Following on from the previous two articles looking at the generation and retail value streams this article will focus mostly on the N = Network and M = Market centralisation as part of the esoteric energy blockchain “Grantham” taxonomy.

As has been the case in exploring the other two value streams (Generation – Wepower, and Retail – Electrify Asia) I will use Power Ledger as a proxy for exploring the network value stream associated with an average Australian bill.

Networks

The potential to address network value streams while riddled with complexity and regulatory risk represents probably the biggest opportunity (≈50%) for any platform who is able to wrestle this dragon.

The potential to address network value streams while riddled with complexity and regulatory risk represents probably the biggest opportunity (≈50%) for any platform who is able to wrestle this dragon.

Australia is a slightly unique case globally in that we have a very decentralised grid and have recently invested billions of dollars in upgrading the grid (some would argue gold plated) to manage increased air-conditioning load for 2-3 days per year.

The value proposition for blockchain platforms seeking to address this hinges on their ability to maximise network asset value as consumers driven by technological innovation increasingly choose to produce/consume their own power and by reducing the risk of grid defection.

In the case of Power Ledger they also argue that by keeping more customers on the grid you are able to extract a portfolio effect for consumers by allowing them to trade amongst themselves.

This means that every consumer would need a slightly smaller battery/solar system rather than having to oversize the system to get them individually through the darkest days of winter.

Opportunities

The main opportunities that exist for blockchain platforms in addressing this potential network value stream relates to the potential for using geographically based price signals instead of investing in physical hardware as has been the only real option to date.

The use of blockchain platforms with real time geographically specific tariffs would unlock significant value for both utilities and consumers by allowing for:

- much more efficient allocation of generation around the grid (ie put new generation nearer to demand but not necessarily behind the meter)

- Evolution of region specific tariff structures and possibility of renewable energy zones

- Potential for real time price signals to replace capex reducing the need for spending on transmission and distribution infrastructure

- Mitigation other niche risks (bushfire) by putting the assets in the highest value adding owner in different market conditions

- More granular network control – if streets/nodes are optimised to manage their voltage stabilisation risk at a local level

Believe it or not there are some similarities with what happened in the GFC and the recent over investment in networks to manage peak loads.

In the case of the GFC sales people were incentivised to sell loans to people they knew could not afford them adding risk to the system. In the case of electricity networks individual users added new peak air conditioning load adding systemic risk at a network cost of $5000-7000 per unit which they were not paying for.

The ability to use geographically specific tariff models enabled by blockchain platforms targeting this network value stream both reduces and decentralises the risk management for the grid operator rather than having to rely on one big accelerator/brake (central generator) we could now have lots of little ones at each node.

Assuming that all the scalability and data integration issues are overcome without wanting to get too “sci fi” it could, if combined with some clever AI create a sort of “self-healing” or self-stabilising grid where blockchain enabled price signals and tariff structures rather than generators and physical infrastructure regulate voltage and power quality.

From a consumer perspective the economic incentives associated with this network value stream (traditionally physical infrastructure) could then at least be shared with them given they are now also contributing to the service.

Risks

The risks for any blockchain platform seeking to target the network value streams can be broken into two major issues relating to regulatory risk and the asset write downs (reduction in revenue) that localising trading would encourage.

Regulatory Risk

- Market rules currently do not reward customers for location based grid stabilisation services

- How much need for hardware/capex could you genuinely displace using price signals from consumers

- Would regulators allow dynamic near real time pricing to manage network peaks who would be the policeman for this?

- How do politicians manage the issue of equity across and electorate ie consumers in one regional market paying a different network rate to another regional market?

- Technical risk relating to how the market would perform in the event that there was a bug/problem with smart meter data or failure of the 5G network responsible for managing the grid.

Revenue Reduction (asset write down)

Almost certainly the biggest sticking point especially for privately owned grids and their shareholders is how to manage the short term reduction in revenue that cost reflective tariff pricing would entail.

At present we have effectively at flat rate of roughly 15c/kwh (fixed/variable network price bundled together to keep it simple) whether you are trading with a neighbour next door or getting it from the La Trobe Valley 200km away.

To use an analogy that the young people might relate to this is like having a flat fee of $70 for any uber trip around Melbourne.

Consumers in any other industry would describe this sort of pricing model as ridiculous and yet it remains the predominant way we transact most energy across the NEM.

The trick to unpicking this problem lies in the evolution of some sort of modified tariff structure that might charge 5c/kwh within your node and perhaps only the full 15c/kwh if you use the transmission system but there are many ways this could be sliced and diced.

The Newstead microgridis one such model that is currently underway in Victoria where residents are allowed to trade for free but with a much higher daily fixed charge.

In order to preserve the asset value of networks it is likely that this tariff structure would need to continually evolve if technologies like vehicle to grid increase in rapid uptake.

While it may be tempting for networks to just increase their daily fixed charge once consumers are able to drive their cars down the road to a charging station and bring that energy back home it removes some of the insurance that the grid provides.

Currently networks (and their shareholders) receive an income from the size of their investment in the RAB (regulated asset base) which they have been incentivised to use on physical infrastructure rather than being paid based on performance.

If networks were able to earn a regulated rate of return on a sort of virtual capex they did not spend (linked to some sort of blockchain enabled tariff model) then that should be a win for both consumers and shareholders if the regulators are able to facilitate models for how this can work.

Market Decentralisation Ratio

The speed of market decentralisation is also likely to be a key factor for any of these blockchain platforms seeking opportunity in the network value stream.

Blockchain platforms like Power Ledger and others looking to base their business models on peer to peer trading are likely to find much more fertile ground in particular geographies with a high market decentralisation ratio.

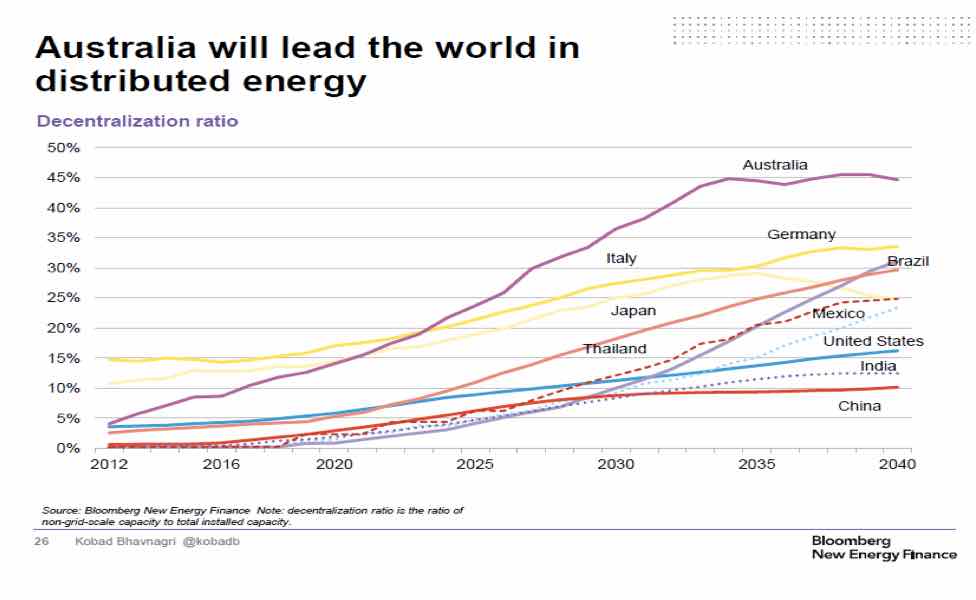

If the team at Bloomberg New Energy Finance (BNEF) have got this graph right then countries like Australia represent good testing grounds for this type of platform and if they can be scaled here may give them a better chance of succeeding globally.

It is also important to acknowledge that this market decentralisation ratio will be primarily driven by 4 factors:

- Falling cost of solar

- Falling cost of storage

- Solar insolation of geographical location

- Policy certainty

Summary

In summary I would like to make the following points regarding both this article and the previous two

- This is a very rapidly evolving landscape

- Regulation will be a key driver of the speed of innovation

- We focused only on 3 platforms (Wepower, Electrify Asia and Power Ledger) many more will enter the market in the future)

- Well done to anyone who is trying to innovate in the energy space

Having now interviewed the founders of these platforms and applying this framework in an attempt to assess the opportunity for any token holders or potential partners the most helpful variable I uncovered actually relates to the market in which the platform was incubated and the DNA of the founder.

Without wanted to get too philosophical about it of the three platforms we interviewed there was an almost Darwinian evolutionary angle to the business models that they were pursuing which informs both their current offering and an understanding of their roadmap priority.

In the case of Wepower they have a different market structure in Europe, low volatility in wholesale energy prices, good wind resource along with the potential to move the sunlight in Southern Europe (Spain) to the North.

So it is not surprising at all that they would first seek to develop a product that unlocks capital for this type of large scale generation.

For Electrify Asia their product was developed in a very dense, well populated, stable grid with very little opportunity to address the network value stream.

They also found themselves in a retail energy market that was about to be liberalised so it is natural that they would seek to exploit these sorts of opportunities first before attempting to leverage the platform into other markets.

For Power Ledger in Western Australia with a great solar resource, rapidly falling battery prices and a genuine threat of grid defection it is hardly surprising that their CEO who used to work for a distribution network would develop a platform seeking to maximise the value of this asset as this technology driven disruption occurs.

I hope that readers have found this series of articles helpful in understanding the value of not just the three blockchain platforms covered but also a layer of insight into how they should be thinking about future platforms who may be seeking their funding.

I mentioned Uber earlier in this article and I think they represent both a pretty decent analogy and a warning for energy incumbents who seek to stop, or impede technological disruption, because at the end of the day history tells us that consumers with choice eventually get their way.

For a link to additional content covered in this series of article on BZE radioplease follow the link to the interview we did with Wayne Pales author of the Digital Utility here.

Matthew Grantham is a guest contributor for RenewEconomy. This is the second in a three part series on energy blockchain technology.