The expected growth of solar capacity needs long-term solutions.

When production from solar and wind generators exceeds demand – a frequent occurrence in places with vast amounts of renewables in the electricity generation mix – the grid operators have to resort to curtailment.

This, they do more often when there is not enough transmission capacity to export the surplus, not enough flexible demand or electric vehicles to soak up the juice or storage to shift the extra supply for later use.

Grid operators in California, Texas, as well as many parts of Europe and Australia are increasingly forced to resort to renewable curtailment as a last resort. And while wind is the main culprit in many cases, solar curtailment has recently been on the rise.

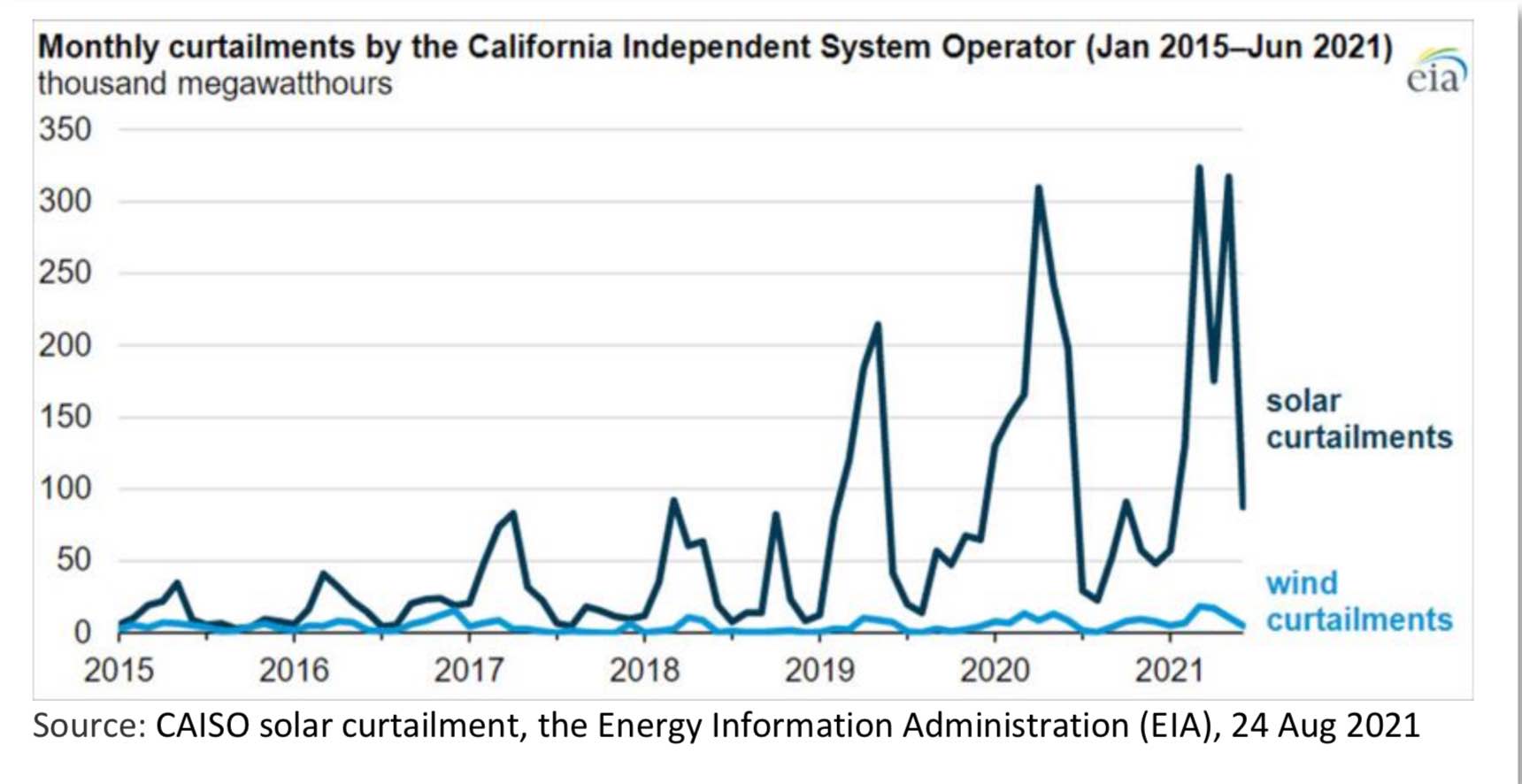

According to the Energy Information Administration (EIA), curtailments of solar-powered electricity generation have increased significantly in the California Independent System Operator (CAISO) in the last few years (visual).

In 2020, solar curtailments accounted for 94% of the total energy curtailed in CAISO, with the grid operator curtailing 1.5 million MWhrs of utility-scale solar, or 5% of its utility-scale solar production.

The growth of small-scale rooftop solar – which cannot presently be curtailed – is making matters worse in sunny placed across the US and elsewhere.

Solar curtailments tend to be most pronounced in the cool but sunny spring months when electricity demand is relatively low – because moderate temperatures means little heating or air conditioning demand. In hot summer months, all solar generated power is needed to supply the large air conditioning load.

According to CAISO, in the early afternoon hours of March 2021, the grid operator had to curtail an average of 15% of its utility-scale solar output on many days. The opposite happens after the sun sets, forcing CAISO to replace the rapidly vanishing solar generation by increasing imports – when available – and relying on gas fired generation, the famous “duck-curve” problem.

Increases in renewable generation and curtailments of solar and wind have followed an increase in new renewable capacity additions – and this is only the beginning as California pushes ahead toward a carbon- free electricity grid by 2045, as do many other states.

To help meet California’s target of 50% renewable generation by 2025, the state is expected to add another 1.6 GW of utility-scale solar capacity plus another 0.4 GW of onshore wind in 2021. Combined, solar and wind represent 44% of CAISO’s capacity additions in 2021.

At the same time, small-scale rooftop solar PV capacity also continues to grow decreasing the need for CAISO-operated generation, leading to more solar curtailments. Wind is not as big a problem in California as it is in places like Texas, Iowa, Kansas, etc. – states where wind is a major contributor in the electricity generation mix.

Clearly the problem is growing more acute requiring longer-term solutions including a number of options considered by CAISO. One promising solution is to enlarge the physical size of the market, therefore increasing the diversity of the generation portfolio.

CAISO has been attempting to enlarge participation in the Energy Imbalance Market (EIM), a real- time market that allows participants outside of California – and non-CAISO stakeholders – to buy and sell energy to balance supply and demand in real-time.

In 2020, 16% of total possible curtailments were avoided by trade within the EIM, according to participants in the EIM – a significant achievement.

Aside from the EIM, everyone’s favorite solution is energy storage. California is expected to add 2.5 GW of battery storage capacity in 2021 alone. The surplus renewable generation can charge these batteries – electricity that would have otherwise been curtailed and wasted.

This, however, is scarcely sufficient. Current batteries are not well-suited to store large amounts of energy over long periods of time, as large pumped hydro storage technology does, shifting large volumes of capacity from the spring to the summer months, for example.

Aside from large duration batteries – now under development – other large capacity energy storage options are being studied including massive hydrogen-based energy storage, which could reduce future solar and wind curtailments.

Hydrogen can be produced by electrolysis using the surplus renewable electricity that would otherwise be wasted, stored for later use. Two projects in early stages of development include a power-to-gas-to- power and one by the Intermountain Power Project called IPP Renewed, which focuses on developing renewable-powered hydrogen production and storage capabilities as well as installing natural gas-fired generators capable of using hydrogen.

Aside from these, CAISO is also looking into a number of other promising but under-developed options such as:

▪ Increasing demand response (DR), which would adjust consumer demand when warranted;

▪ Encouraging time-of-use (TOU) rates, which better match consumer prices with real-time

wholesale energy prices; and

▪ Reducing minimum generation

Finally, there is the opportunity presented by the enormous and inherent flexibility to charge – and potentially discharge – millions of electric vehicle (EV) batteries expected to be available by 2030. EVs offer one of the best types of DR known to mankind if the charging – and potential discharging – can be properly managed.

Geotab Energy claims that the existing 400,000 Teslas in California have the potential to be the largest distributed battery load resource in the world. They amount to more than 3 GW of manageable load.

According to Geotab, ”By treating EV drivers as part of the solution, instead of part of the problem, we can stabilize the grid and create a more sustainable future.’

To avoid further renewable curtailment, all of the above options will be needed.