Global fossil fuel subsidies almost doubled over the course of 2021, a new report has shown, as governments around the world – and not least of all in Australia – boosted their levels of support for coal, oil and gas projects in the name of fending off cost of living crises.

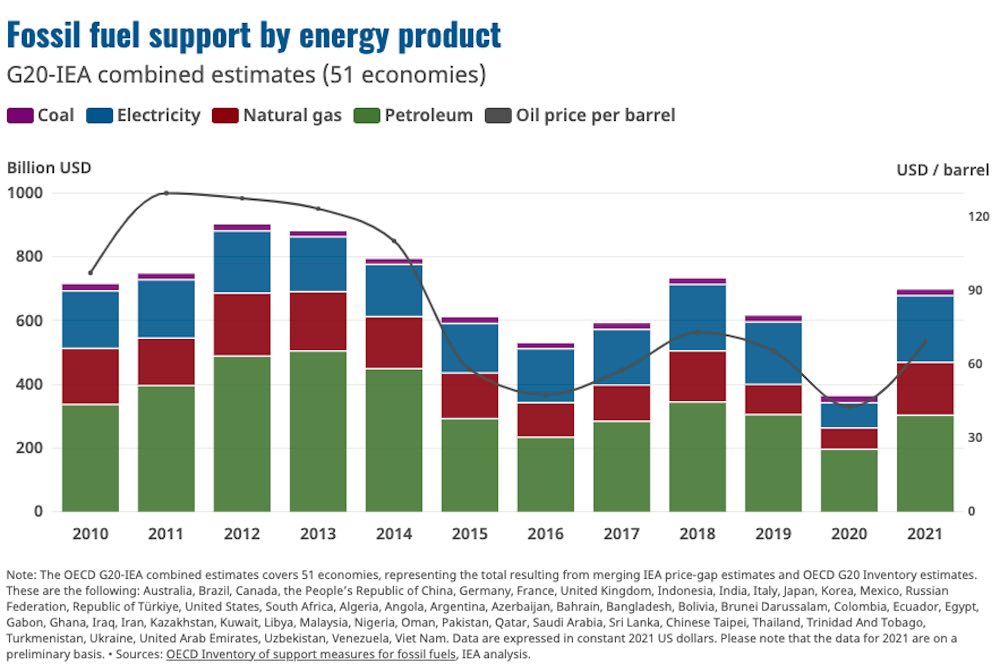

OECD and IEA data shows that 51 countries worldwide spent a combined $US697.2 billion on subsidies for fossil fuels in 2021, up from $US362.4 billion in 2020.

These subsidies are expected to rise further in 2022, alongside fossil fuel prices, as the global energy crisis continues, and the soaring cost of fossil fuel energy takes its toll on consumers.

In Australia, state and federal governments in Australia have spent billions on subsidies for both companies and consumers in 2021 and in 2022, to assuage the impact of skyrocketing fuel and electricity prices and to support the former Coalition government’s “gas-led recovery.”

The latest OECD fossil fuel subsidy data for Australia is for 2020 and show the government spent $10.6 billion on tax breaks and handouts.

But in 2021 and 2022 that figure could almost double as federal funding and compensation for power plant operators following the Australian Energy Market Operator’s (AEMO) intervention in the National Energy Market (NEM) in June alone totals some $7.1 billion.

Since 2020, the former Coalition government splashed at least $5.6 billion in extra federal funding for fossil fuel projects and tax breaks for consumers.

Those subsidies included $58.6 million for new gas storage and import infrastructure, $600 million for Snowy Hydro’s new gas fired power plant at Kurri Kurri – a project whose costs have now blown out past $1 billion – and almost $2 billion to oil refiners to prop up profit margins.

In 2022 before the federal election in May, the Morrison government squeezed in another $50.3 million to support gas infrastructure in the Bowen, Surat and Beetaloo basins and $3 billion worth of support to internal combustion engine (ICE) drivers by cutting the fuel excise tax by 22.1c for six months in March.

State governments added more subsidies via electricity rebates to assist with cost of living pressures. These include Western Australia’s $400 Household Electricity Credit, Victoria’s $250 Power Saving Bonus, and Queensland’s $175 Cost of Living Rebate.

And taxpayers will bear the brunt of $1.5 billion in compensation to power plant operators following AEMO’s shutdown of the NEM in June, when it directed plants to reopen and imposed a wholesale price cap after some shut down operations on the back of soaring coal and gas prices.

These costs are direct tax breaks and extra funding Australian governments have committed to, but ignore the implicit costs of undercharging for environmental costs, such as through climate change, and foregone taxes such as would come from supporting a thriving electric vehicle industry.

The IMF counts these impacts in its fossil fuel subsidy data, which it says topped $5.9 trillion in 2020 and will continue to climb as emerging markets gain more of a share of fuel consumption.

Future costs

The OECD says consumption subsidies, like Australia’s fuel excise tax cut, are likely to continue around the world in 2022 as countries grapple with the risks of ongoing high cost of living for their citizens.

“Russia’s war of aggression against Ukraine has caused sharp increases in energy prices and undermined energy security. Significant increases in fossil fuel subsidies encourage wasteful consumption though, while not necessarily reaching low-income households,” OECD Secretary-General Mathias Cormann said in a statement.

“We need to adopt measures which protect consumers from the extreme impacts of shifting market and geopolitical forces in a way that helps keep us on track to carbon neutrality as well as energy security and affordability.”

While the new Labor government has committed to not extend the fuel excise reduction when it finishes in October, future subsidies include oil and gas field decommissioning costs.

Australian taxpayers will bear the $325 million cost of the first stage clean up of the abandoned Northern Endeavour oil vessel, although oil and gas producers will need to cover some of the estimated $30.44 billion in future decommissioning costs after a new levy of 48c per barrel of oil was imposed in April.