The fossil-fuel induced crisis in Australia’s electricity markets is likely to have cost at least $4 billion, just in the last two weeks since the market operator was forced to introduce price caps and then suspend the market.

The turnover on the National Electricity Market has jumped significantly in recent weeks and months, and the added cost of the intervention forced on the Australian Energy Market Operator as it scrambled to ensure there was enough supply to meet demand could be more than $1 billion.

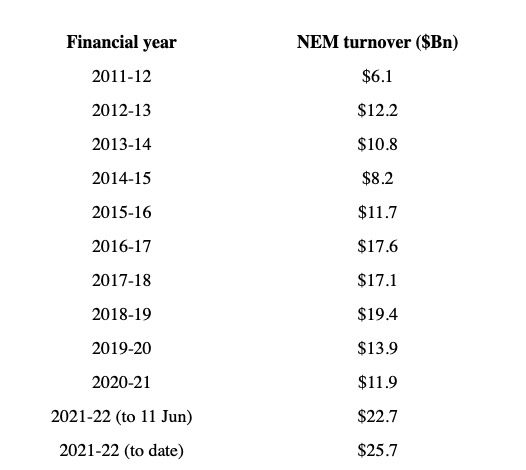

But this is just one part of an extraordinary year where the total turnover on the main grid has more than doubled in the last financial year to over $25 billion.

This is almost uniquely due to impact of the soaring cost of coal and gas – the price of wind and solar has not changed – which has fed through to the price of electricity, and made worse by other impacts such as flooding, mine problems and plant breakdowns, along with high demand.

Some customers will be protected because they have long term contracts struck at a certain price, and most households will not feel the pain until next month, when new billing rates comes into force.

ACT consumers, however, will enjoy a bill reduction, thanks to long term contracts with wind and solar which are equivalent to 100 per cent of their annual electricity consumption.

To assess the impact of the energy crisis, let’s start with the details released last Friday by AEMO on the emergency reserve mechanism, known as RERT, that it was forced to trigger on several occasions to ensure there were no outages.

That figure amounts to more than $86 million, most of it delivered at an eye-watering average cost of more than $20,000/MWh, and all but $4 million of to providers in NSW.

It included payments of $29.9 million paid to providers in NSW on June 17 and 18, $34.3 million to NSW and Queensland providers on June 15, and $21.6 million to NSW providers on June 14.

This total will pale in comparison to the compensation claims that will be lodged by fossil fuel generators seeking to recoup the high cost of their fuels over the two weeks when the market was capped and then suspended.

Under the price cap, prices were limited to $300/MWh – already significantly high and once considered to reflect the highest cost of generation in the grid (diesel).

But coal generators forced to buy coal supplies on the spot market – because their regular supplies were interrupted by floods or rail issues – face a cost of generation of well over $300/MWh.

The cost of gas generation is anticipated to be well over $400/MWh, possibly more than $500/MWh depending on the price paid for the fuel.

AEMO and other bodies will have to go through the painstaking work of assessing compensation claims made through three separate mechanisms, the price cap, the directions issued by AEMO to force generators back to the market, and under the special rules of the market suspension.

All will have different answers, and the calculation could also be complicated by claims of “opportunity” costs by the generators. Some experts have suggested at least $1 billion, with some as high as $1.6 billion.

And, finally, even that pales into comparison with the total cost of wholesale power in Australia’s main grid, which over the financial year ending this week has already doubled from its levels a year earlier.

According to data assembled by energy analyst Dylan McConnell, from the Climate and Energy College at the University of Melbourne, the turnover on the NEM in the past 12 months has more than doubled over the previous periods.

Again, it’s important to note that many customers are protected by contracts, or hedging facilities, but the impacts will still be felt through the economy.

It’s also important to repeat that the cost of wind and solar, unlike fossil fuels, has not changed – because their fuel is free, and they are not subject to changes in international commodity prices – although future projects may be impacted by the higher cost of materials when they are built.

The 2022 calendar year will likely show an even bigger increase in NEM turnover, given that most of the dramatic rises have occurred in the last few months, particularly after the Russia invasion of Ukraine.

According to data provided by McConnell, NEM turnover to date in calendar 2022 is already at $18.8 billion, more than the $14.1 billion recorded for the entire 2021 calendar year, which itself was up from the $10.9 billion in 2020.

And that number for calendar 2022 does not include the added cost of directions under the market cap and the market suspension.