Overall, the Albanese government’s first full year budget is a measured and sensible one.

It rebuilds in-house government capacity across the board, such as: supporting the NaTHERS home building energy ratings scheme; Australian Carbon Credit Unit (ACCU) integrity; emissions measurement; the new Environment Protection Australia; National Reconstruction Fund authority and Net Zero Authority.

It includes financing the ACCC to combat greenwash, and also starts to replace expensive, mercenary consultants with a rebuilding of the public service capacity, as well as taking steps to restore some social equity via measures to look after those most in need.

The 2023 budget banks additional tax receipts from stronger terms of trade, higher employment and stronger corporate profitability, projecting a staggering near $300 billion reduction in net debt over the forecast period, showcasing the underlying power of the Australian economy and dramatically, potentially permanently, reducing the headwind of the annual interest cost, a deadweight on future generations.

While the Albanese government has been the beneficiary of temporarily surging commodity prices – reflected in the massive surprise of a $4.2bn 2022/23 surplus, a staggering $40bn turnaround in just six months – the scale of the budget repair task it inherited, and has now successfully commenced, should not be underestimated given the structural headwinds ahead, particularly whilst ensuring inflations current peak is cyclical, not locked in as structural.

This includes rebuilding the public service. It should be noted that PM Albanese, Treasurer Chalmers and the entire administration were handed a public service that had been chronically decimated by a decade of LNP mismanagement, outsourcing, jobs for mates and disdain for process.

Rebuilding the policy capacity foundation has been a key priority for the Albanese government, and is essential to good government, including responsible and balanced fiscal policy – the government’s key goal in last night’s budget.

The $4.2bn 2022/23 surplus – a massive fiscal balance improvement – carries forward to deliver a huge $300bn reduction in Australia’s federal government peak net debt over the forward estimates of $703bn by FY2027 (24.1% of GDP).

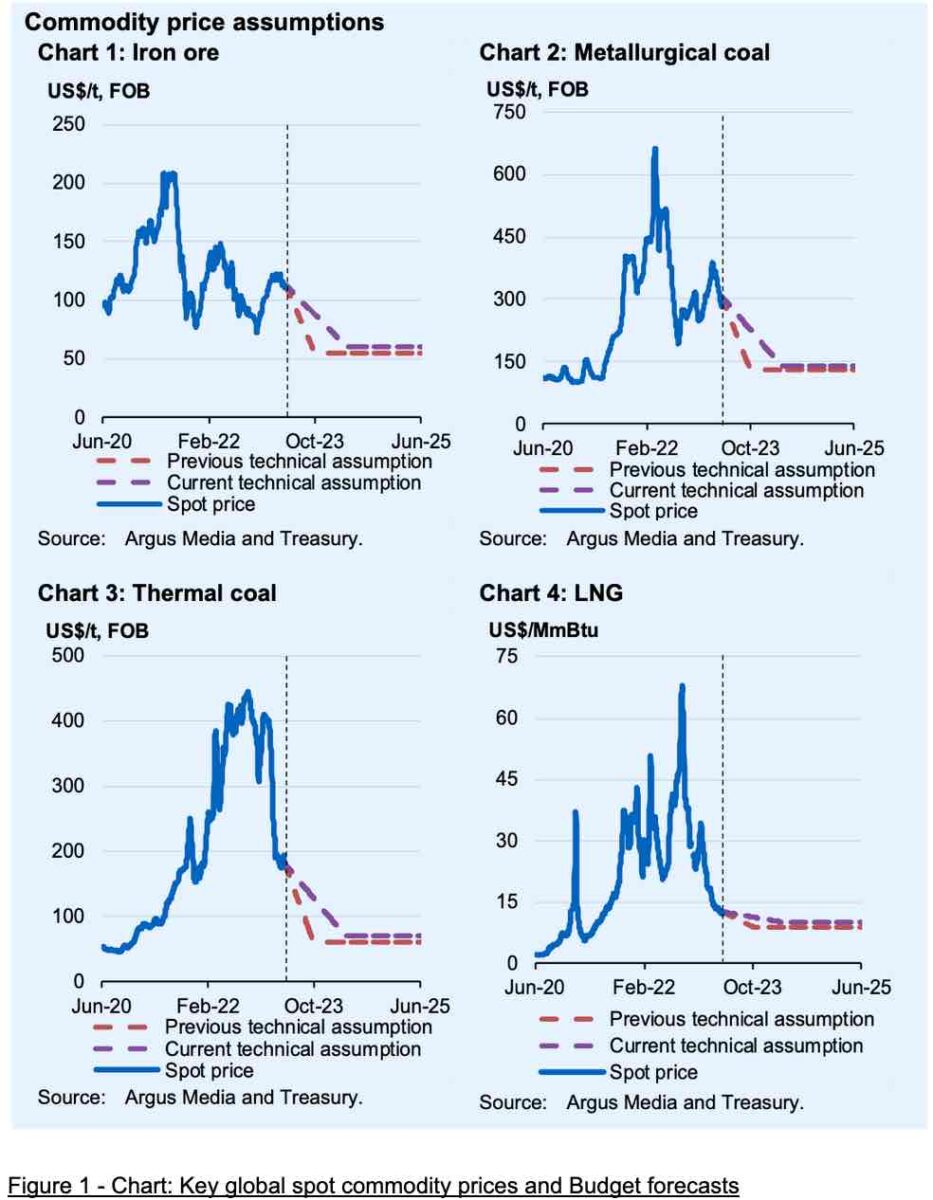

This provides a far more robust starting point in Australia’s fiscal position than was expected 6-12 months ago, notwithstanding the likely structural headwinds that will see an annual budget deficit resume, averaging $29bn pa over the forward estimates, as our terms of trade continue to normalise to long term rates reflecting rapid commodity price declines since the end of 2022 from unprecedented levels over the last two years, and as inflation pressures and stage 3 tax cuts hit.

However, the 2023 budget also works to alleviate some of the inflationary pressures to make them a temporary rather than permanent uplift, which would have threatened Australian economic growth and sustained energy sector-induced cost of living pressures.

The rapid decline in fossil fuel commodity prices globally of late (see Figure 1) is a welcome cost of living and inflation relief to all Australians, even as it signals an end to the war-profiteering by the largely foreign tax-haven based fossil fuel exporter cartel, which has systematically refused to share anything but a token of this windfall in compensation for the energy poverty they have inflicted on Australians.

On the climate and energy financing front, the gains were mixed, with funding for previously announced proposals, some important new announcements but also some missed opportunities given our massive once in a century opportunity to transform the Australian economy and drive investment, employment and value-added exports in the key zero emissions industries of the future.

The PRRT and multinational tax reform is token at best, the $1.3 billion funding of electrification of everything is a good start, but insufficient, and the $2 billion to support two to three green hydrogen demonstration projects at world scale is necessary to combat the US IRA subsidies.

Most of the other IRA responses like the $15bn National Reconstruction Fund, the $20bn Rewiring the Nation Fund and $1.9bn Powering the Regions Fund have already been previously announced. The $1.5bn in Commonwealth funding of energy bill relief previously flagged is sorely needed, but absent new top-up.

We examine each many energy aspect in more detail below:

Petroleum Resources Rent Tax (PRRT) and tax reform

Gross profits of Australian LNG exporters exceeded a massive $63bn in 2022/23. In this context, the PRRT changes announced prior to the budget release are a serious case of fiscal policy underreach.

The marginal reforms to the PRRT, under which producers will be restricted to writing off 90% of assessable income as a tax deduction, are designed to pull forward an extra $600m annually over the forward estimates, totalling $2.4bn (a pull forward, not an increase in total expected PRRT receipts over the long term).

Relative to the estimated 4.4% PRRT royalty share of revenue in 2022/23, the changes announced represent just a tiny 1% increased share to the taxpayer. This looks very pedestrian relative to the LNG export industry’s windfall war-profiteering and oversized contribution to Australian domestic energy price hyperinflation.

By contrast, the Queensland government’s Cameron Dick levied a seriously progressive royalty on coal exports – designed to deliver a return to the people of QLD off the back of surging prices – which is delivering royalties of 12%-20%. Even iron exports attract a 7.5% royalty.

That the gas industry has been gifted a discount on royalties (entirely misnamed as a superprofits tax) relative to every other mining sector in Australia, as it reaps war profits off our sovereign public assets while returning a relative pittance to tax coffers, speaks to the undue influence of the gas cartel and its vocal lobbying on public policy, and the overdue need for donation reform.

The far too modest PRRT reforms in this budget are a missed opportunity to deliver a substantial social dividend to the Australian people, limiting the government’s capacity to fund critically urgent social and energy transition programs, and undercutting the government’s claims to fiscal balance and responsibility.

At least this budget cans the residual funding from the previous government’s farcical ‘gas-fired recovery’ subsidy for the Beetaloo exploration, but disappointingly this is redirected into a $7m subsidy for a Future Gas Strategy.

We now call on the government to refocus attention on multinational corporates operating in Australia to ensure they pay at least some corporate tax here, particularly those fossil fuel global giants who have paid nothing over the last decade, even as they use our finite public resources for private foreign gain. It is disappointing to see not even a reference to this in the 2023 budget.

Additionally, it was disappointing that there was zero effort to cap the $9bn pa imported diesel fuel rebate. It should be remembered that this is bigger than all the renewables support in the federal budget.

National Net Zero Authority

The national Net Zero Authority is exactly what Australia needs to ensure the national interest is central to our energy and climate policy framework.

It’s needed to plan for the accelerating energy transition and work to establish domestic supply chains and areas of priority focus, including value-adding our critical minerals pre-export, ideally leveraging our world leading renewable energy resources to refine, process and manufacture so we can export “embodied decarbonisation”. It is good to see this Authority will also be mandated to support First Nations participation.

The government has assigned a very serious $83m in funding for the Authority over 4 years, and confirmed details on the previously announced $1.9 billion Powering the Regions Fund to complement this Authority.

This includes the $400m Industrial Transformation Stream, the $600m Safeguard Transformation Stream for trade-exposed facilities in the Safeguard Mechanism and a $400m Critical Inputs to Clean Energy Industries Stream. These will support decarbonisation of sovereign manufacturing capability of critical inputs to the energy transformation, such as steel, cement, lime and aluminium. All excellent initiatives.

The Authority and associated measures will be vital in ensuring Australia’s workforce and communities are best placed to pivot from the fossil fuel focused industries from the past to the clean energy and critical minerals and value adding opportunities of the future.

Energy Bill Relief

The budget provides the previously agreed Federal government half of the $3bn in co-funded (with state governments) power price cost of living relief of $500 per household for the most vulnerable Australians hit by the surging hyperinflation of domestic fossil fuel energy prices over 2022 and 2023.

This was made all the more urgent post the Reserve Bank of Australia’s 11th interest rate hike earlier this month. Nothing further was added to this.

Business and household electrification package

The government had already announced a $314m tax relief Small Business Energy Incentive for investments in energy-efficient equipment of SME businesses via a tax deduction of up to $20,000.

Low-income households and renters should likewise benefit from a $1bn low-interest loan program to be administered by the Clean Energy Finance Corporation (in partnership with private banks) for home building energy efficiency upgrades, to boost energy efficiency and insulate households from price shocks.

A further $300m in this budget is allocated to fund energy performance upgrades on 60,000 social housing properties, a very welcome development.

A new $80m of funding over four years is included for the Energy Ministers, Australian Energy Regulator and ACCC combined to build affordable and lower emissions energy policy frameworks.

$37m is allocated to modernise energy efficiency standards, including expanding the Nationwide House Energy Rating Scheme (NatHERS) to cover existing homes as well as new builds, creating an energy efficiency star rating system that will help Australians make the best choices when it comes to renting, purchasing, or renovating houses. This is a key priority CEF has been calling for.

Australia’s US Inflation Reduction Act (IRA) response

The race is on for Australia to position itself as a renewables, critical minerals and metals and cleantech superpower, as global investment momentum in energy transition has been supercharged by US President Biden’s trillion dollar Inflation Reduction Act (including the US$400bn Loan Programs Office); the EU Net Zero Industry Act and other key international policy developments, even as China leads across all facets of decarbonisation.

Global supply chain diversity is a critical focus, and Australia needs to both protect our own energy security and independence, and provide an alternative source of green energy supply for our key trade partners.

A key focus should be ensuring our exports embody decarbonisation – by powering processing, refining and manufacturing onshore with our abundant renewables potential. This will assist our trade partners in our mutual quest for global decarbonisation at the speed and scale the climate science demands.

This budget brings a new $2bn Hydrogen Headstart program to ensure 2-3 large-scale domestic renewable hydrogen projects reach financial close via competitive hydrogen production contracts. It also provides $38m to establish the previously announced Guarantee of Origin scheme to track and verify emissions associated with hydrogen and low emissions products, as well as a mechanism to certify renewable electricity.

CEF is pleased to see the Capacity Investment Scheme (CIS) announced in December 2022 confirmed in this budget (replacing CoalKeeper).

With the inevitable acceleration of coal fired power plant closures, and the ongoing delays and budget blowouts to Snowy 2.0, this will play a critical role of crowding-in private capital for accelerated battery storage investments to complement the rapid renewable buildout of state-led Renewable Energy Zones.

The budget papers do not directly disclose this funding, given it is commercially sensitive i.e. subject to public tenders. It is expected to commence late 2023, and Minister Chris Bowen estimates it will unlock $10bn of investment.

Green finance initiatives include the previously announced $8m over four years to issue sovereign green bonds, a $1.6m contribution to support Australian Sustainable Finance Institute (ASFI) taxonomy, and $4.2m for ASIC for enforcement actions against greenwashing.

Another $18m is provided to implement reforms to the operation of the ACCU scheme.

The skills and training sector will benefit from $3.7bn extra for the five-year National Skills Agreement, taking total federal spending to $12.8bn, with building a skilled workforce for the new clean energy economy critical for the success of the transition.

This budget also provides some additional public capital support for the energy transition to help ensure Australia leverages our world leading renewable energy potential to value-add our globally significant critical minerals and green metal resources onshore pre-export.

The previously announced $2bn Critical Minerals Facility administered by EFA is complemented by an additional $57m for a Critical Minerals International Partnerships program to secure strategic partnerships internationally and $23m for policy and project facilitation.

The October 2022 Budget review had already established significant public financing support for the energy transition, with the $20bn Rewiring the Nation Fund managed by the CEFC; the $3bn renewables, green metals and low emissions technologies funding included in the wider $15bn National Reconstruction Fund; the $1.9bn Powering the Regions Fund (key to assisting the implementation of the Safeguard Mechanism); the $525m Hydrogen Hubs; $146m Driving the Nation Fund; $83m First Nations Community Microgrids; and $188m community batteries fund each managed by the Australian Renewable Energy Agency (ARENA).

The Climate Capital Forum now calls on the federal government to commit $100bn collective public capital support into energy transition initiatives.

This should be across the CEFC, Future Fund, ARENA, Export Finance Australia (EFA) and the Northern Australia Infrastructure Facility (NAIF) – to both ensure the strategic national interest is promoted and projects are desrisked to attract $200-300bn of private capital from our $3.4 trillion superannuation pool.

In this budget, we had hoped for a more substantive start on public finance support, for example a $20bn national strategic interest allocation to the Future Fund to take patient equity stakes in emerging domestic value-adding mining leaders to help retain majority Australian ownership and then pay corporate tax.

Emissions monitoring and environmental protection

The government provides additional funding of $22m over 3 years from 2023–24 to maintain and enhance the capability of Australia’s National Greenhouse Accounts to deliver high-quality emissions data and track progress against Australia’s emissions reduction targets.

Credible real time public disclosure of monitoring, verification and reporting (MRV) of key facilities is yet to be made government policy, but this enhanced reporting is at least a step towards data integrity.

The government will provide $214m over 4 years to deliver the Nature Positive Plan, including $121m over 4 years to establish Environment Protection Australia to enforce environmental laws and restore eroded confidence in Australia’s environmental protection system – another welcome development.

In summary, the 2023/24 budget points to our massive fiscal capacity to build more ambition into our national decarbonisation trajectory, to catalyse the once in a century opportunity of the energy transformation for Australia and crowd in private capital at unprecedented scale.

We are progressing in the right direction for sure, but not yet at the speed the opportunity offers and climate science demands.