(This is the first of a three part series: this article focuses on generation).

There has recently been a lot of hype and excitement about the potential for blockchain technology to disrupt the electricity sector.

This trend has been highlighted by the recent highly successful fundraising activities undertaken by Power Ledger ($26m), Wepower ($40m) and a heavily oversubscribed Electrify Asia ICO ($30m) along with many others.

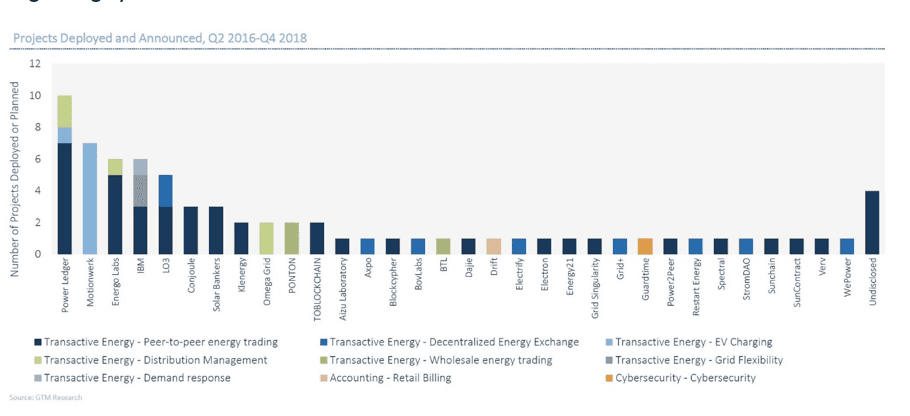

It is relevant to note that there are a very large number of blockchain projects running globally some of whom have gone down the part of token or coin based offerings and some who have not with this list growing by the week.

Given that on a daily basis the combined market capitalisation for energy blockchain protocols (not equity) is being valued by the market on most days over $US500m, it may be helpful to both token investors and potential partners to better understand the respective customer centric value streams (Generation, Retail and Network) that these platforms are seeking to target.

The following articles in this series will focus in a bit more detail on Power Ledger, Wepower and Electrify Asia, given that they have gone down the path of listing their tokens, are actively targeting the Australian market and have very different value propositions using this customer centric framework.

To date the coverage of energy blockchain platforms taxonomy has focused on other variables (demand management) that overlap some of these customer centric value streams making them more difficult to properly understand for both consumers, utilities and token investors.

I have somewhat self-deprecatingly decided to call this the “Grantham protocol” given that it uses the letters of my last name minus the vowels.

As I stated in the podcast linked to the article, assuming that I can find a way to crowbar two A’s into it the likely mainstream uptake as a framework for evaluating energy blockchain platforms is likely to fall somewhere between indifference and silence.

GRNTHM Customer Centric Taxonomy

The proposed framework I am suggesting relates to how these platforms address the value streams associated with generation, retailing network costs along with more platform specific factors such as technology risk (ie scalability, privacy, security), hardware risk and market decentralisation ratio (centralised vs decentralised)

To illustrate the framework from the perspective of how it effects a customer’s bill I will use Wepower (generation), Electrify Asia (retail) and Power Ledger (network) as a backdrop to highlight some of the opportunities and risks each of the respective business strategies faces.

While for the purposes of these articles I have attempted to pigeon hole all three of these companies into isolated value streams it is important to acknowledge that they are all looking to pivot and partner over time along with most of the other companies seeking to innovate in this sector.

Generation

Wepower has made a particular point of targeting this opportunity through a platform that crowd funds using the blockchain and allows their token holders to own the output from large scale renewable energy developments.

Opportunity

Despite only representing 25% of the bill here in Australia, this sort of application has the potential to be an attractive product for retailers especially those like EnergyAustralia who they have partnered with as part of the start-up boot camp and who are currently short generation capacity.

You could see this sort of application being attractive to inner city apartment owners who may simply not have the roof space for solar but still want to support renewable energy projects.

The advantages of this type of blockchain platform is that it can help with project financing by selling the future output upfront benefitting both the developer of the asset (Infigen, Goldwind etc) as well as the consumer who is effectively prepaying at a discount.

There are also other less economically tangible benefits for the consumer but which may create stickiness for a retailer such as knowing exactly which windfarm the energy is coming from allowing their customers to feel connected to that community.

An important optionality that their model brings comes from the fact that their token holders can get value from investing in projects they are not necessarily connected to in the form of income or the form of output from the asset.

In simple terms this could create an incentive for lots of small scale overseas investors to invest in projects in Australia despite not being connected to the NEM.

Risk

There are a number of potential risks and limitations for the implementation of these sorts of platforms none of which are insurmountable but something that any owner of the token or project investor would want to be well aware of.

Regulatory

- Potential electricity regulatory risk relating AEMO, power of choice etc

- Privacy

- Tax treatment

Probably the biggest regulatory risk facing the rollout of platforms targeting this generation value stream relates to whether they are classified as a security in the geographies in which they will operate. In Wepower’s case they currently have approval in Europe that they are not a security but are awaiting a ruling in Australia and will need to seek this in all markets they hope to enter.

Network

- How to manage grid constraints between the asset and the owner of the output (customer) at times of grid constraint ie Melbourne unit owner invests in SA windfarm and the interconnector goes down for 5 days in a storm

- What about the other value streams ie windfarms also start bidding into frequency regulation markets, how do token holders who invested only for output monetise this (or don’t they)

Project Finance (Output vs Equity)

Probably the most interesting aspect of how blockchain applications are applied to targeting this generation value stream relates to how they deal with traditional project finance risk.

If token holders only hold rights to the output and have no claim on the underlying asset they should be demanding a higher rate of return than equity holders.

Using Wepower as an example this would mean a better return on the assets for token holders (output only) than a vertically integrated gentailer (equity owner).

Some of the big traditional project finance risks to consider are

- What is the ratio of debt/equity on the project

- What is the ratio of debt/equity/unsecured output on the project

- At what stage is the token funding (output) contributed – planning vs after financial close

- How is output distributed at times of constraint (low wind, regulatory, local grid)

- What happens at times of very high wholesale energy price ie Energy Australia is generating $10000/MWh while the token holder receiving output is receiving their effective retail rate minus network cost, retail margin etc

- How would investors in the output assess whether the capacity of the asset matches their demand profile ie output of a large scale solar asset may not match the demand of a residential customer who is at work most of the day

There are also additional logistics to resolve relating to what happens to the token holders at the end of their output agreement but not necessarily end of the asset’s life.

- Do they then rebid for this output in a new auction

- Do they receive any preferential rights in this process

I have highlighted a number of project finance related risks here but it is important to note that none of them are impossible to overcome.

In order for blockchain applications targeting this value stream to succeed there is going to need to be a very high level of disclosure from all stakeholders including in this example Wepower, Energy Australia, the project owner (Infigen/Goldwind) and any debt financer (NAB/ANZ) involved in the transaction.

While this article has focussed heavily on Wepower and its targeting of the wholesale energy generation value stream it is relevant to note that any other platform seeking to target large scale generation including Power Ledger (asset germination event) will need to navigate many of these same risks.

Ultimately the big opportunity for blockchain in the generation value stream lies in the ability to bring together lots of small amounts of capital which adds to the overall liquidity of the funding of these projects at a time when their costs are falling and their returns are looking increasingly attractive.

For a link to additional content covered in this series of article on BZE radio please follow the link to the interview we did with Wayne Pales author of the Digital Utility here.

Matthew Grantham is a guest contributor for RenewEconomy.