A surge in demand for voluntary carbon offsets, underscored by a raft of corporate net-zero emissions pledges, has pushed Australia’s de facto carbon price to a new high, paving the way for a market “supercycle,” despite the lack of a targeted federal policy.

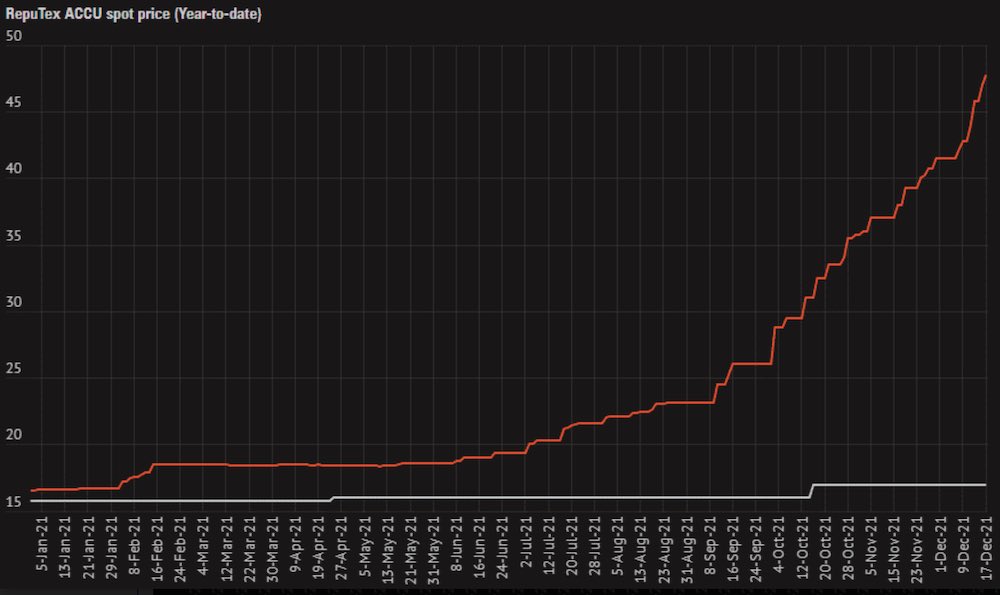

New research from carbon market analyst RepuTex shows the carbon market has experienced a “major bull run” over the course of 2021, with prices for Australian Carbon Credit Units (ACCUs) soaring by more than 180% to $A47 per tonne.

Reputex says the price jump has been bigger than even the European carbon market, which is backed by strong EU policies, and where prices recently closed in on €90 ($A142), before falling back toward €80 ($A126), for growth of 146 per cent, year on year.

Australian prices are headed even higher, according to RepuTex, whose latest outlook has forecast that the medium-term ACCU price will rise to $A60/t, driven by growing investor participation and bullish sentiment around net-zero targets.

“As companies pursue a net-zero pathway, a carbon ‘supercycle’ is almost inevitable, with voluntary demand to outpace supply, driven by a raft of corporate pledges which have come about at a rapid pace” said Reputex executive director Hugh Grossman.

“The surge in voluntary buyers – both corporates and investors – has triggered a structural change in demand that is unlikely to be met by short-term supply, suggesting a sustained period of higher prices could be on the horizon.

“In particular, voluntary demand is expected to grow as companies continue to set net-zero emissions pledges,” Grossman added.

“While many companies are utilising cheaper international offsets to comply with their immediate voluntary targets, most are also building a pipeline of ACCUs to protect their forward positions.

“This should continue to place upward pressure on prices, supported by increasing investor capital as banks, speculators and trading houses seek to access the low carbon transition.”

But Grossman stresses that the alignment of federal government policy with corporate commitments to reach net-zero emissions by 2050 will be highly important to the ongoing progress and stability carbon market in Australia.

Already, tight ACCU supply – attributed to the large volume of ACCUs contracted to the Commonwealth’s Emissions Reduction Fund – is looking increasingly likely to require intervention from theClean Energy Regulator.

“We believe it is increasingly likely that the Regulator will provide project owners with flexibility to redirect supply away from the Commonwealth toward private buyers,” said Grossman.

“Providing project owners with optionality to unlock supply from some contracts is far more preferable than sellers going rogue and breaking their contracts, which will erode the integrity of the government’s contracting scheme.

“Just because the market is already doing it doesn’t mean policy isn’t needed,” Grossman added.

“The design of a transparent net-zero pathway is critical to guide the timing of long-term planning and capital investment decisions, and to ensure investment is directed to the technologies and carbon offsets that can best support Australia’s low carbon transition.

“An orderly transition is always the cheapest.”

See also Michael Mazengarb’s analysis: Why high carbon offset prices spell trouble for Morrison’s flagship emissions policy

Good, independent journalism takes time and money. But small independent media sites like RenewEconomy have been excluded from the millions of dollars being handed out to big media companies from the social media giants. To enable us to continue to hold governments and big business to account on climate and the renewable energy transition, and to help us highlight the extraordinary developments in technology and projects that are taking place, you can make a voluntary donation here to help ensure we can continue to offer the service free of charge and to as wide an audience as possible. Thank you for your support.