South Australia has set a stunning new benchmark in the electricity market, with its big share of rooftop solar sending the average daytime wholesale price of electricity to below zero in the first quarter.

According to the Energy Market Operator, the average price of wholesale power in South Australia between 10am and 3.30pm was minus $12/MWh in the three months to March 31 – the first time this has occurred in Australia’s main grid.

South Australia already leads the world in the share of wind and solar in its grid – 60 per cent over the last 13 months – but it is the growing impact of rooftop solar that is causing the biggest frowns at AEMO as it tries to keep the grid stable and the lights on.

Rooftop solar provided an impressive 47.7 per cent of the state’s generation mix in that three month period, and wind and solar overall provided 82.5 per cent of generation over the quarter, despite some wind and solar farms switching off at times to dodge the negative prices.

Rooftop solar has at times provided a “world first” equivalent of 100 per cent of the state’s demand (when excess wind and solar is being exported to Victoria), but in the latest period its peak was 78 per cent on February 14.

Already this year, AEMO has had to make a first of its kind intervention in the market to order the switching off of 71MW of rooftop and distributed solar to ensure that demand can be maintained at required levels.

It has had to intervene in some form on 70 per cent of occasions to ensure sufficient gas generators are operating, mostly ordering them to generate power even though the prices were below the cost of generation. This cost a total of $18 million over the quarter.

The need for this intervention will be removed once new synchronous condensers, which do not burn fuel but provide the same “synchronous” power needs as gas plants, are switched on in coming months. In the longer term, battery storage with “grid forming inverters” are expected to do the job.

AEMO says a new minimum demand level of 358 MW in South Australia was set on Sunday, March 14, when it issued instructions to switch off certain amounts of distributed solar to ensure that operational demand stayed above 400MW, as we reported exclusively at the time.

The “switch off” mechanism has been fast-tracked in South Australia because of the growing share of rooftop solar, which can equate to 100 per cent of local demand on occasions, are may be replicated in other states as they also experience lower levels of operational demand.

South Australia is also looking to extend these “switch off” or “switch down” mechanisms to other appliances such as air conditioning units, pool pumps, and electric hot water systems, although proposals to control home EV charging equipment in the same way has been met with stiff opposition from the EV industry.

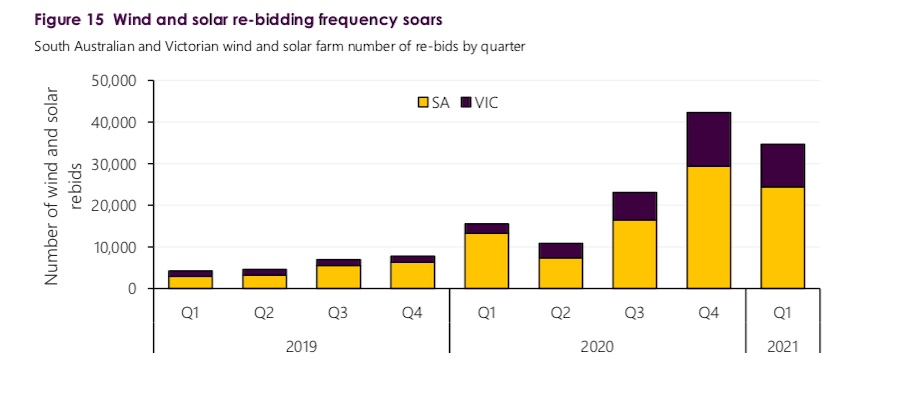

The growing number of negative pricing events is having a growing impact on other technologies, with many wind and solar farms choosing to switching off during negative pricing events because they are either obliged to do so by their contracts, or because they don’t want to pay to generate.

AEMO estimates that around one-third of South Australian and Queensland wind and solar capacity has installed automated bidding software, with a slightly smaller amount (around 20%) in Victoria. The facilities most hit by economic curtailment were the Tailem Bend solar farm and the Lincoln Gap wind farm, both in South Australia, and the Murra Warra wind farm in Victoria.

Interestingly, the level of curtailment overall was down sharply, mostly due to the removal of grid constraints, including the solving of inverter issues in the West Murray region (which had badly impacted five solar farms), and the success of new inverter settings in Queensland which had solved system strength issues and reduce curtailment to near zero.

The negative prices and the growing share of wind and solar had a flow on effect on average spot prices, and futures prices, with South Australia now boasting the lowest prices in the main grid, on a futures basis. These falls in wholesale prices are now flowing through to customer bills, or at least they should be.