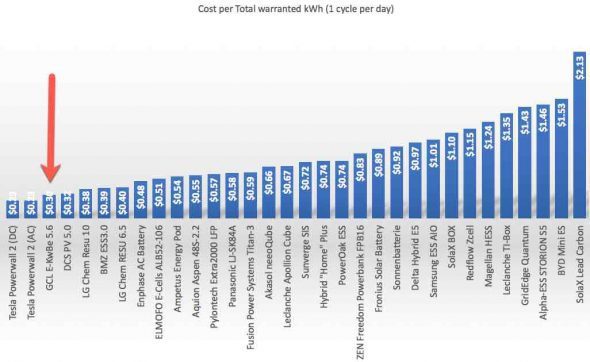

GCL slash price of battery to be 2nd cheapest per warranted kWh

Articles for you

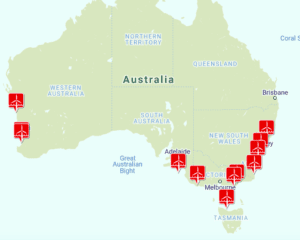

RenewEconomy launches Offshore Wind Farm Map of Australia

RenewEconomy launches its Offshore Wind Farm Map of Australia, the latest in a series of important map references for clean energy technology.