As RenewEconomy recently reported, ‘South Australia continues its record-breaking run on renewables, with wind and solar contributing just over 85% (85.4%) of the state’s electricity demand for the month of December.’

This is a great achievement that builds confidence that a rapid energy transition is practical and economic. But we need to recognise some emerging challenges.

After reading that article I decided to look at the longer-term picture for South Australia, which is leading Australia’s renewable energy transition, and likely the world’s.

I have written about this before for Victoria and the overall NEM (see https://reneweconomy.com.au/how-much-seasonal-energy-storage-will-we-really-need/ ) but I haven’t previously focused on SA.

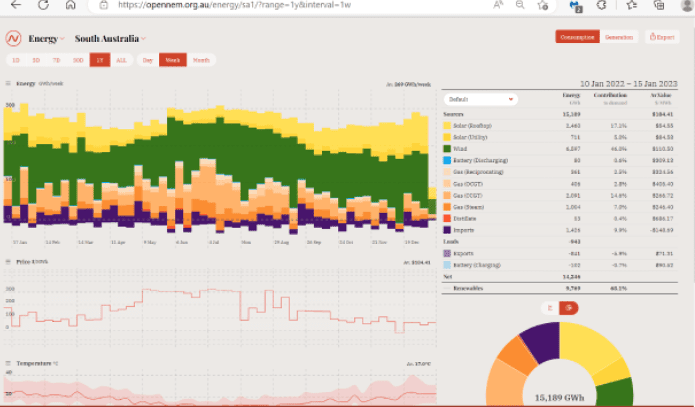

The OpenNEM website shows wholesale electricity prices as well as electricity supply by source on a weekly basis for the past year.

I focus on weekly data because, in future, demand response and management, batteries, EVs etc should be able to smooth short-term peaks and troughs. But maintaining a system with high variable solar and wind over periods of days to a week with low solar and/or wind may be trickier.

The OpenNEM weekly data shows that high weekly wholesale electricity prices are sustained through winter when solar output is low and non-solar generation peaks. The grid is then heavily dependent on wind and dispatchable sources such as gas, hydro and storage, as well as network and transmission capacity for imports.

The Australian Energy Regulator publishes residential quarterly electricity and gas benchmarks based on surveys and analysis by Frontier Economics. These provide the graphs and tables that appear on energy bills in relevant jurisdictions so consumers can compare their household usage with others in their area.

These show (below) that representative South Australian households use significantly more gas and electricity in winter.

An appendix to the report shows some south Australian consumers use more than four times as much in winter as ‘representative’ consumers! OpenNEM shows that a lot of winter electricity is generated using gas at present.

I don’t have good data on seasonal commercial sector gas and electricity demand, but I suspect its winter consumption is higher too: highly glazed, leaky buildings with inefficient HVAC equipment are very good at losing heat in cold weather.

There is also scope to improve efficiency across industry to free up even more gas and to improve electricity efficiency. We don’t really have decent data on the real-world efficiency of existing gas use or future heat pump efficiencies, so all estimates are uncertain.

The role of charging and discharging Electric Vehicles is a big uncertainty that I won’t address here.

There is now strong momentum to shift from gas to efficient electric technologies across residential and commercial buildings.

These are the main drivers of winter gas and gas-fired electricity demand across all southern states, as shown by AEMO. Southern Australian (SA, Victoria, NSW, Tas) winter peak demand is over three times summer demand, over 1,000 Terajoules per day higher.

And AEMO is concerned about emerging potential gas shortages in southern Australia.

Renewable energy and storage cannot address this transition rapidly and cost-effectively without serious winter-focused demand-side action to upgrade our thermally poor buildings and replace inefficient electric appliances and equipment, particularly resistive space and water heaters, as well as switching from gas.

Otherwise in future the ‘dispatchable generators’ – particularly hydro, gas and storage, will be able to set spot market prices high in winter and wind and other generators will also capture windfall gains at the expense of consumers.

International fossil fuel prices will also play a part. Flexible dispatchable suppliers also potentially face declining annual utilisation of capital-intensive plant, increasing their cost overheads per unit of output. The situation could get interesting.

Wind, which often has high winter output, also has an important role to play in winter, so we should focus more on diverse wind regimes that have high winter output. Maybe that’s why the Victorian government is keen on offshore wind.

If we don’t get the balance right, a lot of solar could be curtailed in mild sunny weather and summer and dispatchable generators could use their market power in winter, which will waste a lot of consumer money and slow transition to zero overall emissions.

Many people just focus on the exciting short-term games: we need to be more strategic. South Australia’s experience should be helping us to focus on what will matter in the future.