We are keenly awaiting the next part of the Australian Energy Market Operator’s Integrated System Plan [ISP] as in our view this is easily the most important and virtually only forward looking work being done by any of the main institutions: AEMO, AEMC and the Energy Security Board.

Comments on the consultation document were due by February 2 and we hope they will be published soon.

The ISP represents something around which to base real decision making and investment as opposed to the bureaucratic nightmare being dressed up as NEG policy by the increasingly hard-to-take-seriously ESB.

NEG – The bad news keeps coming

Like 150 others, I attended the NEG consultation forum on Monday. Not one question was taken from the floor. As already covered here, most invited speakers expressed reservations of one kind or another, although Jeff Dimery from Alinta was a fan.

Virtually everyone I spoke to privately expressed strong reservations. You’d have no trouble at all lining up 40 or more finance, legal, administrative and technical experts to point out the many technical flaws and difficulties of this proposal.

Here, I just want to point out that the initial work on the NEG was not done at the behest of the COAG energy council, but at the request of the Federal Government.

The Federal Government had no business asking the ESB to do the work, and the ESB had no business accepting the job from the Federal Government.

This was made clear in the COAG official communique of November 2017. We quote:

“Ministers formally amended the Terms of Reference for the ESB including that it only undertake work as directed by the COAG Energy Council. “

This is a pointer to the fact that the NEG is largely a smokescreen designed to get the Finkel Inquiry’s recommendation of a Clean Energy Target off the front pages of the national press and bury electricity policy under a motherhood blanket.

It suits both the Coalition and the ALP not to campaign on electricity policy. High prices are a negative for voters and, let’s face it, Bill Shorten can hardly spell electricity. At a State level high prices in Victoria, Tasmania and South Australia are an issue.

For Coalition supporters. the anti climate change rhetoric from the right wing is embarrassing to anyone with any education. So bury the issue.

Leaving aside that the policy started as a thought bubble and still looks like one, I’d like to make a few final points on the NEG and then leave it like one leaves a bad smell.

- The ESB has only ever advanced two reasons for why the NEG is “good policy”

- Better polices are politically difficult. I just don’t see that settling for a 4th or 5th or 6th best (carbon tax, EIS, RET, CET, State based reverse auctions) policy is acceptable. The Australia I love always strives to be a world leader not an also ran. And there is no need in this case to settle for a participation certificate. We can and will do better.

- It brings emissions and reliability into the one policy. If only that were true. There are two separate guarantees, one essentially written by the Federal Govt and one by the ESB. There is no contemplation in the policy of the interaction between increasing intermittent renewable generation and the amount of firming required as that level increases. We think that is one of its greatest failings, and that’s saying something.

What is the haste to get it introduced?

This policy was dumped on the market with zero warning and was certainly not preceded by an options paper. Arguably, many of the technical issues come from that. The policy is supposed to endure for decades but its major design issues have to be decided in weeks.

This is nuts. There is no rush.

If the rush is about the Paris commitments, we just observe that electricity is 37% of emissions and the Federal Govt has done zero, nada, nothing, diddly-squat about the other 63%.

That’s a disgrace in itself but certainly indicates there is no rush. And as regards reliability both the AEMO and the AEMC have stated they don’t see any reliability issues for at least three years.

- Finally, and I’ll be pleased to move onto a positive topic ASAP we note that the implementation method is support from the Coag Energy Council [CEC] with changes in the National Electricity Law.

The CED has a member from NZ, two from the Northern Territory, two from Victoria and two from the Federal Govt as well as one each from the other States and Territories.

The voting process, if any, is not public. However, we imagine that to proceed it will require unanimous support from those States and Territories within the NEM.

We think opposition from any of Victoria, Queensland, NSW, ACT or South Australia could kill it. Maybe not the ACT alone. There is clearly a political risk in being seen as the “bad person” to kill this “great” policy. So an easier tactic will be to just delay it until after the various elections.

Energy Australia results- fantastic six months

Energy Australia, which at the June half was lagging the profit improvement being seen by AGL and ORG more than caught up in the December half. Energy Australia is perhaps the most exposed company in Australia to the higher pool and contract prices in Victoria via its ownership of Yallourn. Unlike AGL, EnergyAustralia has no lower priced aluminium contracts to hold it back.

In 2016 in the December half Energy Australia made $93 m of EBITDA from generation but this latest six months it jumped to the $354 m. This pretty much locks in further profit growth for calendar 2018 for EnergyAustralia. See the highlighted parts of the table below.

The other thing to notice is the drop off in wholesale gas volumes. Like AGL, EnergyAustralia is keeping its contracted gas for its mass market customers and letting the industrial customers fend for themselves. Both AGL and EnergyAustralia have lost industrial gas volume to ORG.

If we had time we’d write about the exciting proposal from the Andrew Forrest interests to import LNG to NSW. That will cause more volume and some price competition in NSW gas but in the end the price won’t fall as imported LNG ain’t cheap.

Spark’s results were unexceptional, but Transgrid was soft

No space or time to write up SKI’s results. They don’t publish half-yearly volumes. We simply note that Victoria was flat, South Australia strong and Transgrid soft.

We always thought the Transgrid acquisition price was expensive. In our view it will only be justified if Transgrid gets to build lots of new transmission. There is a good prospect of this because the new renewable energy zones will require new transmission, and, if built, so will Snowy 2.

The weekly numbers

Another uneventful week. Of note was that despite very high growth in year on year electricity demand during the week in South Australia and Victoria pool prices fell compared to the prior week and were unexceptional in general. As ever this further confirmed it’s nearly always issues in the supply side that cause pool price variation rather than demand changes.

Gas prices were softer than last year, electricity futures continued to drift and in general interest was elsewhere.

Even at the broader global commodity level the rise in USA bond rates stopped. The only significant move during the week was a jump in oil prices. That will eventually impact gas prices in Australia if sustained.

Ten year bonds rose from 2.82% to 2.9% in Australia to be about 50 bps above last year.

Share prices

Share prices were mixed in the week. APA’s equity raise was a surprise, although as the business has always operated to stay around the maximum debt appropriate for its credit rating and because it has no automatic compensation for interest rate increases in the way that regulated businesses do, it has always had some interest rate risk.

More fundamentally and for years this has been true, despite the add-on capex the business is undertaking its fundamentally short of new projects that can earn a return on capital. An LNG import terminal in NSW would likely have some impact on gas transmission volumes from Victoria and Queensland, mostly owned by APA.

Volumes

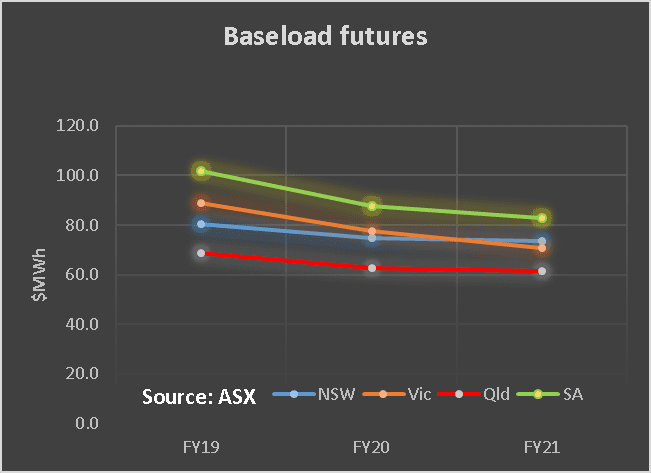

Base Load Futures, $MWH

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.