The battery storage market is expected to finally “explode” in Australia in 2016, with the residential sector expected to grow 20-fold over the next 12 months , while the battery storage industry grows into a billion-dollar-a-year market within a few years.

In what is expected to be a repeat of the solar boom of five years ago, the battery storage market – this time without subsidies – is expected to enjoy massive growth as homes and businesses look to make the most out of their rooftop solar panels, and as utilities look to storage as a cheaper offset to grid expansion.

A new report by leading US research firm Greentech Media says Australia’s energy storage market will focus mostly on the consumer market, particularly households, and is primed by oversized systems, paltry feed-in tariffs, increasing fixed network charges and high electricity prices. As well, the cost of new metering has jumped seven-fold.

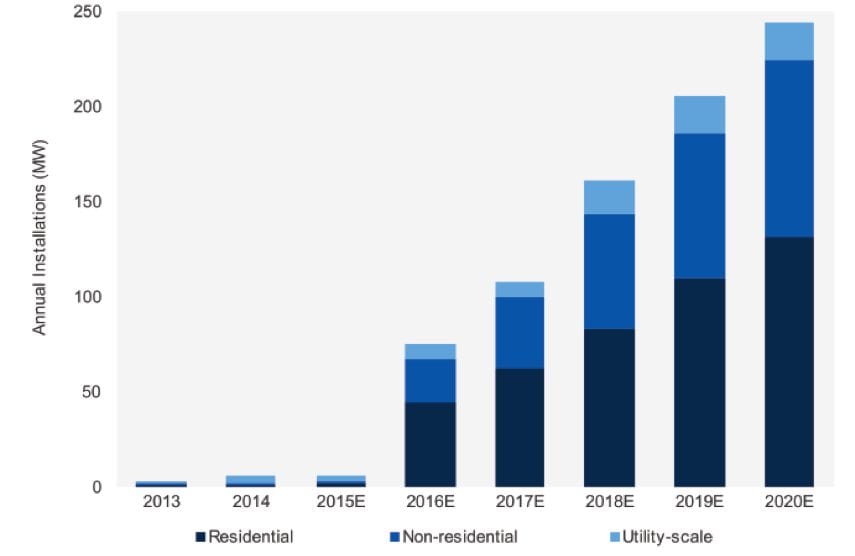

It says that the residential market for battery storage will surge from a mere 1.9MW in 2015 to 44MW in 2016, as the overall market jumps from 6.6MW to 75MW. By 2020, Australia is expected to have installed more than 800MW of battery storage, worth more than $2.5 billion.

The Greentech Media report is one of a number of analyses that have predicted a rapid uptake of battery storage. Just this week, the Australian Energy Market Operator prepared a scenario that suggested 40 per cent of homes would have battery storage within the next two decades. It predicts the market will continue to snowball to 11,200MW by 2035.

Australia has already been identified by the likes of Tesla and Enphase and others as the most prospective market in the world, thanks to its high grid prices, its abundance of rooftop solar, excellent solar resources, and the nature of the tariffs across the nation.

Brett Simon, an energy storage analyst at GTM Research and the report’s author, says numerous international players are being drawn to Australia’s nascent market. These include Tesla, Panasonic, Enphase Sunverge, Kokam, LG, and many others, including local battery technology developers Redflow and Ecoult.

“In mid-2015, a significant number of storage system vendors announced residential products for the Australian market. Some of these products are available already, and more will enter the market in early 2016, Simon said.

“Furthermore, it’s notable that Australia’s electricity retailers are starting to offer energy storage systems for their customers, including major players like Ergon Energy, AGL, and Origin Energy.”

Others, such as Synergy and Alinta, also plan to do the same, while governments in the ACT and South Australia are also openly supporting storage. Even the federal government has predicted massive take-up, and has asked the Clean Energy Finance Corporation and the Australian Renewable Energy Agency to support the technology.

Simon says storage vendors are also eyeing Australia’s commercial market, which he tips will jump from 1.4MW to 23MW, driven in part by high demand charges and incentives in South Australia.

“As battery prices continue their rapid decline, storage will become more attractive, especially in the residential sector,” the report says.

It says the NSW and Victorian markets will be primed for growth by the expiry of premium feed-in tariffs (many of which end at the end of 2016). It says the Queensland market will be the biggest, simply because of the size of its rooftop solar market. Tariff change will also drive the uptake of battery storage in South Australia.

“The coming policy shift for feed-in tariffs significantly improves the case for energy storage across the nation, as customers with solar PV seek an improved financial outcome by storing and consuming stored energy at times of high electricity prices, rather than selling solar-generated electricity back to the grid for little or zero remuneration.”

It also notes policies like Adelaide’s Sustainable Cities Incentive Scheme offer direct financial benefits for storage, and the enthusiasm of prime minister Malcolm Turnbull for “disruptive technologies”. Environment minister Greg hunt has predicted a significant uptake in battery storage.

“Economics still remains a major challenge for widespread storage uptake, but costs are expected to decline, as more players and products enter the market in 2016 and beyond,” the report says.

“At present, Australia lacks significant incentives for ancillary services, reducing the potential for the utility-scale energy storage market. South Australia’s recent policies that incentivise storage may provide a roadmap for other states to follow, but the future policy framework is unclear.”

Greentech Media says the Australian market may offer a “test case” for international developers to pursue strategies in other global markets.

“Innovative channel strategies and other business models tested over the next few years will offer valuable results for utilities, developers, retailers and regulators that seek increased energy storage deployment,” the report says.