Queensland has moved from being an electricity exporter to a net importer in January, 2022, pushing wholesale prices through the roof, and to what can only be described as absurd levels.

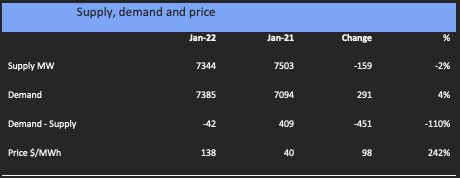

We start this analysis by comparing the main data points in January 2022 with those of January, 2021.

A 4% increase in demand and a 2% reduction in price, together with other factors we will get to, have led to pool prices rising to $138/MWh in January 2022, an absurd level compared with the previous year and when compared to prices in the south of Australia.

There is a knock on effect in NSW, where NSW has actually been a net exporter to Queensland instead of the normal situation of importing up to 1GW, and despite NSW still not being able to import what it would like from Victoria.

See also: Australia’s north-south divide: Electricity price jumps in coal dependent states

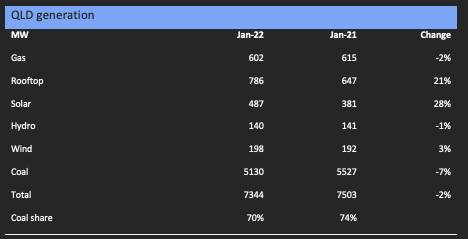

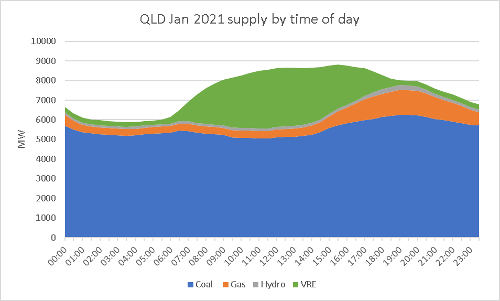

Looking at average Queensland generation by power source in a bit more detail, we see a huge share for coal, still at 70 per cent even if it is down from 74 per cent a year earlier.

And if we break coal down, again on MW average over the month:

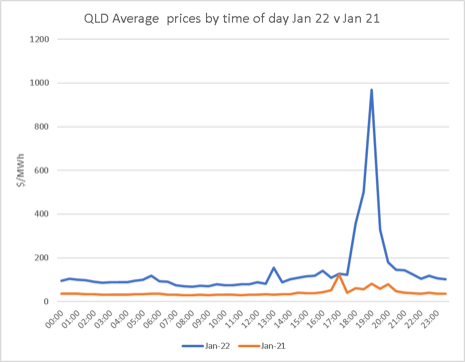

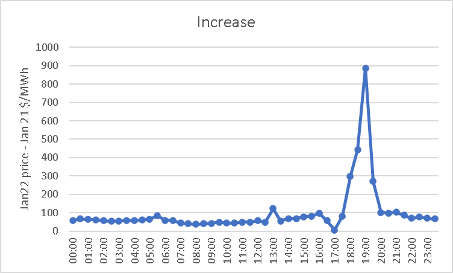

Looking at the price by time of day:

Although the peak period sticks out like the proverbial, prices for every half hour were way up on last January.

And finally for data we show two time of day simplified supply charts adding wind, solar and behind the meter to make VRE.

Analysis: causes

January 2022 is only one month and any analysis can easily be criticised for focusing on too short a time frame, but in ITK’s opinion January reveals exactly the kind of problems and issues that can be expected in QLD. Indeed its pretty much playing out as expected.

Firstly we have known for years that ageing coal generators are a risk. AEMO has been saying so. Even though Queensland generators are younger and the focus has been on NSW and Victoria a broadly similar situation exists in Queensland.

Secondly each an every coal fuelled turbine in Queensland is a significant piece of supply. If a turbine at Callide C blows up, it’s an electricity emergency. If a coal generator reduces output over a longer period of time it drives up prices.

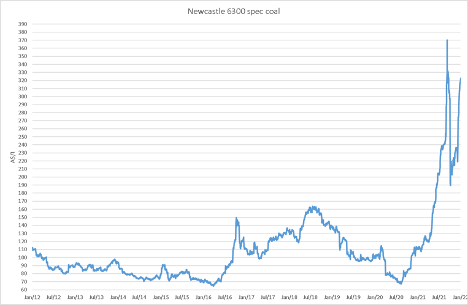

Thirdly, one of the big problems with fossil fuel generation is fuel prices. ITK has advocated for many years that fossil fuel generators require a higher cost of capital than wind and solar because future fuel prices are uncertain. Obviously this is playing out not just in Queensland but in China and in Europe.

And the fact that it’s a global thing points to another thing and that is despite what Queenslanders would like to think they live in the same world as everyone else. Beautiful one day, perfect the next, but maybe not so good next week.

Most Queensland generation, but certainly not all, has captive mine mouth coal, some of not particularly high quality, but for mines that can export you need to pay up:

Equally with oil at $US90/barrel export LNG prices that are directly tied to the oil price, as all those in Queensland are, will be up around $A16- $17/GJ. Gas-fired generation needs a big, big price to justify burning that gas. Even hydrogen starts to look attractive.

And so these “facts” lead to an obvious point: just like every other NEM region it’s in Queensland’s best interests to reduce its reliance on coal generation.

Lots of new supply needs to be built and it needs to be built quickly. New supply has to be built in advance of old supply closing. NSW gets this, Victoria gets this, Queensland does not seem to get it.

The controversial root cause

In my opinion the reason Queensland is stuffing up its energy policy is because the government owns most of the generation. The fundamental problem is that the government is conflicted in making decisions because it owns the main generation companies. It’s a “moral hazard”.

I argue that the reason Matt Kean could make such good and comprehensive policy in NSW, bringing essentially all stakeholders including the ETU with him on the journey, is because NSW was not conflicted in owning the coal generation that will be impacted by the new policy.

Similarly, in Victoria, the state government can put in place policies to get new supply built ahead of the expected closure of coal generation in Victoria over the remainder of the decade.

In Queensland, it’s not the same. You can argue the political environment is different, but it is not so different to NSW, which also has lots of coal generation and lots of coal mines.

Queensland has refused to face up to the facts. It continues with Palaszczuk policy of promising the south of Queensland greener energy and everyone else that coal generation will go on for ever. That course of action eventually leads to rot. Good government does require facing up to facts, it does require making policy. Ships need to have their courses set, you need to tell people where they are going and how to get there.

A way forward

The simplest way forward in Queensland is for the state-owned generators, Stanwell, CS Energy and Cleanco to be given some money by Queensland Treasury to underwrite the building of lots of new wind. Solar alone won’t cut it and, anyway, with a bit micro management, rooftop solar can do a lot of the solar work. What’s needed is several GW of wind. That’s what’s called for in the ISP and that’s what will take some of the stress off peak prices.

In my view, it should be the government encouraging the private sector, but in Queensland it can be the state-owned generators doing the work. Once the wind farm program is started and with, say, 1GW of batteries thrown in and the construction jobs, the social license effort, the required transmission arrangements made, moving Boyne island to renewable energy; once that is done, the coal closures will follow naturally.

But it will be a real problem if the Queensland government doesn’t get on with it. That’s been obvious for years and this month just makes it even more obvious. Queensland is going too slow and not facing up to the facts. That is weak in a state that has a reputation for strength.

See also: Coal states brace for power crunch as heatwave collides with generator outages