The learnings in 2021 are that reliance on a few old coal generators owned by an oligopoly is a recipe for expensive and unreliable electricity.

Secondly, that AEMO may need to be functionally slimmed down and restructured if it is to do a good job on its core goal of managing all the new generation into the system.

Thirdly, that every time China flexes its industrial economy it starts bombing the atmosphere with CO2 and boosting coal prices.

Keep it simple

The ultimate goals of electricity and energy policy in Australia are simple and those goals become clearer every year. And when you know the goals the policy generally follows:

Goal 1: Replacing Australia’s ageing coal generators with something more fit for purpose. Policy “should” be aimed at ensuring this replacement process goes smoothly. It’s as simple as that. Smoothly means ensuring reliability, security and price objectives are all met. It seems obvious that (1) new capacity for both energy and power needs to be built before the old capacity is closed and that this will impose short term costs on all concerned and (2) that a schedule of closure dates should be set. Then there are a set of subsidiary issues around replacing the other services of coal generation such as voltage, current and frequency support.

Goal 2: Integrate the rooftop sector into the entire electricity system. Does integration necessarily mean that owners of behind the meter systems have to give control over their system to the system operator? This is an important topic, but for another time.

Goal 3:. Ensure that the new energy system allows our energy-intensive industries to remain globally competitive and provides a future for energy exports. Events this year prove once again that coal fired electricity makes Australia less, and not more, competitive.

In 2021 we learn that relying on a few old coal generators makes electricity expensive and unreliable

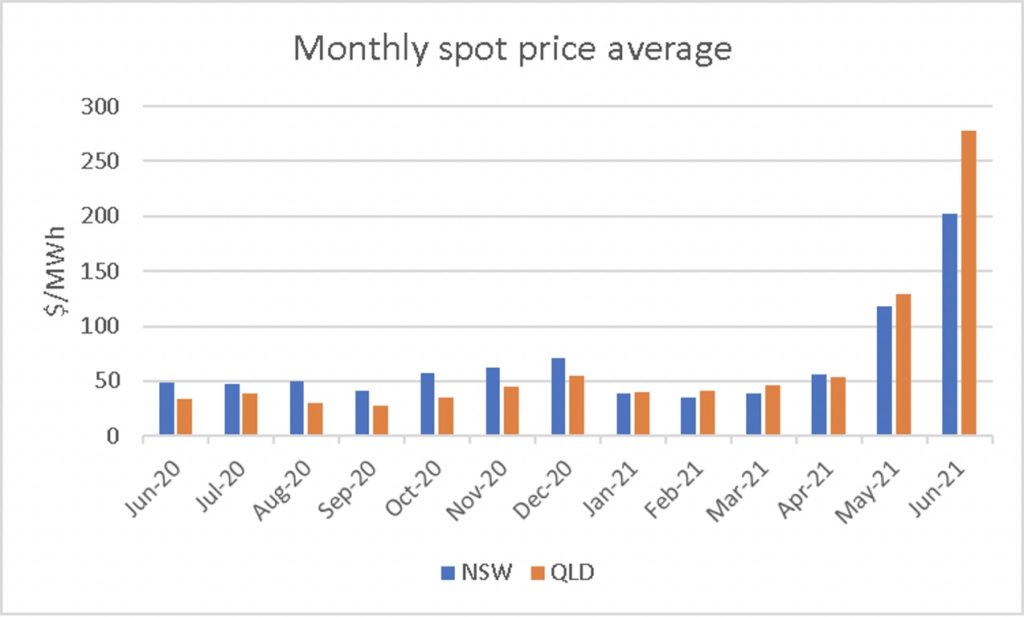

A combination of a massively higher spot coal prices an earlier and colder winter, one generation unit in Qld exploding, and the fact that other coal generation was unavailable has pushed spot prices for June in NSW and QLD to 5x and 6X last year’s level.

Its been obvious for 15 years that Australia needed to replace its coal generators.

For most of that time this has entailed a fight between conservatives and old economy money that wanted to build new coal generation, verses the more progressive disruptors who could see it had to be done differently and could be done better by firmed renewable energy.

In the last two years, or arguably since Tony Abbott lost the Prime Ministership, it’s been obvious to all but the National party that the coal industry has lost that fight.

But still there has been a reluctance to accept the consequences, namely if its not going to be new coal then the old coal generation has to be managed out and that means building new supply ASAP.

Specifically, the new supply has to be built in front of the old supply closing. Equally, if spot market prices are the main driver we can expect that (1) new supply will bring the coal closures forward and (2) coal generators will aim to maximise their market power while they have it.

System reliability is an issue because, as we have just seen and as everyone knows, when you only have a few really big and really old coal generators then there is a good likelihood of breakdowns and those breakdowns will cause disruption.

Queensland this time, but two years ago it was Victoria. A unit of Liddell also broke down badly recently. Australia has an energy-intensive economy that is being powered by old and out of date kit.

As far as this analyst is concerned, Matt Kean is just about the only politician who actually gets it. It’s not about ideology, it’s about running a business.

And the coal generator owners have too much market power because there aren’t enough owners to provide enough competition – and because they have learned to act oligopolisticly.

So that’s what the decisions of various coal generation owners, to offer less capacity or offer capacity at higher price bands, coupled with breakdowns at Callide and Yallourn, show.

The system at present can’t easily cope either with capacity reduction or with the forced outages. It only took one year of low prices for coal generators to start going offline. ITK has no argument with the industry maximising profits but the lesson to be learned is that relying on a few coal generators leads to trouble.

Another message is that 50% renewable targets possibly means 100% in the real world, because the coal generators can’t survive on 50% thermal share.

I would argue that if there was, say, 500MWs of 3 hour battery in Queensland there might have been little or no price disruption, no blackouts. More wind in Queensland might also have helped.

The wrong lesson would be that it’s in anyone’s interest to pay coal generators to stay around causing trouble for longer.

But it’s no good building new capacity if it’s incapable of being connected. And this is where the fundamental flaws of AEMO’s structure come to the fore. AEMO doesn’t even have a mission statement.

Let’s hope the new CEO can put some focus into the business and, at first glance, this might mean pruning it down so that every employee is solely focussed on the core function.

Does AEMO need to be significantly restructured?

AEMO as a business seems completely screwy. It’s a guarantee limited company, 60% owned by government and 40% by members. It runs at a loss. Even AEMO seems to realise that its performance is not up to scratch. The FY20 annual report stated:

“During the Financial Year 2019-20, the Board conducted a Board Performance Review that covered:

An assessment of Board performance;

An assessment of Chairman and Board Committee performance; and

Management’s assessment of Board performance.

The Board agreed actions to improve the Board’s strategic focus, agree priorities for Director and Executive succession, and improve stakeholder engagement reporting and meeting planning.

During the Financial Year 2020-21 , the Board conducted an internally facilitated review.”

But does this go far enough?

AEMO’s functions range from:

- Market operation of the NEM and WEM

- System operation of the NEM, SWIS and Victorian gas transmission

- “Responsibilities” for Victorian electricity transmission including revenue (AEMO’s major revenue source) transmission network connection and procurement. THIS IS THE FIRST PROBLEM AND SHOULD NOT BE AEMO BUSINESS

- Operation of the STTM for gas

- System planning (ISP)

- Gas and electricity demand forecasting

Some of the activities, but particularly running Victorian electricity transmission, seem to be completely unrelated to AEMO’S core function. Having all these jobs was probably ok when nothing was happening, but that’s not the situation today.

It means senior management is unlikely to be sufficiently focused or incentivised to the main task. That is, ensuring that the NEM is retooled from the 20th century technology to the 21st century.

What is the goal of AEMO management and board? Is it to keep fees down, prevent blackouts, maximise the speed of change and the ease of connection, make money from running the system?

How are management incentivised to achieve these goals, whatever they are?

We suggest it would be in the interests of most stakeholders and virtually all consumers for AEMO’s primary goal to be in ensuring there is a steady stream of new generation that is connected in a timely and effective fashion. Effective, in this case, means keeping the system running smoothly.

That goal remains until the NEM is decarbonised, globally competitive and with sufficient reserve margin.

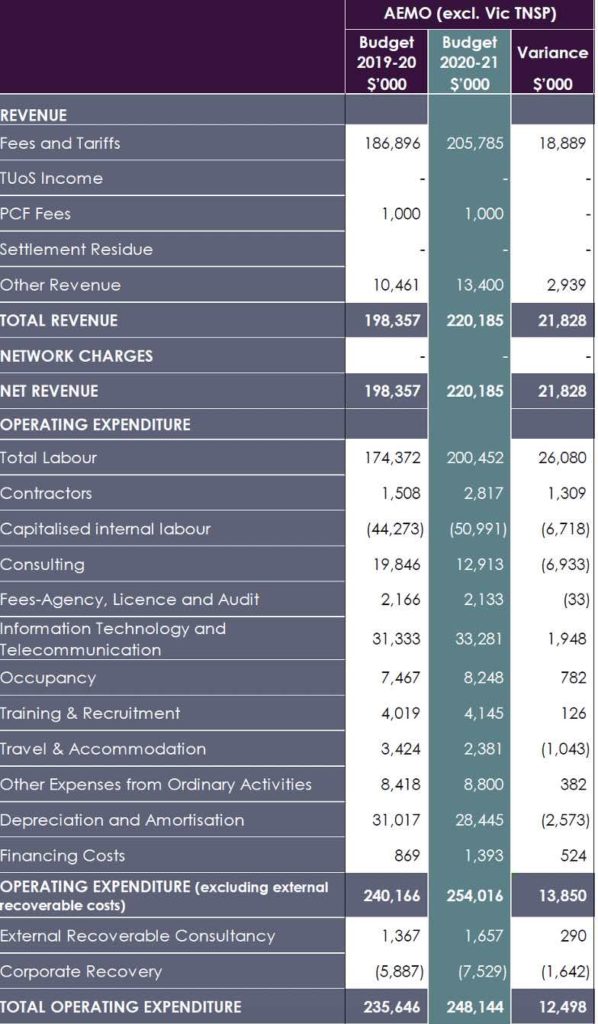

So when you look at the AEMO P&L basically the revenues and costs of the core business are more or less swamped by Victorian transmission revenues.

Outside of the Annual Report, AEMO provides a P&L which excludes the Victorian Transmission business revenues and costs. A screen shot shows:

Regarding financial incentives ITK observes that registration fees are only about 1% of total fees and that queue and project developer fees are not budgeted for. So there is no financial incentive for AEMO to register generators or connect them.

The majority of the fee is just a levy on consumption or a daily rate. The following screen shot shows only fees relating to the NEM, about 50% of AEMO’s total fee income.

Unintended consequences are inevitable when incentives are changed, but the thought bubble is if AEMO received more of its revenues from connections there would be a change in behaviour.

Not necessarily for the better, maybe there would be unreliable connections, but behaviour would change. But then there are all these other fees from gas, from West Australia and the revenue and costs of Victorian transmission which go through AEMO’s formal P&L. Why?

AEMO will only be judged on its systems role

Equally the last two years have shown that AEMO and the regulators still aren’t really up to the systems job. AEMO no doubt knows what to do, it just hasn’t been able to execute.

It wouldn’t matter in some respects how many wind and solar farms, how many batteries were built; they don’t seem to get connected very quickly, if at all. The facts are that a wide variety of developers all over the NEM from Victoria to North Queensland run into trouble getting connected.

It certainly can’t always be entirely the fault of the generation developer; they aren’t all incompetent.

This raises the inevitable issue of whether AEMO has enough resources in the form of people and tools to actually perform at the level expected? Unfortunately there is not much analysis of the workforce, beyond detailing the senior executive team, in the Annual Report.

2021 serves to reinforce that being exposed to coal and gas is a recipe for high prices

The spot price for Newcastle coal now is around $A160/t.

By the time you allow for quality differences and the like, a coastal generator in NSW, that is Eraring and Vales Point, that had to buy coal at spot would be paying around $A50/MWh for coal and both the futures market, and a consideration of new mine development costs suggests that coal prices the equivalent of say A$40/MWh are likely to be persistent

Coal prices are high because China has grown its demand for thermal coal by 350 mt in the past year. That’s happened because its production of thermal electricity is up by 900TWh at annnualised rate in one year. The one-year growth is equal to about 5X annual consumption in Australia.

Coal prices are also high because the low prices of 18 months ago lead to coal mining operations being curtailed and it takes time to restart them.

Even if new coal mines aren’t developed because of longer term concerns, generally some more production can be eked out of existing operations by increasing shifts, etc.

Prices may stay stronger for longer. That’s because coal mine financiers are thin on the ground.

There are always plenty of developers but even in Australia it’s a long, hard process to develop a new coal mine and financiers can see the negative medium-term environment.

So, whereas high prices generally lead to capacity expansion, increasingly we think that coal operators will just take the money on offer today.

This view is to some extent reflected in the futures price, which drops away to a touch over US$80/t more or less above the price required to justify a new mine.

China bombs the world with CO2

The increase in thermal electricity production annualised is about 350 mt of extra coal or about 70 mt more than China has been able to manage from its own mines.

You can argue there is more gas included in thermal generation and that efficiency has improved, but that is all besides the point. Thermal generation is a bigger share of the total than last year and up 20%.

In one year China has added the equivalent of five Australias into its thermal generation mix. China isn’t just being hostile to the West, its being hostile to the entire planet, including the Chinese people.

This has driven the coal price in China to ruinous levels of about 935 RBM (A$190/t). That’s equivalent to about A$69/MWh just for coal alone, plus there are other variable and fixed costs.

So, in the medium term, should this continue it will be ruinously expensive for energy intensive China.

And that’s the point, really. China is an energy intensive economy locked into one of the world’s more expensive energy costs. Since at least 2014 the problem has been that China cannot produce enough coal, even though it produces 3.9 billion tonnes, to supply its needs.

So it has to import and those imports set the price.

And if electricity consumption continues to grow, as this year indicates, the world cannot keep the coal up to China, especially when China is fighting with Australia and especially as the world by and large, even Indonesia doesn’t really want to do coal.

China’s main friend in this is, unsurprisingly, Russia.

It might take another 5-10 years for this to meaningfully impact China’s economy, but it will.