ITK keeps track of renewable energy production thanks to data provided by Global Roam. Good data is the bedrock of good analysis.

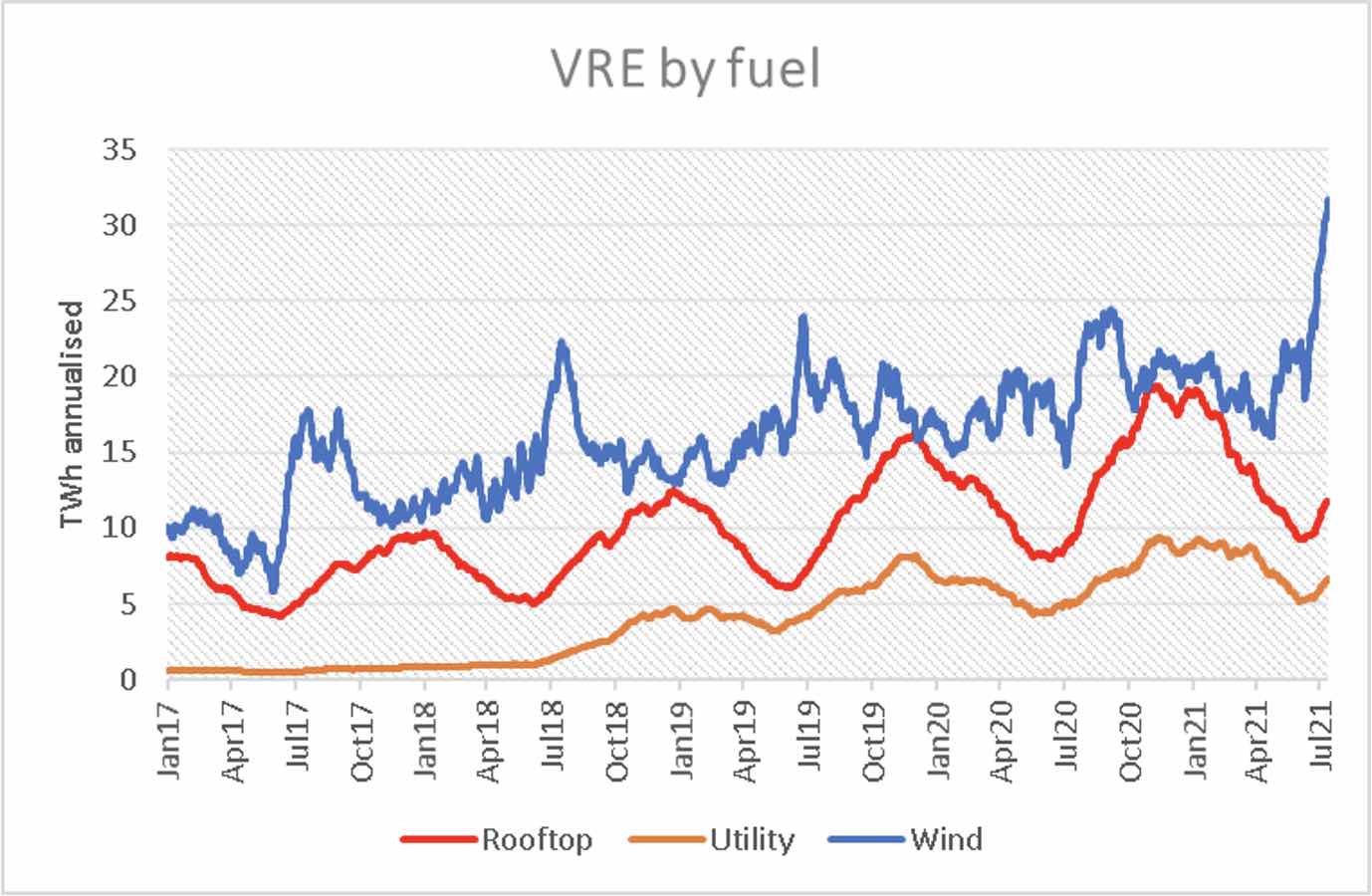

We measure the progress of decarbonisation in the electricity sector by looking at the total and share of VRE (wind, solar and rooftop solar).

Since the output is variable, we use a moving average. Specifically, we take the 30 day moving total and annualise it by multiplying by 365/30. Strictly, we should only annualise seasonally adjusted data and VRE production is very seasonal, so what we show has to be seen with that limitation in mind.

But what a great story it is. Total annualised VRE (variable renewable energy) production is up to 50 terawatt hours for the first time, or about 23% of total demand (depending on how you measure that).

Even though we are moving into the seasonally strong part of the year for wind, I didn’t myself expect the surge we have seen recently.

As the figures below clearly show, we have only recently moved out of the seasonally low part of the year for solar, so if the wind remains strong, we can expect that 50TWh number to go up for at least another couple of months.

An annualized 60TWh around December looks possible. Next year we may see 70TWh. But the low next July may not be that different from this year with pricing dynamic potential.

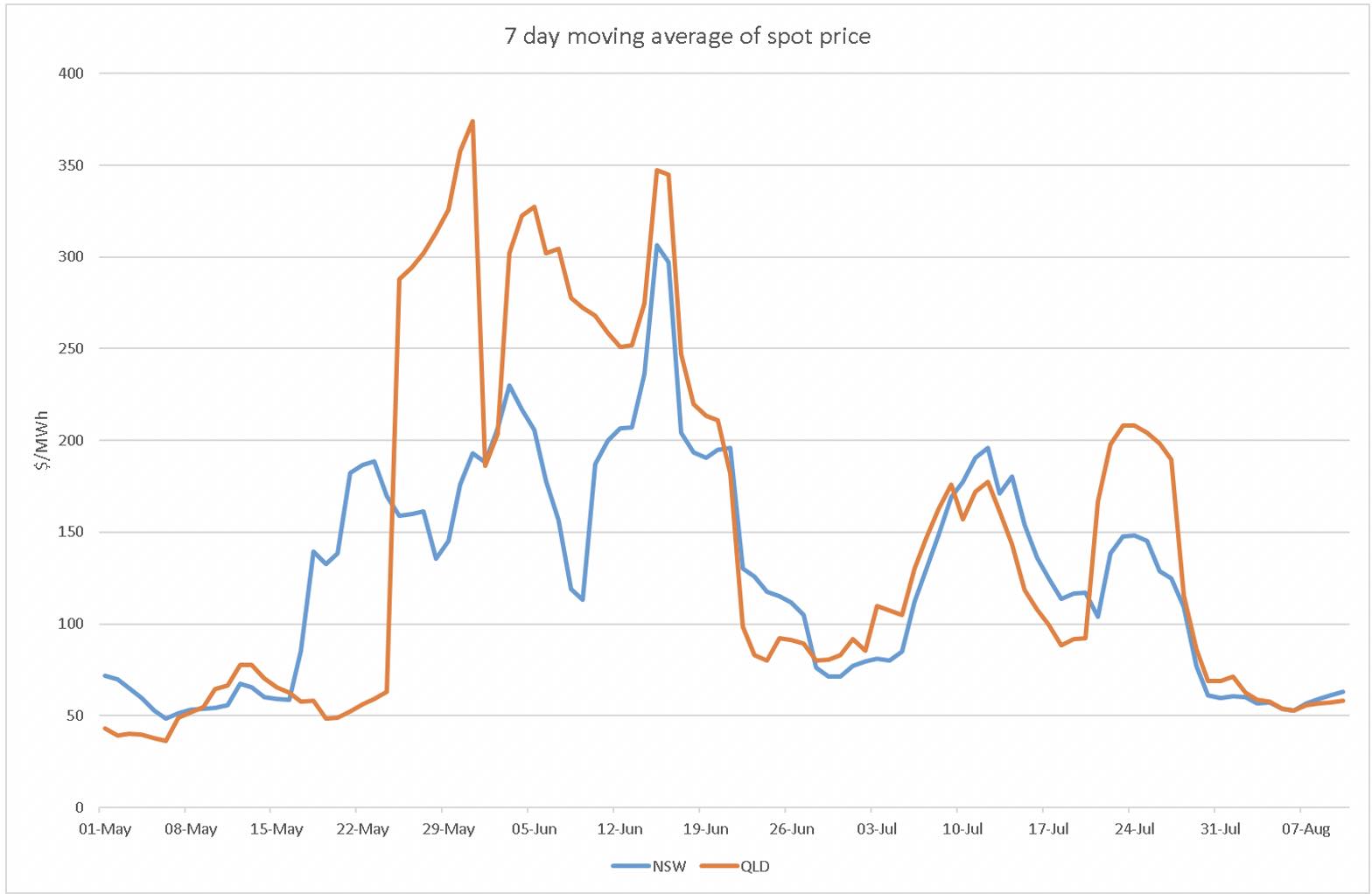

Prices soften in response

ITK has been banging on for more than a year now to anyone who would listen that pricing power for thermal generation was likely to be strongest in the middle of winter, when solar production is down and heating demand is up.

This year the Callide explosion, the Yallourn flooding and the incredible rebound in coal and gas prices produced a fantastic opportunity for coal generators, which naturally they took.

The point about prices is they move much faster than the physical market can react. We talk about inertia in the electricity market but that is non-existent relative to inertia in coal and gas production.

Management have to be convinced about the price move, over time has to go up, extra shifts planned, capital expenditure adjusted. The response take months, at best.

Meanwhile, who wants to sell coal in Australia at a contracted price when the export spot price for 6300Kcal is $A220/tonne? Happy days while they last.

Now, however, the bubble is deflating as Covid and spring soften demand, bits of Callide come back on, Yallourn works its way through the flooding issue, and total VRE is already up 15TWh from its low point.

The Callide explosion was a forced event, but it has exactly the same economic effect as a closure of a power station – except without any notice. None of that three-year stuff. And the market coped. Anyhow, that too is another story. Prices are now back to where they were in May.

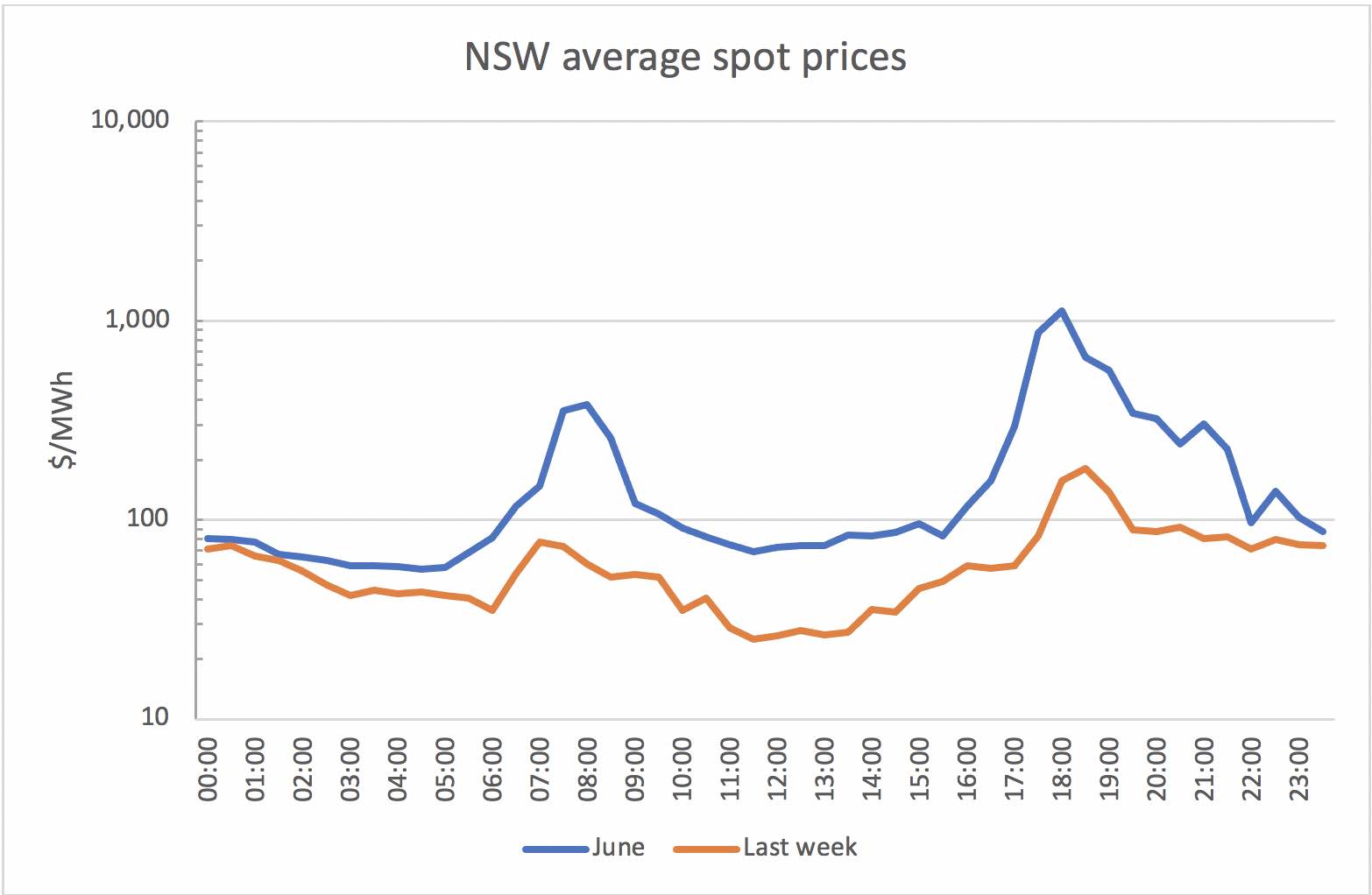

And if we compared the daily shape of prices in the past seven days as compared to the June average using NSW; note the log scale in this chart. The point I’m trying to convey is that midday prices in NSW are already down to $25/MWh and will continue falling as solar production seasonally increases.

Solar prices will stay soft on average and ramping is cramping

Lots more behind-the-meter solar is pretty much a certainty and only draconian policy changes could prevent that. It’s cost effective and consumers want it. In California it’s to become compulsory on new commercial buildings and some high-rise towers. (California to mandate solar, NYT story)

The impact of this will be to reduce the volume and revenue opportunity for all other suppliers, but coal generation (which will have to run at a loss) and utility solar (which can only compete in the same time space) will be the most impacted.

The second impact will be the dramatic ramping requirements as the sun goes down. Victorian generators will basically not be able to do the job; NSW and QLD coal generators will increasingly struggle, notwithstanding that for coal generators they are great at ramping.

This is what the capacity market debate is all about, but old and ageing coal generators are just the wrong tools for the task.

A system that wants to rely on tools that will never be fit for purpose is completely stuffed. I have more respect for our policy makers’ intelligence than to believe that this will end up as the case.