Solar households can now get a look at what their PV generating future might look like under a sun tax, as some of Australia’s biggest distribution network companies take the final steps to introduce solar export tariffs in July, 2024.

Following a series of trials, draft proposals and plenty of heated debate, three NSW network companies – Essential Energy, Ausgrid, and Endeavour Energy – that will be among Australia’s first to introduce solar export tariffs have submitted their 2024-29 revenue proposals to the Australian Energy Regulator.

So what do these so-called sun taxes look like on paper, how are the network companies justifying them, and – most importantly – what will they cost solar households?

Let’s take a look…

Ausgrid

Ausgrid services more than 4 million customers across Sydney, the Central Coast and the Hunter Valley and says that by 2029, it expects rooftop solar uptake will nearly double on its network area (and the number of batteries will increase around eight-fold).

– The proposal

Ausgrid says it has decided to introduce opt-in export pricing for households in July 2024, and then to make it the default assignment for new and existing small customers on time of use (TOU) tariffs and demand network tariffs from July 2025.

So there’s a bit of a grace period for customers to get used to the idea of paying for solar exports to the grid – or to buy a battery to store it instead!

Ausgrid says its sun tax includes both a charge component and a reward component, depending on the time of day.

The export charge component is 1.18 cents per kWh of energy exported above the BEL (basic export level, which for Ausgrid customers is 2,500kWh/year) between 10am and 3pm.

The export reward component offers 2.19 cents per kWh of energy exported between 4pm and 9pm and in the peak period, when total demand is highest, and therefore when customer exports provide most benefit to the network.

– The cost

Ausgrid says the proposed level of the charge is low, and is expected to have “minimal bill impacts” for households customers over the 2024-29 period.

It also says that under its basic export level of 2,500kWh per annum, customers who set their inverters to a maximum of 1.37 kW exports between 10am and 3pm can avoid all export charges entirely.

Ausgrid’s explanatory statement to the AER also notes that one of its key takeaways from stakeholder feedback was that it will be important to explain to customers that it’s unlikely they will be actually charged to export by their

retailer.

“Rather, it is much more likely that customers will experience export pricing by receiving a slightly lower retail feed-in tariff (or slightly higher feed-in tariff depending on the time of export). They are also being rewarded for shifting their usage and smoothing out load on the grid.”

And here’s another interesting bit:

“Why isn’t our export reward price higher?… Our pricing approach seeks to deliver fairness for customers with access to export-capable technology, such as rooftop solar, and customers that do not have this technology.

“In deciding what is fair, we have balanced the size of the reward for exporting customers with the regulatory mandate that we give a free allowance for exporting electricity to the grid. We want to ensure that we don’t create a cross subsidy at the expense of customers who aren’t export capable.”

– The justification

Ausgrid says it is introducing export pricing “to reflect the increasing costs to support [Clean Energy Resources] customers’ exports and provide an incentive for CER customers to self-consume or time their exports to minimise these costs and maximise the benefits they receive.”

The DNSP says it has increased the reward price and lowered the export charge, in response to stakeholder feedback. It says the one-year transition period reflects the increasing costs to support rooftop solar customers and provide an incentive to self-consume or time their exports to minimise these costs and maximise the benefits. It has also removed an opt-out option.

“We want to empower customers to use the network and maximise the value they get from self-generation, benefiting from being flexible, and facilitating the transition to net zero.”

Essential Energy

Essential Energy operates and maintains one of Australia’s largest electricity distribution networks, spanning 95 per cent of NSW (and parts of southern Queensland). More than 27 per cent of its customers have rooftop PV and the average size of system currently being installed is 6kW.

– The proposal

Essential says its transition to two-way prices for rooftop solar will start from 1 July 2024 for customers with an interval or smart meter, and from a year later for new customers or those installing solar.

Essential’s solar tariff is a combination of its existing Sun Soaker tariff plus an export price and rebate, which it calls Sun Soaker Two-way.

– The cost

The exact pricing for this tariff scheme is not easily found anywhere in the January regulatory filings – and there are a number of them. The best we could do is find mention of a Sun Soaker export charge of 0.94c/kW per month, and that’s just for 2024-25.

Export charges will apply from 10am to 3pm daily to all solar exports over the basic export level (BEL) of 1.5kW – exports up to and below the BEL will attract no export charge. There will also be no export charges at all between 3pm and 10am daily.

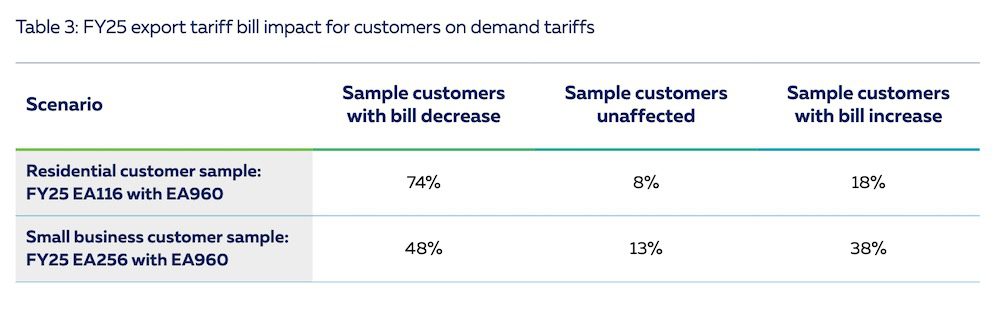

What Essential does say is that its “bill impact analysis indicates that residential and small business customers will have lower network charges” under Sun Soaker two-way tariff compared to its existing anytime (flat rate tariff) and Time of Use tariffs. And it provides these charts below.

– The justification

Essential says that the continuing increase in customer exports means parts of its distribution network are reaching their limits and points to a forecast indicating “probable …voltage issues on our network if we do not undertake investment to manage customers’ exports.”

Essential uses its projection of mostly lower network costs across the 2024-29 to justify its decision not to apply a grace period before moving customers to the new tariff.

“By introducing two-way pricing for export services, we can reward customers who own CER for sending power they generate to our network when needed, and charging them for sending power when it is not being demanded by other customers,” Essential says.

“This will provide significant benefits to all our customers by helping us to lessen our overall costs and prices, and ensure customers pay fairly for using our network.”

Endeavour Energy

Endeavour Energy services 2.7 million people in households and businesses across Sydney’s Greater West, the Blue Mountains, Southern Highlands and the Illawarra, and the South Coast. Currently, 23% of Endeavour’s residential customers have solar, with a cumulative capacity of 1GW. It forecasts that by the end of the 2024-39 period, the proportion of customers with rooftop solar will double to 41%.

– The proposal

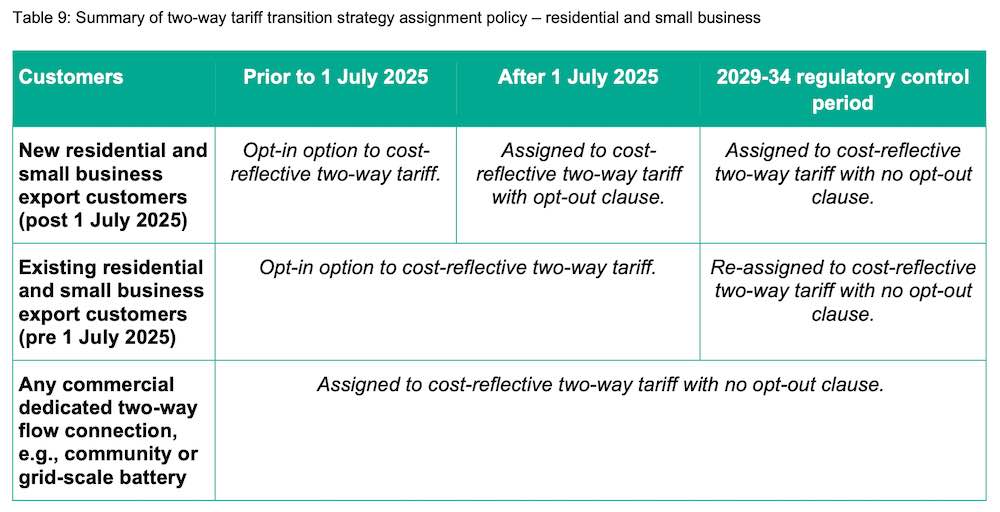

Endeavour is proposing to give existing customers the option to opt in to an export tariff from 1 July 2024. From 1 July 2025, new and upgrading customers who export energy back to the grid will all be moved onto the export tariff, but can opt out if they want, up until then end of the regulatory period in 2029. From then on, there is no opt-out clause.

With its two-way “Prosumer” tariff, Endeavour proposes to charge for energy exports to the network in excess of a 2kW threshold in-between the times of 10am-2pm every day.

The DNSP will, on the other hand, reward customers for exporting electricity from 4pm-8pm on weekdays.

“To facilitate export pricing, we propose two-way flow tariffs to signal to customers both the costs and benefits of their energy consumption and generation behaviour by using a simple, transparent, and predictable combination of prices and rewards for flows in either direction,” it says.

“Providing cost reflective prices and rewards for two-way flows is an opportunity to empower choice and control over customers’ energy use and harness the full network value of customer investments in (Clean Energy Resources).”

– The cost

Again, it was difficult to nail down anything concrete on the cost to consumers of the new two-way tariff structure to Endeavour Energy customers – no mention anywhere of the export tariff as cents/kWh figure. That said, Endeavour forecasts an increase in annual network prices for residential customers from 2024 to the average over 2024-2029 at 9.8%.

In the coming regulatory period, the DNSP says it will spend $65 million on supporting increased customer uptake of new technology including rooftop solar, batteries and electric vehicles – $55m more than in the 2019-2024 period.

– The justification

A key argument Endeavour uses to justify solar export tariffs is that without the price signals sent by the two-way charging system there would be a whole lot more solar export curtailment across the board, which is no good for anyone.

“We expect our $76 million CER integration expenditure program to unlock 6,000GWh of renewable energy that would otherwise be lost through curtailment,” Endeavour says.

Our take

There’s a lot – a lot – to take in from all these very detailed documents, including a lot of upbeat and progressive talk from the networks.

But at first examination there is very little clear detail on the potential cost to consumers and how, exactly, this is being accounted for. Essential and Endeavour did their best to hide the actual /kWh cost of export tariffs they are proposing, which presumably must be in there somewhere in order for the regulator to approve them.

Much of the modelling for customer price impacts is based on very small rooftop solar system sizes, usually somewhere around 3kW. Given current industry estimates put the average rooftop solar system being installed at closer to 8kW in size, this is not very helpful.

As Mark Byrne wrote here at the end of last year, the networks may think they have done enough in their customer and other stakeholder consultations, but any tariff reforms in NSW that are accepted by the AER are bound to be used as templates for other networks.

Therefore, “broad assertions about increasing costs, empowering customers and improving fairness aren’t enough,” Byrnes argues.

“Instead, we need to see granular evidence of the problems they are trying to solve, such as substation heat maps (to show emerging congestion issues) and cost benefit analyses of non-network as well as network options to respond to any local congestion likely to be caused by high future solar exports.”

While the energy bill impact modelling sometimes counts on the use of very small system sizes, the networks use the argument that rooftop solar uptake is soaring and system sizes are getting bigger to justify the need to act so quickly on export tariffs.

Meanwhile, the big increases in home battery uptake and even more bullish forecasts about EV uptake don’t seem to be factored in as potential “solar soakers” in themselves, that might ease stress on networks.