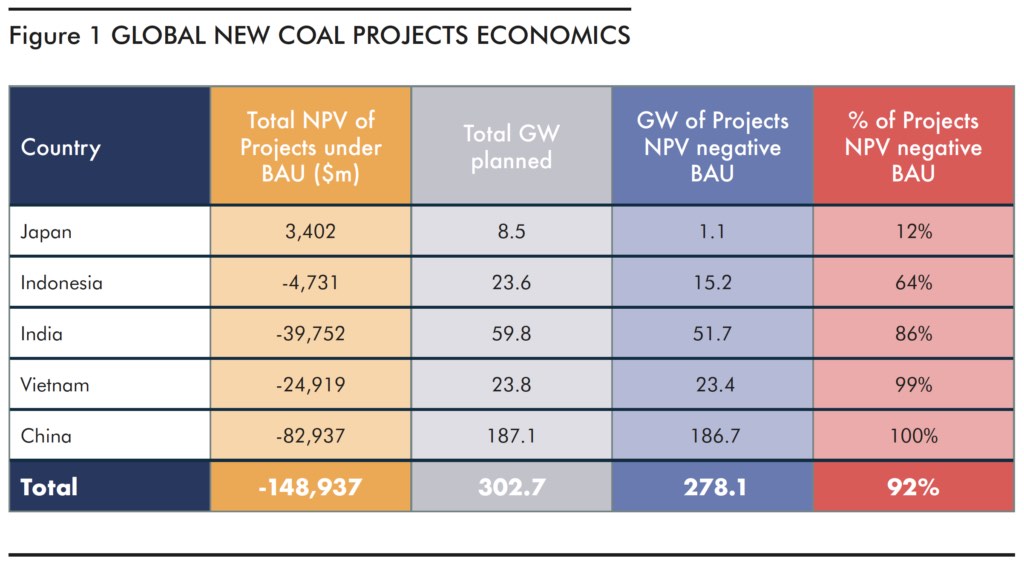

A new report from financial think tank Carbon Tracker has pointed the finger at China, India, Indonesia, Japan, and Vietnam, as responsible for 80% of the world’s planned new coal plants, over 300GW worth of new coal capacity that significantly endangers the Paris climate goals.

Carbon Tracker published its new report on Wednesday entitled ‘Do Not Revive Coal’ in which it highlights the fact that China, India, Vietnam, Indonesia, and Japan, are not only responsible for 80% of the world’s planned new coal plants but are also responsible for 75% of existing coal capacity.

Currently, China is the world’s largest coal producer, with 1,100GW of operating coal capacity accounting for 55% of global capacity, and a further pipeline of 187GW on the horizon.

Similarly, India, with 12% of global capacity, is the world’s second largest coal power producer with an operating capacity of around 250GW and a pipeline of 60GW.

But 27% of existing global coal capacity is already unprofitable, while another 30% is close to breakeven and generating a nominal profit of no more than $5 per MWh.

Carbon Tracker identifies $220 billion worth of operating coal plants as at risk of becoming stranded if the world meets the Paris climate targets. But despite this, the five Asian countries highlighted in the report are currently planning to build more than 600 new coal-fired power units with a combined capacity of over 300GW.

Unsurprisingly, though, 92% of the coal units planned by these five countries will be uneconomic, yielding a negative net present value (NPV), even under business-as-usual conditions, and could risk “value destruction” of around $US150 billion under such business-as-usual conditions.

While this might sound like a risk only for developers, the reality is much more sinister.

Carbon Tracker also discovered that around 70% of the global coal fleet relies to some degree on policy support and would likely be unprofitable in the absence of such market distortions.

As such, as Carbon Tracker explains, consumers and taxpayers will ultimately end up footing the bill for the wasted $US150 billion as these five countries, like so many others, either subsidise coal power or prop it up with favourable market designs, power purchase agreements, or other forms of policy support.

Carbon Tracker warns that by committing to more coal now, policymakers “risk shouldering consumers with higher electricity prices, value destruction for investors and taxpayers, and higher pollution.”

“This is a relevant investment signal to investors to avoid committing capital to new coal projects with many likely to generate negative returns from the outset, even under the more optimistic BAU scenario,” the authors of the report explained.

“These new coal plants should be cancelled.”

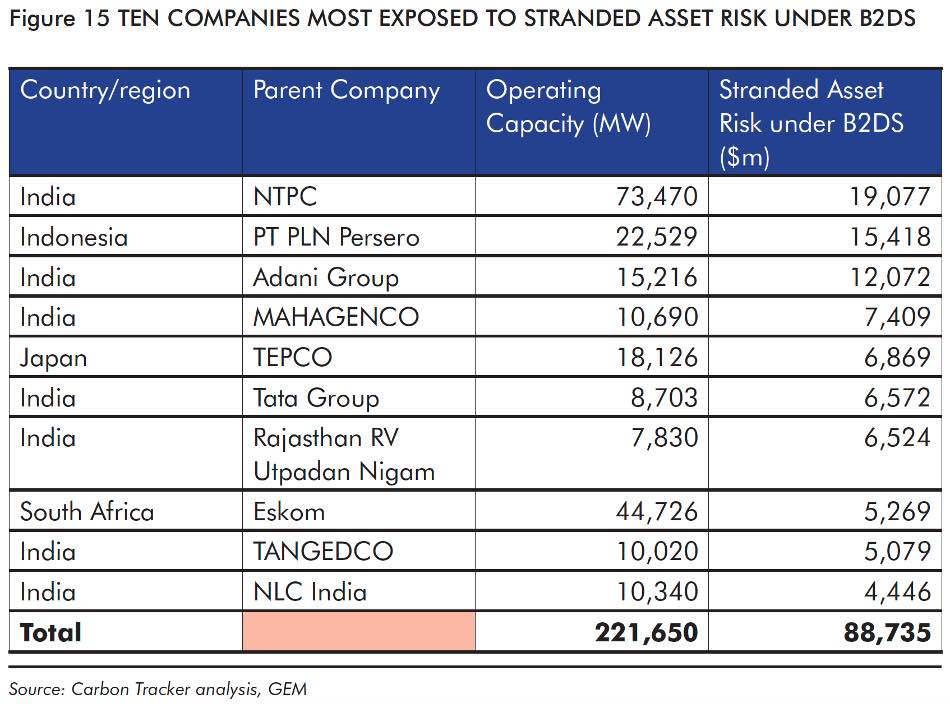

Unsurprisingly, given such poor economics reliant so heavily on government intervention, the corporate situation in these five countries reveals just ten companies accounting for around 40% of the potential stranded risk inherent in the planned coal development.

Specifically, India’s NTPC and Adani Group, and PLN in Indonesia are “by far” the most exposed to stranded assets. Meanwhile, of the ten most exposed companies (below), seven are headquartered in India.

“These last bastions of coal power are swimming against the tide, when renewables offer a cheaper solution that supports global climate targets.

Investors should steer clear of new coal projects, many of which are likely to generate negative returns from the outset,” said Catharina Hillenbrand Von Der Neyen, Carbon Tracker’s Head of Power & Utilities.

“Coal no longer makes sense financially or environmentally. Governments should now create a level playing field which allows renewables to grow at least cost, using post-COVID stimulus spending as an opportunity to lay the foundations for a sustainable energy system.”

In comparison to the sorry state of affairs for the global coal sector, the case for renewables continues to improve and demonstrate itself as the only sensible road forward.

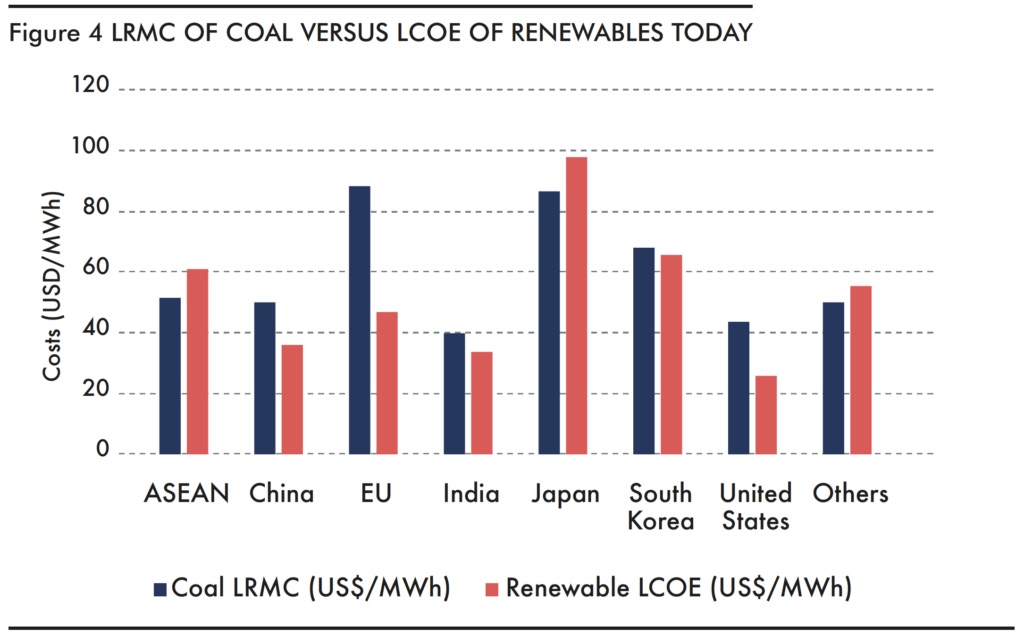

Already today, new renewables beat 77% of operating coal, a figure which is expected to rise to 98% by 2026 and 99% by 2030 when comparing the Levelised Cost of Electricity (LCoE) of new renewables to the long-run marginal cost (LRMC) of existing coal units (below).

The report also finds that around 80% of the world’s operating global coal fleet could be replaced today with new renewables and result in an immediate cost saving.

By 2024, new renewables will be cheaper than coal in every major region, and by 2026 almost 100% of global coal capacity will be more expensive to run than building and operating new renewables.

Subsequently, as the competition from renewables increases, and when combined with increased regulation, Carbon Tracker expects coal plant usage to fall in the immediate near term, further undermining their unprofitability.

This is seen most clearly in the same five Asian nations which are so hellbent on delivering more coal capacity into operation.

For example, new wind and solar in China could already generate electricity at lower cost than 86% of the country’s existing and pipeline capacity, and by 2024 renewables will outcompete coal across the country.

Similarly, in India, new renewables can already generate electricity at lower cost than 84% of operating coal and will also outcompete everywhere by 2024.

In Japan, which has 45GW of operating coal capacity and another 9GW in the pipeline, renewables are already cheaper than new coal projects and will be cheaper than operating coal plants by 2022.

This, despite the fact that Japan is comically hampered by lack of land, capacity market payments that favour fossil fuels, and grid constraints.

Vietnam, with its 24GW of operational coal and 24GW in the pipeline, will see new renewables outcompete existing coal units by 2022.

And in Indonesia, with its 45GW of operational coal and pipeline of 24GW, will see new renewables outcompete existing coal by 2024.

Finally, to cap off the madness, is the fact that China already leads the global roll-out of renewables, boasting 530GW of installed renewable capacity and a target of reaching 1,200GW by 2030 which, at current rates of build, could be met in under six years.

Similarly, India has a target of 450GW worth of renewables by 2030 – more than five times its 2020 capacity – which will meet 60% of the country’s energy demand.