From time to time, in an anti-rewenable bluster, critics will point to the phenomenon of “negative” prices on the wholesale electricity market as “proof” that renewables like wind energy are “useless” and produce electricity when no-one wants it.

Fact is, negative prices have long been a feature of electricity markets around the world, particularly those that depend on “base-load” coal generation that doen’t like being switched off at night-time when their output was no longer needed.

Generators will underbid the other, pushing prices down to the floor of minus $1,000/MWh, because it makes more sense to them to pay someone to take their output rather than going through the hassle of powering down the units.

Authorities and regulators went to great efforts to cover their back, introducing “controlled loads” that forced hot water systems to be switched on only at night (and undermining the case for solar hot water units), and offering cheap energy to manufacturers to use their equipment at night time.

Negative price are still happening in base-load coal country, and Queensland is proof of that.

With just a single ageing wind farm of just 12MW in its grid, it can’t blame wind energy for the negative prices of recent weeks, it’s because the coal units were competing for the privilege of not being turned off.

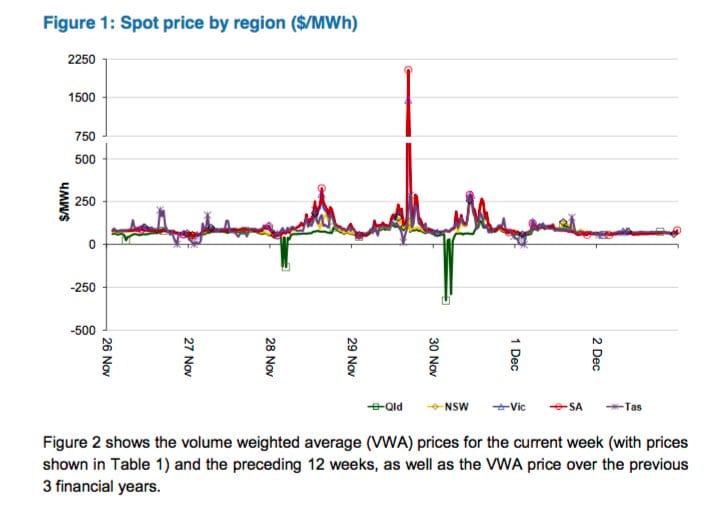

A new price monitoring report from the Australian Energy Regulator highlights four occasions in late November when prices in Queensland went negative.

The issue was the constraint on the network linking Queensland and NSW, because of maintenance. So instead of being able to export coal power to NSW, the Queenslanders were forced to consume it themselves, or switch it down.

The first negative pricing event occurred at 4am on November 28, when prices averaged minus $129/MWh. That was briefly arrested when CS Energy, the government owned generator, decided to call on 240MW to pump water uphill at it Wivenhoe pumped storage facility.

But when that was down, prices went negative again, falling to minus $132/MWh at 5am. There was twice as much coal and gas capacity than was needed.

Two days later, on November 30, the dose was repeated, right down to the switching on of the Wivenhoe pumps again for a brief amount of time.

This time, however, the price hit the floor of minus $1,000/MWh in two five minute dispatch intervals and the price for the 30 minute settlement period was minus $327/MWh at 4am and minus $290/MWh at 5.30am.

So, it just goes to show that excess wind is not the only cause of volatile and negative pricing, it happens with coal too. And peak pricing events are also not the fault of wind and solar, they happened more frequently when there was only coal, gas and hydro plants available.