The Energy Security Board is the most progressive of the institutions governing Australia’s National Electricity Market.

It’s clear a huge amount of work has been done to think about the post 2025 framework. Nevertheless, in ITK’s view, from a long, long way back from the action, we don’t think it’s nearly forward looking enough. We can’t see the framework envisaged getting the NEM through the 2025-2040 period.

We would like to see a more forward looking approach to technology and more emphasis on reintegrating the disintegrated and increasingly dysfunctional components. The whole needs to be greater than the sum of the parts.

In several places the document is overly focused on detail without enough discussion of foundations. In others, such as explaining the popularity of behind the meter, the authors miss the mark completely.

In other areas such as transmission, the document focusses on problems that, so far at least, are relatively unusual and not the main issue, eg congestion driving uneconomic bidding and transmission.

Overall in ITK’s humble opinion as a spectator in the grandstand, the ESB has not developed a sufficient vision to guide the development of longterm market structures. Although the issues seem well understood the answers are not.

ESB directions paper – 5 issues

1. Manage exit of coal stations while providing reliability

2. Work out how to provide system services when everything is done by power electronics

3. Work out how to redesign the system so that distributors, communities and household seamlessly integrate with industrial size generators and consumers.

4. Coordinate REZ introduction process and associated transmission

5. Try and herd the States back into the NEM framework

Do all of this in the context of a Federal Government that doesn’t get it, with household consumers that couldn’t give a toss and without a sufficient understanding of the real technology roadmap.

The real technology road map is not about gas, or carbon capture, that is so, so 2oth Century, so old fashioned. It reminds me of Origin Energy ads to consumers from a few years back that had incandescent light bulbs. It just showed how out of touch management at the time was. I digress.

The real technology road map is about how to electrify everything and do it with power electronics. In my humble view that is the true and only path to enlightment and everything else can be seen as a temptation designed to move you into harm’s way.

Structure, culture and capabilities

The first question to be asked is whether the ESB is the right organization in the right NEM structure. My long standing issue is that the Finkel report produced a structure with lots of oversight but no execution capability.

The division of powers between the main regulatory bodies, ESB, AEMO, AEMC and AER and the added dimension of States increasingly running their own show is not conducive to efficient anything let alone taking advantage of the major opportunities low cost renewable energy offers to Australia.

If the NEM was a business there would be a CEO with divisions reporting to a Board. It is far from that. Despite the incredibly well qualified status of the members of the ESB I personally can help wishing there’d been at least one representative from the younger generation, or at least the next wave of thinkers. But I’ll say no more on that as what would I know?

ESB still doesn’t get DER

For instance in the Directions Paper the growth of rooftop solar is attributed to feed in tariffs. No evidence is provided for this and in my view the growth is both more multi dimensional and to the extent it’s a single cause, mainly due to the ever falling cost, after carbon credit allowances.

The ESB’s view if it is wrong is a mistake of fact, in my opinion, but if I am right shows a lack of understanding. More important in my view is the lack of imagination or at least the wrong sort of imagination.

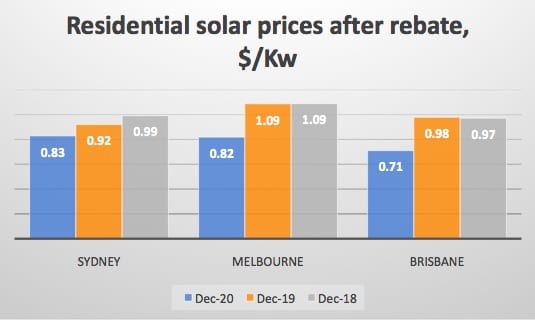

Residential solar prices have fallen significantly in the past two years to around $0.80/kWh. By contrast single axis tracking utility solar costs say $1.30/kWh. Yes you get nearly 2 times the output but you also have to take an MLF hit and find a PPA customer.

The residential customer is using at least some of the power right where it clearly is most valuable, that is at the point of production. The household is not responsible for system strength issues and in general you could argue that it’s a higher revenue/capital ratio. So why feed in tariff should be seen as the big incentive I’m not sure.

There is plenty of imagination of what I see is the wrong sort. For instance the idea that households en masse wish to engage in two sided markets. Do we see evidence of this in water, or gas, or telcos, or petrol? Sure there are some folk with the time and skills, but most households, in my opinion, could not care less and have no time to take an interest.

Nor do they want another door to door salesman selling them mumbo jumbo returns of say $200 a year in return for losing control of their never thought about rooftop system.

We already have the answer to DER – Like Poe’s purloined letter its right in front of the ESB’s eyes, but they can’t see it and nor can anyone else.

My imagination is different, and probably overstimulated by Xmas cheer. It starts with recognizing that the key enabling organization in the fast track NEM is the network services provider. In the current system the network is the “enemy”.

It’s a nasty monopoly that gold plates everything and so upset everyone that Josh Frydenberg legislated away some of its authority. I’ve done much analysis over many years on network costs. But we can’t keep fighting the last war.

Networks have the potential to do the bulk of the provision of system services and the integration of DER far better than any other organizations. They already exist, they have technical expertise, low cost of capital, ability to interface with every household.

Networks have been savaged by the AER in part but even more by the AEMC with its dumb, dumb, dumb ideology above all “power of choice” reform which took metering out of the hands of distribution and thereby killed the whole thing.

The first step is to appreciate that the meter is not a meter, the meter is rather the interface between the consumer and the system. If it’s a dumb meter it doesn’t do much interfacing. A mechanical counter is very 3rd world.

But the broader piece is to think harder about the role of networks, to think harder about the appropriateness of the separation between retailers, generators, consumers and networks as envisaged in the original Hilmer reforms and subsequent design of the NEM.

Networks are monopolies but they are also enablers. Networks could provide community batteries, move rooftop solar from one house to another or to a shop, take power from the grid. Networks could provide local reactive power, frequency and voltage and they could provide “internet of things” type data with machine learning from millions of sensors on every point of presence.

In this view of the world DER becomes not an addon to the system but a fundamental building block, supplemented by utility scale generation.

The question, and I don’t have the instant answer, is to how to incentivize and empower networks without turning them into rent seeking monopolies.

Network providers are massively better equipped to do the job of DER aggregation and control and to act as VPP agents than anyone else. Done right though there may be less need for VPPs.

If we start to emphasize street and suburb level community networks interlinked but capable of operating independently a different world view may emerge. What is the point of a customer in Adelaide and one in Brisbane being part of the same VPP? Is that likely to be efficient if the problem is a power shortage in Melbourne?

Is a market for every electricity service really a good idea like charging for use of the office photo copier?

Many people will be familiar with the idea of charging individual users in an office for every photo copy page, every biro, etc. But in the end most organizations I know move away from that idea because the costs exceed the benefits.

It’s worth asking if it’s the same with electricity. The thrust of system design for years has been to split the provision of electricity into myriad parts.

First to split out retail from generation from transmission from distribution. Then to split generation into energy and power and then into energy, power and ancillary services. Then to create separate frequency markets. Now we want to add new inertia and fast frequency markets.

In the process of doing this the value of integration, synergy if you like but more respectably the idea that the whole is greater than the sum of the parts is lost.

A prime example is the well known problem of the battery value stack. Batteries provide both network and retail services, but its so complicated to access these stacks. So what do we do, get the AEMC to chase yet another rat up a drainpipe. Better perhaps to rethink the entire disaggregation idea.

Perhaps the USA does it better where the entire retail/generation/network service is regulated as one entity. Communities that want to split out from the whole and go it on their own have that right. That model too has its problems down in the weeds, but at least in say Florida seems to have served customers well.

Another example of this entire disaggregation seen through a slightly different lens is the retailer reliability obligation. What is the benefit of making retailers responsible for reliability.

According to the ESB the “role of retailers is to manage exposure to the spot market on behalf of their customers”. The ESB says this and yet in the next breath imposes a retailer reliability obligation which makes the retailer responsible for system security.

Has the ship sailed in regards to REZ and transmission?

At least in NSW it seems like it may be too late to be talking about progressing REZs (renewable energy zones) and transmission access.

My understanding is that initial bids for the first REZ in NSW will be undertaken in late 2021 and that the intention is the bids will include transmission rights for the life of the underlying generation asset.

Exactly how much transmission that is, ie just to the boundary of the REZ or beyond, and what, if any, MLF is locked in I don’t know.

Perhaps there is still room for the ESB to get involved in this, but what can they add? All they can do is recommend a rule change to the AEMC and then we sit through a long process.

And yet the ESB makes the good point, which I suspect is most clearly made by Merryn York that there is always likely to be some congestion possibility in the transmission system. It is, probably, inefficient to build enough transmission for the windieset or sunniest days. Still some redundancy is not a new concept in the NEM.

Bottom line at least in NSW, the Government is moving the REZ and transmission reform pace along much faster than the ESB and the AEMC and the AER. Lets see how the NSW process plays out.

Coal closures

Again the complaint from outside the tent is that the thinking is unimaginative. Blueprint Institute recently provided a different way to manage coal plant closures via an auction to discover what coal fired generators really thought they were worth and therefore how much compensation they would require to close, or to close early.

Blueprint didn’t consider any of the myriad technical issues around closure but a formal process would at the very least burn in for once and for all that the coal generators are going to close and perhaps that their value is not all that high.

Now is not the time to reexamine those issues only to note that in general its another instance where more extensive re engineering than the ESB has so far offered might produce better results.