While the Morrison government has sought to celebrate recent falls in retail electricity prices, it hasn’t prevented more Australian households from owing increasingly larger debts to their electricity retailers, as vulnerable customers are left exposed during the continuing pandemic.

The Australian Energy Regulator (AER) published its latest assessment of energy market performance on Wednesday, which showed electricity debts increasing as large parts of Australia were plunged into Covid-19 lockdowns in the middle of 2021.

Federal energy and emissions reduction minister Angus Taylor has sought to claim credit for falling wholesale electricity prices – which have been primarily driven down by increasing uptake of renewable energy technologies – but household energy debts have risen to new highs.

It suggests that measures to address household financial stress caused by the Covid-19 pandemic have not been sufficient to prevent more households from falling into higher energy debts.

The trend has been outlined in the latest retail energy market update published by the Australian Energy Regulator (AER) on Wednesday, showing that households incurred higher electricity debts during the first quarter of the 2021-22 financial year, covering July to September 2021.

“Average debt of residential customers increased by nearly 10 per cent since Quarter 1 in the previous year and is now $1,079. Increases occurred across all AER regulated jurisdictions, with NSW residential customers having the greatest proportional increase,” the AER said.

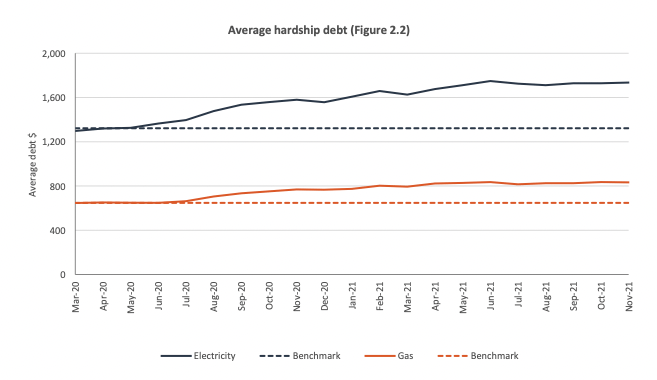

“Both the average electricity debt of residential customers who entered into hardship programs, and debt of customers on hardship programs also increased by nearly 10% from Quarter 1 of the previous year.”

Average household debts were highest in Tasmania ($1,395) and South Australia ($1,307), while debts were lowest in the ACT ($778) and Queensland ($857).

Since 2016-17, the average value of household energy debt has increased by around 56 per cent, while the number of households in debt fell by around 20 per cent over the same period.

It suggests that while there are fewer households in debt, those in debt have incurred larger levels of debt to their energy providers.

The outcomes mirror the recent findings of Energy Consumers Australia, which called on electricity retailers to do more to protect vulnerable customers.

“We are seeing larger energy debts and more people owing a debt to their retailer,” Energy Consumers Australia CEO Lynne Gallagher said in November.

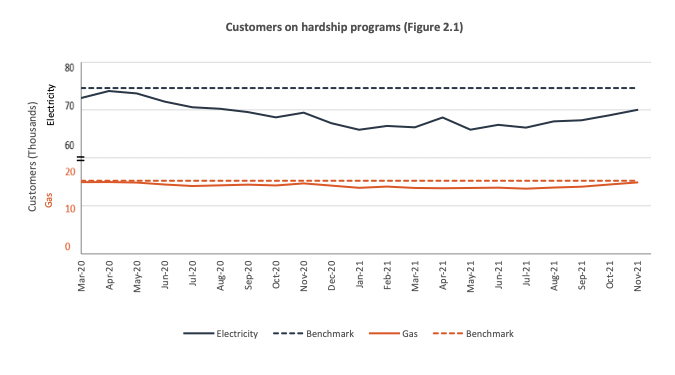

“Yet the number of people being placed onto hardship programs by their retailers has fallen significantly – that simply should not be the case.”

“The way the energy system treats financially vulnerable people was a problem before Covid-19 and we can now see it will remain a much larger problem after it, unless we do something different,” Gallagher added.

Fortunately for households, the AER data shows disconnections falling by 27 per cent in the quarter, with the AER issuing a ‘statement of expectations’ following the Covid-19 outbreak, which instructed retailers not to disconnect New South Wales households from the grid if they have been impacted by the pandemic.

Last week, Taylor seized upon a report from the ACCC that found that retail electricity prices have fallen to eight-year lows, claiming credit for the result.

“Our plan is delivering real savings for Australians, and this is yet another report, following recent reporting from the AER, the AEMC and the ABS, showing how this government’s actions are supporting sustained and substantial electricity price falls,” Taylor said.

“The government is committed to ensuring access to affordable, secure and reliable electricity. Australian households and businesses deserve no less.”

But the latest data from the AER shows that despite decreases in electricity prices, some households are still falling further behind in their ability to pay their bills.

This has been further amplified by the Covid-19 pandemic and a lack of government support for households who may be struggling with lost income.

The AER found that overall, the number of households in debt fell by around 10 per cent across July to September, primarily driven by Queensland retailers returning adjusting their debt practises and Queensland households being provided with a $50 bill credit from the Queensland state government.