Large-scale Generation Certificate (LGCs)

The passage of the 2017 compliance date brought softer prices in the LGC market and also an under-surrender of LGCs. Yet the biggest news during this period was the short lived impact on prices that the Clean Energy Regulator’s statement had.

There is a common perception that the passing of the compliance period (14th February following the compliance year) results in a softening of LGC prices.

An analysis of the last decade shows this largely to be true, with some kind of meaningful decrease in price observed in 7 out of the last 10 years (2010, 2011-13 and 2015-17), though often the reduction in price was preceded by a short term run up in the lead up to compliance and in other instances the price movements are part of a longer term trend.

None-the-less the passage of the 2017 compliance year will likely only add some credence to this theory with a drop in both the spot and shorter end of the forward curve taking place across February.

The spot market opened February lower at $86.15 before strengthening to a high of $86.75, only days later. From there a steady downward trend ensued, gradual at first before gathering more pace after 14th February.

With the spots sitting in the low $84s later in the month, the major highlight came by way of market and surrender updates from the Clean Energy Regulator (CERs).

Having previously flagged the prospects of an under surrender in January, the CER’s shortfall update showed that along with a 10% carry forward of circa 280k LGCs (which is not considered a shortfall), there was a shortfall of just under 1.4m LGCs for the 2017 year.

This shortfall was spread across 22 entities, though two second tier retailers made up over 65% of that figure.

Unlike a year ago when another of the major liable entities opted to pay the penalty for a sizeable proportion of its 2016 liability, the shortfall penalty payment has not garnered as much criticism or media attention this time around.

While the news of the under surrender was enough to capture market participants’ attention, it was not the issue that had the biggest impact in the market. That was left to comments made by the CER surrounding LGC prices.

As had been the case in January, the Regulator took the opportunity to express its views on the supply/demand balance of LGCs into the near future.

Having reiterated its expectation that the scheme will remain in surplus across the 2018 and 2019 compliance years and be met in time for the 2020 compliance year, the Regulator also took the step of saying:

“As the market starts to see the pace of build this year, and an increasing supply of certificates entering the market, we expect spot prices for certificates to moderate further.”

Perhaps not expecting price related commentary from such quarters, the spot and forward markets dropped sharply on the comments.

While the lows for each contract were as follows Spot $83.50, Cal 18s $84.25 and Cal 19s 74.00, there was a time where each appeared set to trade even lower, though low liquidity at the time was a barrier to further activity.

Whilst the comments appeared to have an immediately negative impact on the short end of the curve, this proved short lived with a prompt recovery ensuing on the day and a total recovery in pricing taking place within a matter of days.

The reality prevailing in the LGC market right now is that either the market does not share the Regulator’s optimism surrounding the ability of developers to stick to current project commissioning timelines and thus ensure a surplus of LGCs in Cal 18 and Cal 19, or it does not believe the surplus will be substantial enough in those periods to avoid the continuation of scarcity pricing of LGCs.

Add forward curve chart

The Cal 20 vintage on the other hand is different. After a hiatus which extended from late November, February ultimately saw a resumption of trade activity in the Cal 20 vintage and the direction was undisputedly downward.

Having last traded at $58.50 in November, the market returned to activity once more at $50.00, before gapping down to the low $40s and then ending the month at $38.50.

While trade volumes during this time were low, the pricing outcome implies that the market believes there is a much greater chance that a meaningful surplus of LGCs will be achieved in the Cal 20 compliance period.

Over the coming months, further project commitments and updates to the timelines of existing projects will be key to determining whether this view holds or instead is proven wrong.

February also saw the release of the National Energy Guarantee (NEG) consultation paper. Aside from the obviously challenging political reality that the policy faces, a great many concerns have been raised by participants surrounding its implementation.

From the perspective of renewable projects, it appears that projects accredited under the RET will be acknowledged as part of efforts undertaken via the NEG. Yet a fundamental question which remains unanswered is whether or not the existing RET will be closed off to new projects at some stage.

If it is not, then any new project commissioned before 2030 should apply for accreditation under the RET to be able to create LGCs, for there will be little alternative open to them now that the Clean Energy Target has been jettisoned.

As a result the surplus of LGCs would continue to grow and LGC prices would ultimately go to zero.

If instead a decision was made to close the RET to new projects, what would the criteria be to determine eligibility? Date of financial closure? Commissioning date? What happens if delays force a project beyond that date?

And what if the number of projects committed by that date is insufficient to ensure a surplus, or if the surplus it produces is not large enough to compensate for any potential reduction in generation owing to drought or for variability in solar radiation or wind levels?

So many questions, so much time wasted, one can’t but help wonder if the entire exercise is pointless.

Small-scale Technology Certificates (STCs)

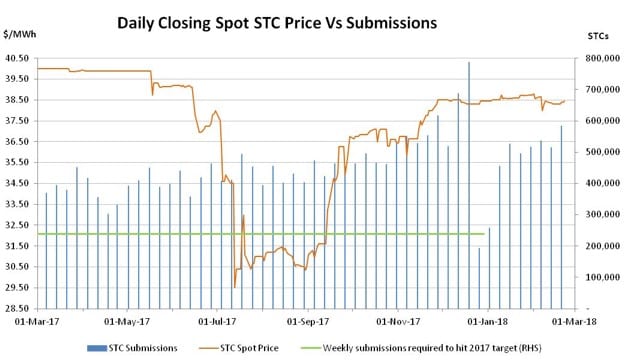

A modest reduction in prices, an under surrender of STCs, large trading volumes and plenty of speculation as to the level at which the target will be set for 2018 were the hallmarks of the STC market across February.

As with the solar industry more broadly, it was a busy month in the STC market during February with the spot market opening at $38.75 and trading down to a mid month low of $37.90, after which the market recovered steadily to reach $38.45 by month’s end.

It was a particularly bustling period for the forward market with many strips for settlement across the second half of 2018 taking place initially in the $38.90-$39.00 range (before the spot market softened) and subsequently in the $38.70-$38.85 range, illustrating a smaller reduction in prices than the spot experienced.

There was also plenty of activity in the 2019 forwards with many strips for settlement across the Jan-Dec19 period taking place between $38.75-$39.00 during the month.

Despite a catch up in surrender taking place in Q4 as the true up of actual electricity load versus the estimate used by liable parties across the year took place, 2017 still saw a modest under surrender of STCs with 12.2m STCs acquitted against a target of 12.45m.

STC submission numbers remained red hot across February with a weekly average of 538k taking place across the month, thus lifting the weekly average for 2018 to 486k. For some context, by way of comparison with last year, average weekly submissions for 2017 were 428k.

The strong supply figures have only fuelled the already rampant speculation of the 2018 Small-scale Technology Percentage (STP). The target for 2018 will be dramatically larger than 2017, of that there is no doubt. The question remains as to exactly how hefty, with the current rate of STC submissions indicating that a target in the high 20 million range would be looking increasingly inadequate.

Whether a target of 27m is significantly less politically palatable than 33m almost appears to be matter of semantics when compared to the 2017 target of 12.45m. Despite that fact, there are many who believe that the Turnbull Government will be loathe to announce such a dramatically larger target and therefore anticipate implicit (or other forms of) pressure being brought to bear on the Regulator in an attempt to encourage a more moderate outcome. With the legislation requiring the STP to be released by 31st March and the wheels of government generally ensuring that it arrives only just before that date, it seems the speculation is set to continue for at least another 3 weeks.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.