A few months ago, I wrote a relatively lengthy diatribe about Bitcoin. The virtual currency can only be generated through a ludicrously energy-intensive computation process, which is kind of the idea. Requiring huge amounts of energy is the barrier to stop people creating as much currency as they like. It’s a lot of energy – Bitcoin mining is set to consume as much power as Australia does by 2024.

Unfortunately, this stroke of non-genius has arisen at very precisely the worst possible time: when we have just discovered that the way we generate and use energy on Earth is comfortably the most self-destructive and dangerous system ever devised by our species. Not only is there nothing inherent in the Bitcoin mining industry and its adherents that drive them towards embracing clean power, there are many people actively urging burning fossil fuels for Bitcoin. That has not changed.

Is Bitcoin a friend, or a foe, of climate action? I very strongly contend that it’s a foe, more so because it has, since I wrote my post, started to pretend that it’s a friend.

A new Bitcoin greenwashing effort

Elon Musk’s involvement in Bitcoin has been a total mess. Initially, Tesla announced it purchased A$2bn worth of Bitcoin. Then Musk seemed to do a partial turnaround, announcing that Tesla has suspended the use of Bitcoin to purchase

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Musk flipped from that position too, pretty quick-smart. “Spoke with North American Bitcoin miners. They committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising”. This announcement seemed to entirely ignore the fact that a global body had just been set up to do exactly that. In April, the ‘Crypto Climate Accord’ was announced, to near-zero fanfare. It has some trustworthy names attached to it, including an association with the UNFCCC and the Rocky Mountain Institute, but it was essentially ignored by the Bitcoin community.

Musk’s new centralised Bitcoin monitoring effort, the Bitcoin Mining Council led by Bitcoin guy Michael Saylor, activated its website yesterday. Saylor announced its creation by declaring very transparently that it was “born out a desire to shape the narrative around cryptocurrency’s energy use”, and the website angrily insists that Bitcoin’s energy usage “is a feature not a bug, and provides tremendous network security”. Musk’s contribution here seems to be periodically reducing and increasing the value of Bitcoin through tweets that are often generously be described as ‘cryptic’ but probably more accurately described as ‘market manipulatey’, along with spurring the creation of this half-hearted greenwashing effort.

I’ve set a calendar note to check in on the signatories to the BMC and the Crypto Climate Accord, to see exactly what progress they inspire. I’m relatively confident in predicating it’ll be zero, for both.

New modelling and empty promise

In another recent example of what has essentially become a massive game of PR and damage control for an industry deeply sensitive to perception, emotions and feelings, ARK Invest, who initiated my interest in this with a viral thread full of misinformation about renewable energy, released a study they claim shows that Bitcoin can help integrate and even financially incentivise the growth of renewable sources; notably solar power.

The model in no way represents the real world: it creates a simple time series of solar output, battery storage, electricity demand and Bitcoin mining demand, and assumes nothing else. In this model, a collection of extremely dubious assumptions about mining costs and energy costs are combined with wholly artificial constraints that lead to a guaranteed positive message about diverting power away from homes and cities and towards Bitcoin mining companies.

In the real world, fossil fuels exist: they need to be displaced by renewable energy, and they won’t be if new renewables are being diverted towards increasing the profits of Bitcoin companies instead. The general idea here is that Bitcoin mining serves as a ‘demand sink’ when there is ‘oversupply’ of solar power – but the value of clean energy isn’t just financial. By displacing fossil fuels it is also environmental and social, through reducing climate and air pollution impacts. This model excludes that. Additionally, Bitcoin mining is so profitable that there is no reason any mining facility would ever turn down the dials on their whirring, buzzing racks of computers. What use is flexible demand that refuses to flex?

Why isn't there a real-world example of a Bitcoin mining facility verifiably flexing their demand relative to the output of wind and solar? The technology is ten lines of code.

It hasn't happened already because no Bitcoin miner wants to fall behind in the competition for more $ pic.twitter.com/bUmRFAt04B

— Ketan Joshi (@KetanJ0) April 21, 2021

Bitcoin’s new faux-clean obsession

El Salvador’s President, Nayib Bukele, really likes Bitcoin. His country is now the first in the world to accept Bitcoin as legal tender. He is also responsible for the country sliding into authoritarianism. All of the country’s judges in the Supreme Court have been replaced by allies, and rush of new appointments have been made. “Now, Bukele’s lawmakers are threatening to remove the human rights ombudsman, too”, writes Human Rights Watch. “For more than a year, we have been warning that President Bukele poses a serious threat to democracy and the rule of law in El Salvador. His actions have made that threat crystal clear”.

None of that is a problem for Bitcoin’s advocates, who have absolutely lost their minds over Bukele announcing yesterday that the country’s geothermal power resources would be diverted towards mining Bitcoin.

Our engineers just informed me that they dug a new well, that will provide approximately 95MW of 100% clean, 0 emissions geothermal energy from our volcanos 🌋

Starting to design a full #Bitcoin mining hub around it.

What you see coming out of the well is pure water vapor 🇸🇻 pic.twitter.com/SVph4BEW1L

— Nayib Bukele 🇸🇻 (@nayibbukele) June 9, 2021

Twitter’s CEO, Jack Dorsey, predictably leapt on it. “Bitcoin incentivises renewable energy”, he said. But it’s an extremely confusing tweet. El Salvador has two geothermal sites: the Ahuachapán site with a 95 MWe capacity, and the Berlin field with a 109 MWe capacity. Geo Energy Marketing says that a new “binary cycle unit” of seven megawatts was due for completion in 2021. But 95 new megawatts of geothermal, ‘incentivised’ by Bitcoin, seems essentially impossible.

According to Think Geoenergy, new developments in El Salvador take between 5 to 10 years, due to the massive geotechnical challenges. And the country already has 110 MW in the development pipeline. Did that nearly double overnight, in a process that usually takes nearly a decade?

Bitcoin will incentivize the construction of vulcanoes everywhere https://t.co/uQXG4Q55LT

— Digiconomist (@DigiEconomist) June 10, 2021

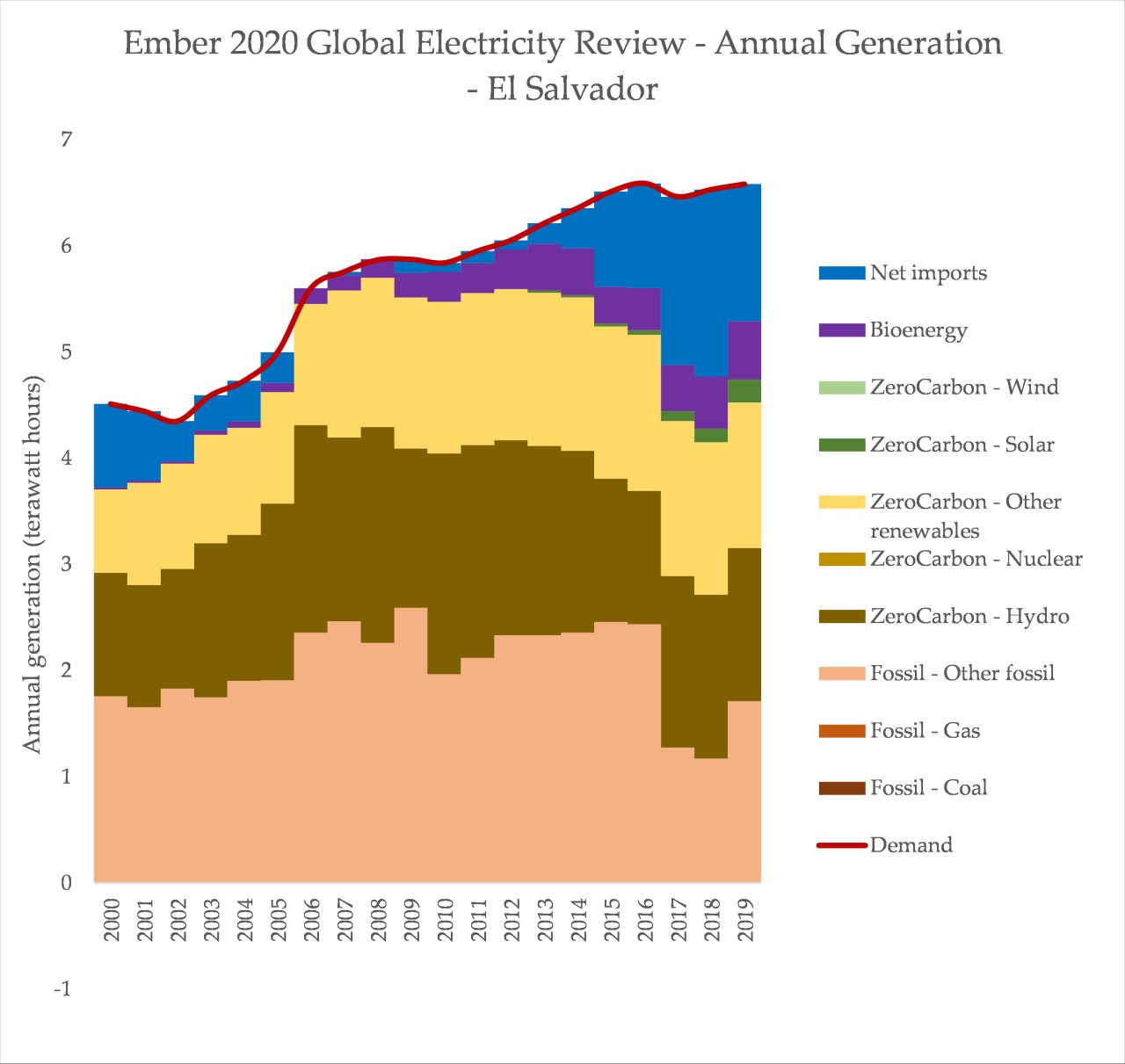

Of course, El Salvador is the perfect example of the Bitcoin mining problem. “All the miners in China are spreading this news, after all they have just experienced a fucking day”, said journalist Colin Wu, in reference to rising crackdowns on Bitcoin mining in China. But will El Salvador provide a safe haven? Even a small exodus into the country would immediately overwhelm the relatively limited power resources – mostly oil, hydro, geothermal and imports from neighbours.

The country is incredibly reliant on imported fossil fuels, not just for a decent proportion of power generation but total energy across all sectors: 69% in total. Most of the imports come from Guatemala, according to a report from the International Renewable Energy Agency (IRENA), which also urges a shift to renewables to meet rising electrification and demand, along with a need to reduce reliance on imported fossil fuels. The country’s geothermal plants already provide energy and heat to rural communities.

The story Jack Dorsey is celebrating here is an ugly one. An increasingly authoritarian leader is leaning heavily on the hype and, notably, the greenwashing efforts, around Bitcoin mining. Literally surrounding clean energy projects with energy-guzzling mining hubs that divert clean power away from communities is in fact a perfect example of an important truth: Bitcoin mining does not incentivise clean energy. It is a parasitic relationship; in which a public resource is greedily blockaded and consumed with nothing given back in return.