Telecommunications giant Telstra says it intends to “replenish” its near 1GW of battery storage assets to play into the electricity spot market, and tap into Australia’s resources of “abundant, dirt cheap but clean energy” as it takes on the country’s big energy retailers.

Telstra has just secured an energy retail licence in three major states and in 2022 will roll out its first energy product to its more than five million customers, part of its plans to leverage its huge customer base and become one of the big five energy retailers.

The cross-fertilisation of telecommunications and energy has been mooted for some years, but Telstra’s plans represent by far the biggest and most potent to date, even if it is just one of a number of big players seeking to muscle into the market hitherto dominated by a handful of energy incumbents.

Its energy strategy is led by Ben Burge, the former CEO of Powershop Australia, who has spent the past few years crafting the strategy, which also includes signing big contracts with wind and solar projects, and re-purposing its vast array of distributed assets perviously used only to supply power to its network of towers.

“We would love the opportunity to save you a tonne of cash and assuage any guilt that you might have about the role that your current retailer might have in polluting the Earth,” Burge said at a Telstra investor presentation on Tuesday.

Burge said Telstra Energy will aim to secure more than 500,000 customers by 2025, along with its plans to source the equivalent of 100 per cent of its electricity supply from renewables.

“We’ll start by signing up some of our employees as the first customers,” he said. “This will allow us to build, test and release progressive capabilities and capture feedback before we start opening the doors to the public by the end of this financial year.”

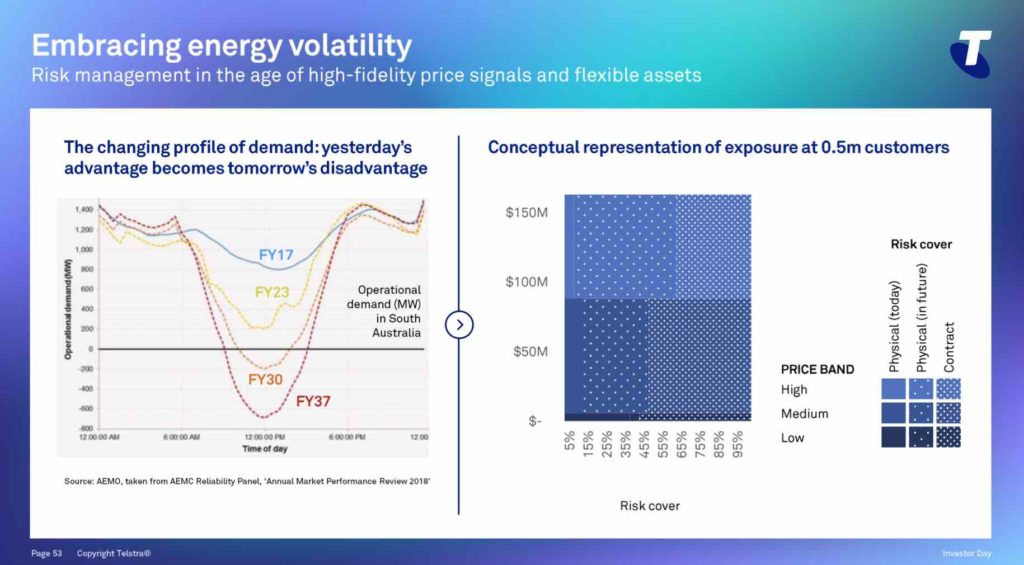

The other major consideration for Telstra, as it is for other energy retailers, is to manage market volatility, and Burge used this graph below to illustrate the hollowing out of the demand curve in South Australia from rooftop solar, and to highlight the potential of Telstra’s 1 gigawatt (hour) portfolio of battery storage assets.

Up till recently, Australian energy retailers called on gas assets to hedge the risks of spot market exposure and Burge says that “for a bunch of reasons that is no longer the case.”

“You can see the changing shape of electricity demand during the day,” Burge said.

“From a risk management perspective, the future energy market will be more dynamic and volatile. Done right, the energy transition can be nation building. In the long term, we should enjoy abundant dirt cheap but clean energy supplying a large proportion of the day night months and year.

“This will be pushed by short episodes during which the flexibility to reduce or increase net system load will be both necessary and valuable.”

Burge pointed to the recent explosion at the Callide coal generator, when Telstra had been able to step in and protect lights on for 50,000 families by using its own power assets and contracts. He expects that capability to grow to the equivalent of more than 200,000 customers within the next few years.

“In part this is assisted by the transition to five minute settlements, replenishing our one gigawatt hour of batteries with technologies that are capable of spot market participation,” he said.

Telstra currently deploys only around 70MW of its battery storage capacity in the open market, mostly as emergency backup through the market operator’s RERT mechanism. But he says this will be increased as part of the natural replenishment, which will be done at negligible additional cost.

“Given the margin profile for energy retailing generally, this form of risk coverage makes a material difference to the margin position. In the long term, there is a significant opportunity to improve risk outcomes by subtly shifting the time at which our customers use energy.”

And as for whether it’s better for an energy retailer to move to telecommunications, or vice versa, Burge said: “I’ve considered this question for both sides of the fence. And I would certainly prefer to be in this on this side of the fence.”

One reason is the poor consumer engagement of traditional energy retailers. That presents opportunities for Telstra to tap into traditional “churn rates” – the switching of suppliers in search of better deals or moving house – and the company’s low cost of customer acquisition.

The other is the key role that machine learnings will play in the decarbonisation of the grid, and the shift from a supply side focus to demand management.

“We expect machine learning and connectivity at scale to dramatically transform the potential demand response to Australia’s transition to an affordable zero emissions grid,” Burge said, noting that smart modems in households will add to Telstra’s advantage because of the role they can play in managing household appliances.

And in an ominous warning to the incumbents and the scale of change they face, Burge added: “The market that will exist in five years time will be very different to what we’ve seen in the last decade.

“What used to work for retailers 10 years ago will be really different. So, we’re not … necessarily banking on it in our sort of core core plan, but certainly, we are seeing more opportunities emerge that are based on data driven positions.

“The other thing is we are not burdened by a legacy of gas. And that’s the biggest advantage for us.”