AGL this week updated the market on its proposed de-merger, providing key details which should have, but clearly didn’t, reassure investors.

The main features of the new details are:

Combined debt of the two businesses is expected to be roughly identical post demerger as before;

There will only be a small ongoing equity raise despite lower earnings, by way of an under written DRP (dividend reinvestment plan).

The generation contract between Accel Energy, the newly constructed coal generation business, and AGL Australia, the gas and electricity retailing business, is of relatively short duration in the first instance, which means both businesses have the option of buying and selling elsewhere in the foreseeable future.

Accel will own 20% of AGLA. This increases the assets of AGLA through to 2030 and makes it easier for the business to borrow. At some point Accel will likely sell its interest. It will not have a board seat at AGLA.

A summary of the FY20 demerged numbers as presented by management, but with allocations of central expenses and capex done by ITK is:

Looking forward, Accel might be around $1,000m of EBITA in FY22, but AGLA will be down to no more than $200m, reflecting falls in the wholesale gas book margin.

In comparison to our prior numbers, the AGLA ebitda is way higher. That is mostly because wholesale gas is included in AGLA (we had left it and its $400m of ebitda with Accel) and partly perhaps because something, likely Southern Hydro, makes a lot more money than we realised.

The assets of the two businesses are:

AGL Demerger offers a way forward

The AGL share price is down very sharply post the demerger update.

Part of that was no doubt due to the further earnings torpedo where management said that FY21 Ebitda was going to be in the lower half of the existing range, so we estimate Ebitda about $50m below prior consensus of $1,720m.

That number benefits from a one time $90m insurance recovery, and also a further $25m of net profit from an accounting policy change that reduces depreciation and amortization.

Management also reiterated that FY22 will see a material step down in earnings and that step down has been locked in through “forward sold positions”.

That step down mostly impacts the Accel Energy business but part of the decline is due to increases in wholesale gas supply costs which will impact the “AGL Australia” business.

Demerger likely to create value

Leaving the earnings downgrade aside we see the demerger as a positive step. AGL was a sitting duck if it just waited round while the NEM continued to decarbonise and it lost market share without being exposed to the upside.

The AGL and ORG shares prices are well down this year. Lithium shares are up over 100%, as is Lynas, a rare earths producer.

The market loves the electric vehicle story. Companies like Neoen, Iberdrola and PowAR continue to invest rapidly; and another $3 billion a year goes into behind the meter investment, and so on.

The existing AGL is hopelessly conflicted and unable to participate. Every wind farm investment is a nail in coal generation’s coffin

There is no prospect of selling the coal generation business, AGL made its bed years ago and having made good money in some years now has to live with the consequences.

The demerger does provide a fresh start for both businesses. Even the Accel business, left to its own devices, may find a way forward.

Maybe there is a hydrogen opportunity, and or a battery bank, or solar thermal, or something that takes advantage of the transmission infrastructure.

De-mergers mostly either reveal or create value. In our opinion they “create” as much as reveal. Often management of the new business see opportunities and directions that just weren’t given much consideration in the conglomerate.

The value is hidden, and its probably not always there, but often enough.

Our biggest problem with the demerger, but not one that anything can easily be done about, is that AGL Australia, the new retail business, has far too much gas in its profits.

That’s a problem because Australian management in general don’t get that gas is just as big a carbon issue as coal.

Far better in our view, but like too hard for management, if all the gas business had gone with the coal generation.

Power contracts offer optionality to AGL Australia

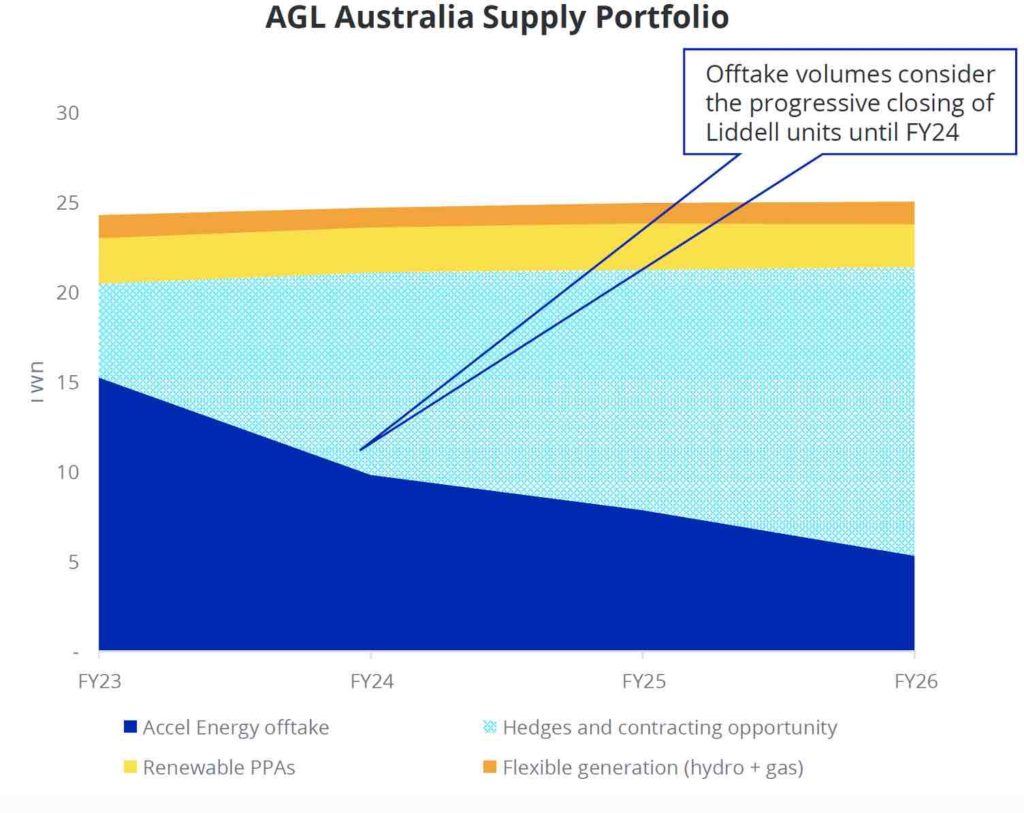

Regarding the power and energy contracts between the two businesses the key point is that from 1 July, 2023 AGLA is only expected to buy 20% of Accel’s generation in Victoria and 35% in NSW.

However, these quantities can be increased essentially at AGLA’s discretion and assuming ACCEL wants to sell:

Accel Energy likely to have $1 bn of ebitda

Accel Energy has about 20TWh exposed to the electricity price. Costs in Victoria, including fuel, are largely fixed for any year but rise over time.

In NSW, by contrast, Accel enjoys a diminishing cost advantage over other coal generators but is still exposed to coal price risk especially in the medium term, and competitive advantage against other coal generators is not much help when the competition is price and cost ignorant rooftop solar.

Every $1 change in the price received on that 20TWh is worth $20m. Origin Energy states that they expect about a $20/MWh hit to Eraring power station average prices.

If we use that as the benchmark for Accel, its $400m downside, taking Ebitda from FY20 proforma $1500m down to say $1000m, maybe a bit lower.

A partial offset will be that Accel will gain 20% of AGL Australia, and if we used proportional equity accounting that would add, say, $150m, and from a cash flow perspective 20% of AGL Australia’s dividend.

We would expect some further negative impact in FY23. Still, NSW Futures have improved almost $15 from their low point, and $65/MWh is not a bad price, if the coal was fully hedged.

Victoria is presently the area of greatest downturn. We are still yet to see Stockyard Hill and Moorabol windfarms (a combined 850 MW) ramping up but that is already factored into forward expectations.

The basic situation remains as it has since the NSW Roadmap was made legislation that new supply will continue to come into the market, offset from time to time by coal generation closures.

We expect this means that electricity prices will on average be “low” that is at or below new entry for wind or solar, but volatile. Accel has limited ramping ability in Victoria, but Bayswater in NSW has some flex.

Notwithstanding the $1400 m environmental liability we anticipate Accel to have say $400m of cash flow per year post capex, interest and tax out to 2030 which should suffice to pay down debt, pay a dividend, and enable some reinvestment.

Conceptually the low level of debt will lower the interest tax shield but its too early to talk tax.

Is the analyst negativity justified?

On the conference call there was criticism from investment banking analysts that AGL was buying back shares at higher prices than today and so therefore how can management judgement be trusted?

But investors and management and forecasters of all sorts constantly get price forecasts wrong. What matters is not the past, but the future.

For that matter analysts got it wrong in saying Accel wouldn’t have any debt capacity when it turns out it does.

It is true that management will be raising a moderate amount of equity via an underwritten DRP for the next year, and we do regard that as a signal of a balance sheet under a bit of stress, but its not demerger related stress, its stress because earnings are going to be under sustained pressure.

Should management have forseen that? Of course they should? Still they are hardly alone in human history in not forecasting future prices properly.

Looking at earnings to enterprise value

AGL presently has about $3 billion of debt and following today’s 10% share price fall the market cap is $5.1bn so EV of $8.1bn or $9bn if you include the environmental liability.

FY22 consensus ebitda is likely around $1.4bn making an enterprise value EV:Ebitda multiple of 5.8 or say 6.5 times if you include the environmental liability.

This is surely low enough to have it show up on the investment screens of value investors, if there are such folk any more.