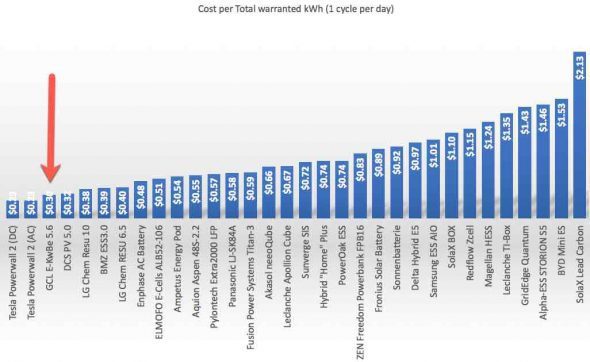

Following our graph of the day earlier this week, showing cost per warranted kWh for a range of stand alone batteries and All-in-one storage systems, GCL has announced specification and price changes that move their cost from $0.67 down to $0.30 per warranted kWh.

GCL are at pains to point out that, although the Tesla Powerwall 2 can be ordered for a promised Feb/March installation, their batteries can be shipped from Australian warehouses today.

For homes that want a smaller battery (5.6kWh vs Tesla’s 13.5kWh) for a lower overall price the E-KWBE can be retrofitted to an existing solar system with a GW2500-BP DC Converter for around $5k + installation costs.