 – Households that install solar panels save money

This is not universally true but is true for at least 39 countries according to a recent report from Deutsche Bank. These includes countries you might have heard of like Australia, France, Germany, Japan, Mexico, Spain, Turkey, China, India and certain US states. Importantly, these savings can be achieved without government subsidies so where there is financial assistance, the economic benefit for households is even better.

When critics question the affordability of unsubsidised solar power, they usually focus on the wholesale price of electricity where full depreciated coal-fired power plants produce very cheap electricity. However, the wholesale cost is not the delivered cost to the customer. Typically, the cost to produce electricity represents only 60% of a household’s bill with the rest made up of the cost to get the power to the home. As such, the delivered or retail price of electricity must be used in the analysis of the cost of rooftop solar because it has the advantage of incurring no delivery costs. When the cost of solar in a country matches the retail price of electricity, the country is said to have achieved “grid parity”.

Increasingly affordable solar power is driving unprecedented global demand that has resulted in annual growth of 43% over the past 10 years. Companies providing goods and services to meet this demand have a bright future.

Figure 1: Cumulative Global Solar Installations (Gigawatts)

#2 – Cost keeps falling

The rising cost of delivering electricity to households from conventional sources allows alternative solutions to compete; however, that is only half the story; the cost of alternatives (specifically solar) are also falling! The US Department of Energy’s Lawrence Berkeley National Labs (DoE) produces an annual report titled “Tracking the Sun” that updates the installed price of photovoltaics in the US. The latest report shows that the installed price of a residential system has fallen by 61% over the past 15 years. This has been echoed for larger installations as well resulting in an annual decline of between 6-8% per year for all sizes of solar.

Figure 2: Installed Price of Residential & Commercial Photovoltaics over Time (US$ per watt)

Preliminary data from the DoE for 2014 indicate the declining trend for all sizes of solar has continued and might have accelerated. We believe the reason for this accelerated cost decline is companies are starting to achieve economies of scale in the “soft costs” for a solar installation. These costs include marketing, system design, installation labour and permitting (but not manufacturing).

When a business can spread more costs over a fixed cost base, it is said to be achieving economies of scale. For example, if the business had one full-time sales representative who only sold one solar system a month then that one system would have to bear the full cost of that one sales rep. However, let’s say customers inundate the sales rep and the rep can convert 100 sales in a month, then the rep’s salary is spread over 100 sales instead of just one. In this way, the cost per sale has declined.

Previously, the manufacturing side of the cost equation had been the main driver for the declining installed cost of a solar system because manufacturers had achieved economies of scale coupled with technological breakthroughs. Increasingly going forward manufacturers will need to find additional cost reductions from refining their manufacturing process and technological advancements as there is little scope for additional scale gains. That said, companies continue to demonstrate that they can get the delivered cost of solar down. Grid parity is no longer the industry’s goal, rather solar manufacturers want to be the cheapest form of any power generation.

#3 – Solar stocks have been sold off due to the fall in oil

We have previously written about the recent link between the price of oil and the share price of solar companies here. To summarise, we believe the market is making the mistake that a falling oil price is bad for solar companies. Since we wrote that article, we have come across a report from Goldman Sachs that calculated the delivered cost of electricity from a natural gas-fired power station. While oil is hardly used to make electricity anymore, solar critics do point out that natural gas is a major form of power generation and the price of natural gas is influenced by crude oil. The strong relationship between oil and natural gas prices is true. However, the Goldman Sach reports shows that even assuming virtually free natural gas, the economics still favour rooftop solar in California, New Jersey, Massachusetts, Colorado and New York.

The recent underperformance of solar stocks represents a good buying opportunity for investors.

#4 – Financial policy support is mixed…..

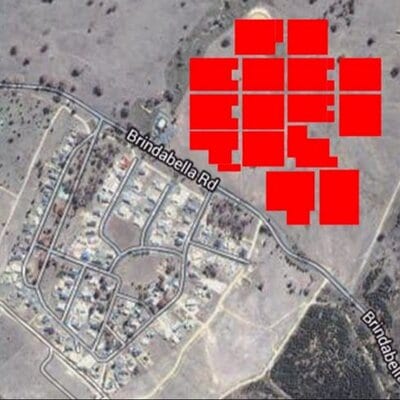

Admittedly global government policy support is mixed as demonstrated here in Australia where the debate over the Renewable Energy Target (RET) is paralysing the renewable energy industry. However, just as Australia’s review of the RET demonstrates the risk of changing government policy, the ongoing growth in solar rooftops across the country confounds the critics. Energex has just announced that 27% of detached homes in southeast Queensland now have solar on their roofs. Similarly, SA Power Networks recently reported that 23% of homes in South Australia have installed rooftop solar.

The unsubsidised economics of solar in this country are so good that households are increasingly going solar without much prompting from policy. Fiscal incentives to support solar are becoming increasingly unnecessary thus reducing policy risk for the entire solar industry.

#5 – ….but emissions regulations are a tailwind for demand

Government policy is increasingly becoming focused on reducing the emissions intensity of their respective economies. Whether it is the US Environmental Protection Agency’s proposed carbon pollution standard for new and existing power plants or the UK’s Department of Energy & Climate Change implementing the decarbonisation goals of the Energy Act 2013, governments are mandating cleaner energy sources. We are expecting the 2015 United Nations Climate Change Conference to be held in Paris in December to be a catalyst for greater uniformity in the global approach to tackling the challenges of climate change. Greater coordination between governments and a general acceptance of the need to reduce our aggregate emissions intensity would be a tailwind for the entire industry.

#6 – Two bull elephants in a herd of elephants

India announced that it would install 100 gigawatts of solar power by 2022. China announced it would build another 81 gigawatts of solar by 2020 matching India’s goal. To put those targets into context, the entire world as at the end of 2013 had only installed 139 gigawatts of solar according to the European PV Industry Association. The targets set by these two countries will make them the de facto leaders in the solar industry, but there are other gigawatt sized markets as well: these include Japan, UK, Germany, Italy, Romania, South Korea, US and Australia.

While yet to achieve gigawatt markets, African and other less developed countries are embracing solar in a fashion similar to their adoption of wireless telephony. Africa largely sidestepped the build out of a wired telecommunications network because it was cheaper and more efficient to leapfrog to wireless infrastructure. In a similar fashion, less developed countries are moving towards the “distributed generation” model where power is produced and consumed in the same place when there is not a well-developed centralised grid infrastructure. This saves the country from having to build out an expensive national distribution network but still be in a position to deliver electricity in an affordable fashion.

As countries move up the development ladder, they are adopting sensible strategies that avoid some of the redundant investments made by developed countries. Rooftop solar is becoming an integral part of the ‘grid of the future’ which should lead to solar becoming a global opportunity with more countries joining the gigawatt class market every year.

#7 – We are not running out of sunshine nor is it hard to find

Perhaps a silly statement but consider this: the world spends well over US$500 billion a year looking for oil and gas. Fossil fuels are a depleting resource and we need to keep finding more if we want to keep using it. Finding more is also very difficult, and when you do find some these days, it is very expensive to extract.

Alternatively, if your roof has a clear line of sight to the sky, you’re half way there. Naturally, clouds will impact the performance of your system but your panels are a resource you can draw on when it is available. Coal and other fossil fuels will still be needed in the short term to ensure a consistent level of supply, but their role is already being diminished. In time, battery storage will follow the same path as solar, and the next phase of the evolution of our power sector will occur.

Solar has a bright future and companies tied to this industry have only started to feel the market’s potential.

Natham Lim is Australian Ethical’s International Equities Portfolio Manage.