The Western Australian government has given ASX listed renewables developer Carnegie Clean Energy nine weeks to clarify the finances for its Albany Wave Project in the light of proposed changes to federal government tax incentives that “threatened” the company’s bottom line.

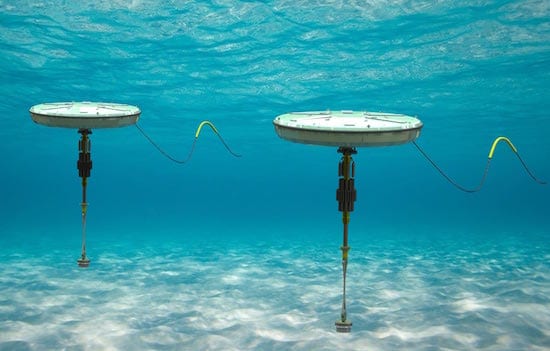

The proposed 20MW project – which would likely have its beginning as a 1MW pilot – aims to use Carnegie’s CETO 6 technology to tap what the company says is one of the most consistent wave power resources in the world, off the coast of Albany.

The project, which was promised a total of $19.5 million in state government funding in an election commitment ahead of the March 2017 WA election, was to be aligned with the region’s existing infrastructure, including an existing wind farm.

In a statement on Friday, the state Labor government said it had agreed to pay Carnegie a previously negotiated and revised first milestone payment of $2.625 million for the project (half the originally agreed sum) on which Carnegie had commenced site development activities and design works.

But while Carnegie had complied with its contractual obligations, the government said it must now provide “a comprehensive and detailed funding plan” for its own financial contribution to the project, due to the federal government’s proposed changes to research and development tax incentives.

“The company will be given nine weeks to complete this plan,” the government said, after which time it would assess whether the company had the financial capability, in this altered tax incentive environment, to complete the project.

“The federal government’s proposal to change R&D tax incentives, contained in their 2018-19 Budget, has threatened the bottom line of several Western Australian companies – from renewable energy to tech metals,” said regional development minister Alannah MacTiernan.

“These changes emerged after the State Government signed the funding agreement for the Albany wave energy technology development project.

“Given the circumstances surrounding the Federal R&D changes, the State Government is committed to protecting its investment and building safeguards in the project to minimise financial exposure.

Carnegie has been going through a difficult period.

It has taken major write downs on the value of its CETO technology, citing the competition on price being posed by wind and solar technologies, and it took a major write-down on its Energy Made Clean purchase, which it partly blamed on ongoing diesel subsidies that had slowed down the adoption of off-grid and remote renewables-based micro-grids.

It has agreed to merge that business with MPower, a subsidiary of the listed Tag Pacific, but is now aiming to change the terms of that deal. It has also agreed to sell another stake in its nearly complete 10MW solar farm at Northam to help boost cash reserves.

On top of that, it cited the potential impact on the changes in the R&D alliances, its share price has plunged, and last week long-serving CEO and managing director Michael Ottaviano resigned as CEO and was replaced by the company’s chief technology officer.