AGL is in the privileged position of owning one of the two largest electricity customer bases in Australia’s National Electricity Market, and is the second largest provider of bulk energy in the NEM after the Queensland government.

Slowly, those advantages are being frittered away. It’s entirely reasonable to say that doing not much is sensible during a phase where the latest “big change” program has been thrown on the scrap heap, and where there is a brand new MD and five out of nine directors have very limited time on the board.

But just as with climate change, the clock keeps ticking. Because shareholders rejected one change program doesn’t mean that going back to a softly, softly approach to change is going to be adequate.

In order to see the share price going up, AGL has to show investors steady cash flow growth or provide them with a plan that seems achievable and which investors can support in the medium term.

In my view, AGL has yet to demonstrate a “story” that investors could realistically embrace. In particular it has yet to demonstrate how its scale in customer base is being used to earn above WACC (weighted a average cost of capital) returns.

Specifically, electricity customer numbers have been more or less static for years. Volumes per electricity customer have done nothing.

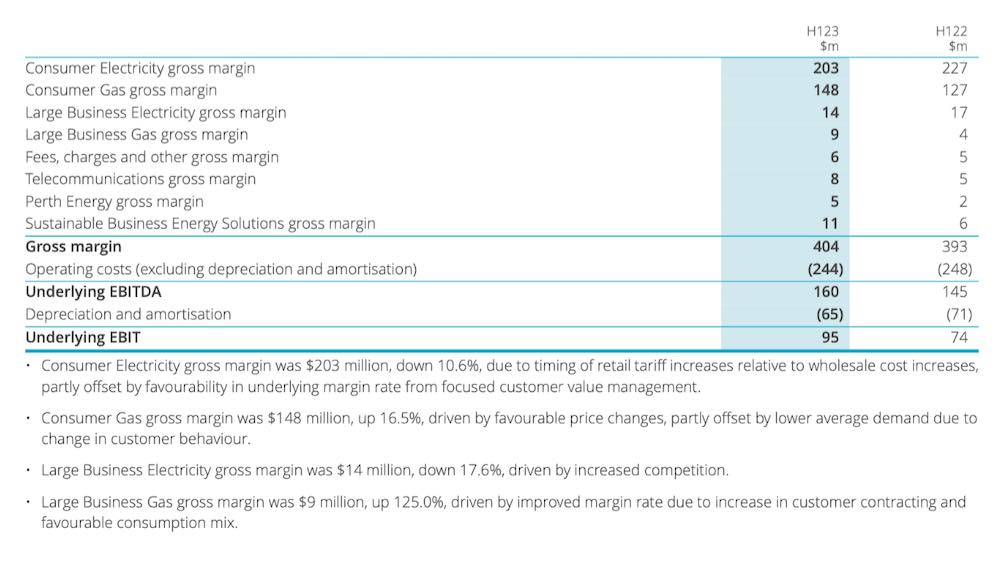

The one favourable dynamic is good cost control as, like Origin, AGL transforms to its next-gen customer care system. I don’t want to make much of one six-monthly set of figures, but I will ask again what the investment proposition is.

Nor has AGL yet demonstrated how getting out of bulk generation (the 20TWh from Bayswater, Liddell and Loy Yang A), and buying in the electricity from Tilt and whoever, is going to lead to either good returns or even any operational expertise. What does AGL stand for? What is its comparative advantage?

During the management presentation AGL stated “AGL is leading Australia’s energy transition”. If closing Liddell counts as leading the transition, perhaps that is true. I personally don’t think even management really believes that slogan, let alone the customer base.

AGL is aiding and abetting its own disintermediation

AGL faces two main threats in addition to decarbonsiation. It’s not clear to me it even recognises one of them.

The first threat is the Saul Griffith threat, households and maybe some businesses will electrify, increasing their total consumption of electricity but probably buying less from the grid.

The figure below is on a daily basis. It’s one of my favourite graphs.

On a yearly basis that comes to 13MWh per year. To produce that much electricity takes roughly 11kW of roof mounted solar. Of course some of the solar has to be stored, but many houses are capable of having 11kW of solar and the capital cost, say $11,000, is not much relative to the cost of the house.

And even if we add in a battery, typically a $14,000 Powerwall, it’s still $25,000 and that takes care of the household energy consumption including petrol/diesel. You stay connected to the grid for $1 a day, maybe.

If you drive to work, or drive during the day, you have trouble charging your car but you will sell some excess solar to the grid and buy it back over night to charge the car.

The houses that will most likely follow this strategy are those that can most easily afford the capital expenditure for the solar panels, EVs and maybe household battery. After your small businesses and shops, high consumption households are the most valuable customers that big gentailers like AGL have.

Many of these houses will also have gas and this, too, is very slowly going away. AGL has only a limited amount it can do about this, or so it seems.

The obvious answer is to become the owner and operator, or at least operator of the behind the meter assets. However, even from a software point of view that’s a tricky proposition and it’s not clear how much value-add a retailer offers to the average house that has its own solar and even firming (battery).

So far, no large Gentailer has a convincing answer to this consumer empowerment, to make a pun.

My own answer – and it’s no doubt riddled with flaws – is for a gentailer to move back into distribution, transform the current distribution franchises into smaller suburban-based systems and become the provider and coordinator of the system power supply.

This would include street and suburb batteries and vehicle charge points and a bunch of other stuff. Even excluding the regulatory impediments such a concept would never make it out of an AGL offsite. Get real.

Disintermediation also at the big end of the scale

The second threat is that, as usual, AGL, along with Origin Energy and Energy Australia, turns its nose up at owning and developing wind and solar in favour of exotics like hydrogen and pumped hydro.

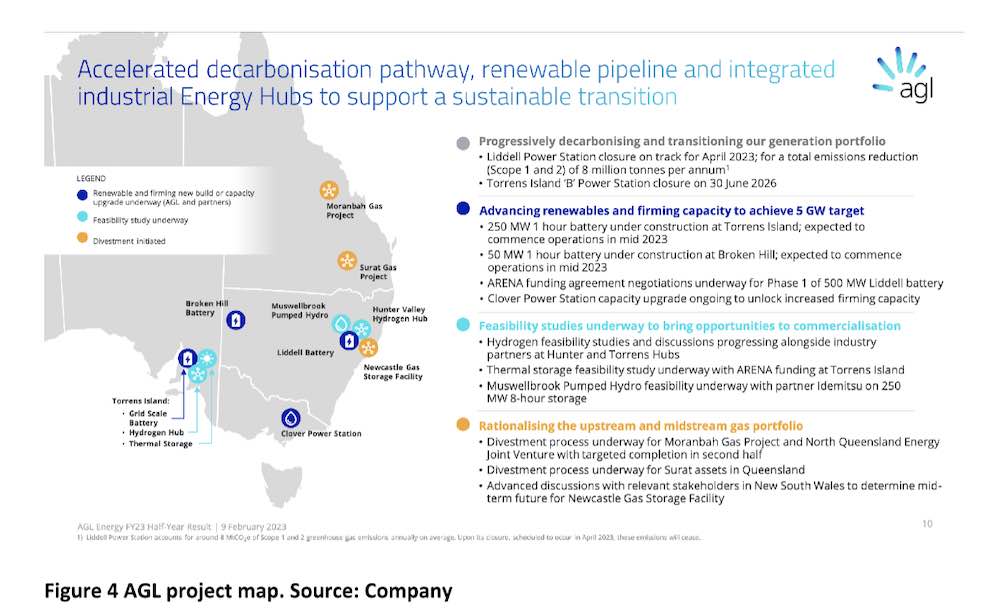

As justification for this tired old strategy AGL offers the following figure:

The first point to be made is that returns have to be risk adjusted. The reason why wind and solar have lower returns, ex ante and I think ex post, compared to firming is because it’s lower risk. I mean if I put illegal drug importing on the chart the returns would be a lot higher.

But there are two further problems. The first one is that the amount of firming “energy’ is going to decline over time. That doesn’t necessarily mean much because firming supply generally earns its return from Power (MW) rather than Energy delivered (MWh).

And it may be that providing power capacity can earn its cost of capital. But if you are just providing capacity and not taking much risk then you will earn a return not that different to a wind or solar provider. And meantime you have given up your portfolio position in bulk energy.

The second problem is that, looking at AGL’s development map – and no doubt it contains a bunch of red herrings, or should they be red balloons – the projects look uninspiring and very long-dated.

As far as I can tell, a development application has not yet been lodged for the 250MW/8 hour Musswelbrook concept, so it’s years and years away.

And I would argue that 250MW/8 hour of pumped hydro will just be a one of a large number of similar proposals. Professor Andrew Blakers noted today (in our new episode of the Energy Insiders podcast) that head height is the distinguishing feature of a good pumped hydro, but I don’t have that info here.

As for the hydrogen, all I can say is AGL is just joining the queue of leprechauns chasing the pot of gold at the end of the rainbow. And it will take a long time to get to the end of the rainbow. So I guess the hydrogen hub can show up in results presentations for years to come, perhaps the next “Geodynamics”.

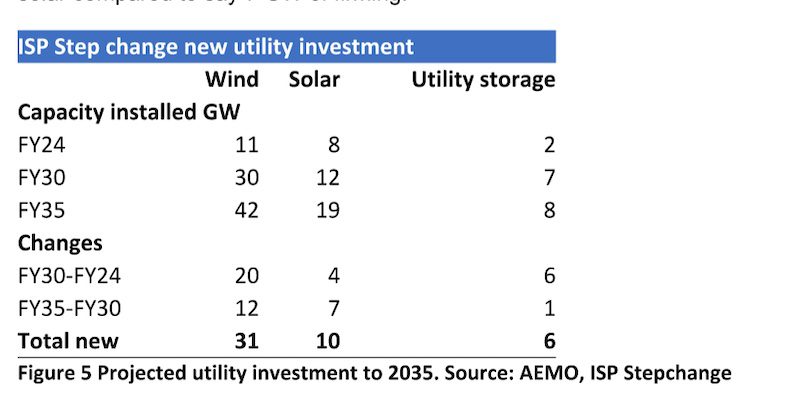

Meanwhile staring at them right in front of their eyes is a need for more than 41GW of wind and solar compared to, say, 7GW of firming.

It’s not that though. The 41GW is really just the beginning, by the time electrification gets going more strongly the amount of wind and solar being built will likely continue to increase strongly. A new technology could emerge, but why invoke that? It’s crystal, silicon crystal that is, clear that wind and solar can do the job.

But for AGL the returns on wind and solar are not high enough. Not suitable for such sophisticated successful investors as AGL, Origin or EnergyAustralia management teams. Leave that to the hoi polloi like Neoen or Iberdrola or Tilt. And if anyone asks, AGL owns 20% of Tilt, so that counts as a partner investment.

Meantime, all the wind and solar developers will go out and strike their own PPAs. For sure some will be with the existing gentailers, but they need not be.

In the end the wind and solar developers will get bigger and bigger and have more and more expertise and bargaining power and will be in a position to dictate terms to retailers, or more likely will just start to acquire them. Long, long ago it was decided that generation and retail belong together.

Even today big retail still has an advantage, small retail never did. Yet big retail is going to lose that bargaining power even if it hasn’t already.

So in the end AGL will end up with customers consuming less volume at both the small and big end of town.