Federal government support for gas is an exit window for producers and retailers

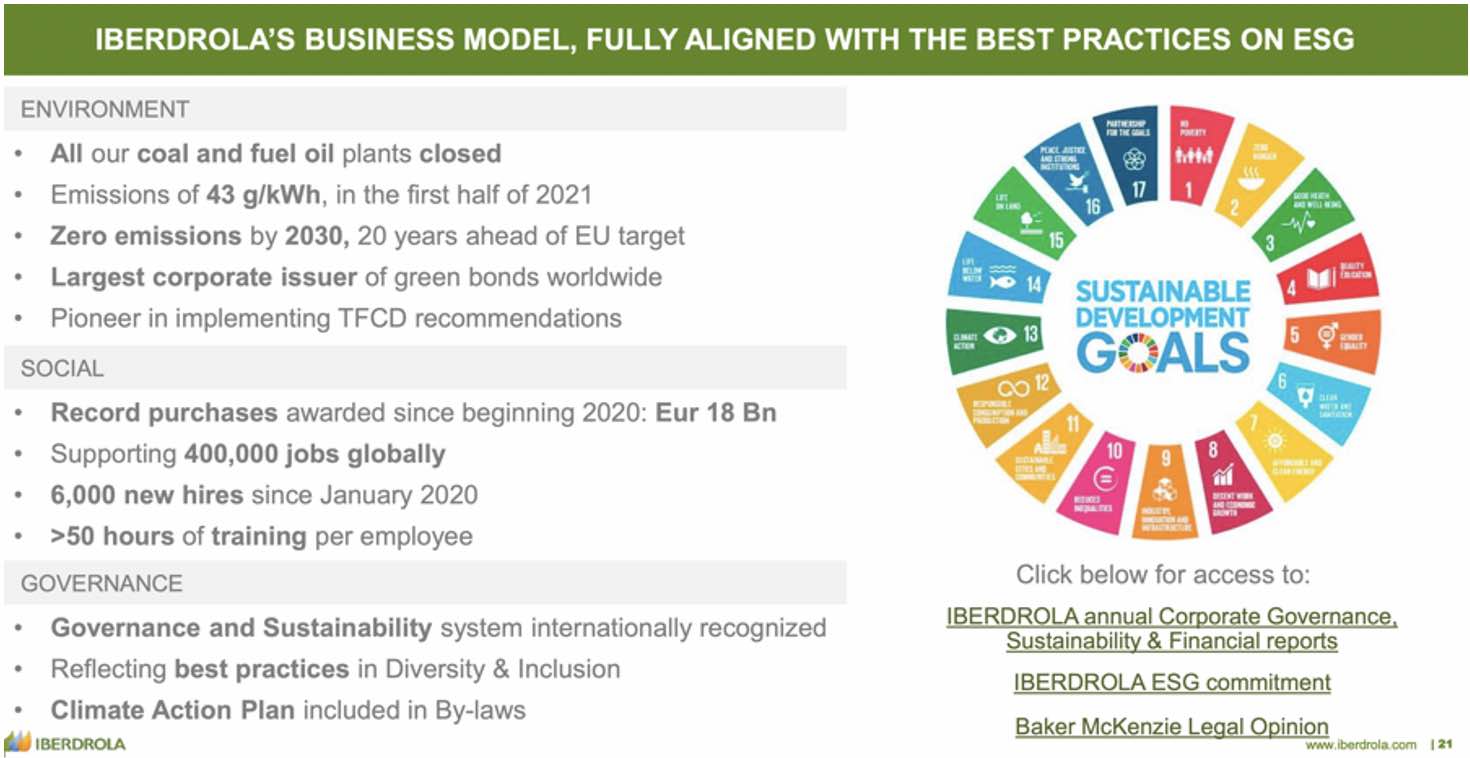

In Europe large utilities are exiting thermal power as fast as they can. It’s what their shareholders want them to do. Examples include Iberdrola, National Grid (UK networks) and Orsted, and even Siemens.

Asia, which is the dominant consumer of energy these days, is slower off the mark, and it’s still possible to make an argument that coal and gas will have a big future in Asia.

However, here at ITK we have long thought the better view is that Asia will follow Europe with a lag. This view is based on:

- Negative impacts of climate change will be felt just as much in Asia as in the West.

- Low or zero carbon electricity is lower cost to Asia than electricity made from imported fossil fuels. I’d agree that Asia is only now coming to a landing on this and it’s a far from universal view.

- Locally sourced renewable energy provides a degree of energy independence that importing fossil fuels does not.

If you look at Japan’s projected energy mix, even with a skeptical eye, or what’s happening in Vietnam, South Korea, and even to an extent India (never a big gas player) you can clearly identify more than a few straws in the wind.

I can understand why cautious senior management would be cautious about how committed to decarbonising Asia is and at what pace, but that very caution can also be costly to investors long term.

Australian “policy”is based around a view that Asia will be so slow to decarbonise that new 20 and 30 year life projects, particularly gas, should be fully supported.

Australia appears to think it can continue with its current policies of putting lower quality coal through generators built close to the population and having some of the worst fuel standards for transport in the world. Australia can invest in hydrogen as a plan B.

The point we want to make is that the Federal Government cheer squad for gas, assisted by its many “talk the book” supporters, provides a window for existing gas producers to exit the industry while there are still plenty of buyers.

Origin energy may be the company best placed to exit gas

Lock the Gate commissioned ITK to do an analysis of Origin Energy, looking at the future of its gas business in the light of the negative impacts on the environment of gas production and consumption.

ITK has concluded that, although risky, it would be in Origin shareholders’ interests for Origin to exit its gas business, and its coal generation earlier rather than later.

The full report, written prior to Origin’s latest impairments announced last Friday, is available at https://www.lockthegate.org.au/reports.

We argue that although the gas business is performing well, it has a limited future.

We say this because APLNG, responsible now for most of Origin’s profits, is a finite life asset in which Origin holds a minority stake and which will eventually have a closure liability. Origin’s gas retailing business has lost much of the advantage of vertical integration back to supply.

We argue that Origin could sell its investment in APLNG and reinvest the proceeds in green hydrogen production including a large investment in wind and solar.

It could further reinforce this position by selling its relatively well preformed gas wholesaling and retailing business. Not only would this enable brand value creation but it would greatly simply the transition to the Octopus customer care system.

It would also align Origin with the values of its UK retail partner Octopus values something which is very far from the case at today.

We argue that the electricity business is performing badly because it doesn’t have any brand value, and that by focussing on becoming a green energy gentailer it would offer a differentiated strategy with high brand equity.

All of these points are highly contentious and risky.

Still, we think that Origin needs to find a long term way forward. The incompatibility of oil and gas exploration and development, and electricity has been evident for a long time.

Climate change and the investment in Octopus simply makes that incompatibility stronger despite managements attempts to present it as a diversified portfolio approach.

We argue that the reality is that when the diminishing band of oil and gas true believers make an investment choice they will favour a pure oil and gas company, presently Santos most likely.

Investors who are interested in utilities will almost certainly, in ITK’s opinion, be interested mainly in a business which embodies the future of electricity, clean green, decentralised inverter controlled electricity with modern low carbon firming technology, with a retail base with high brand equity driven by values shared by the seller and the buyer of the service.

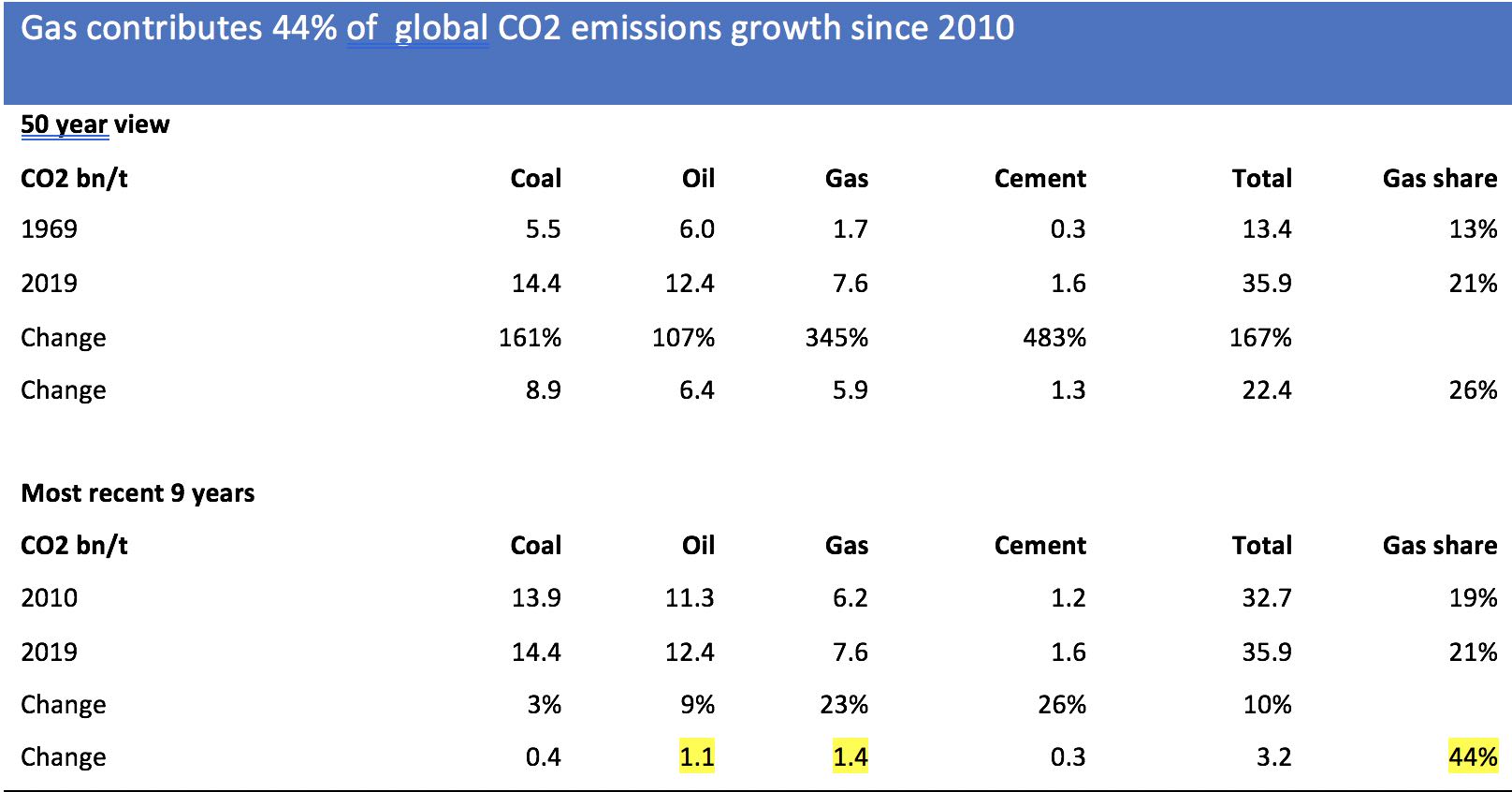

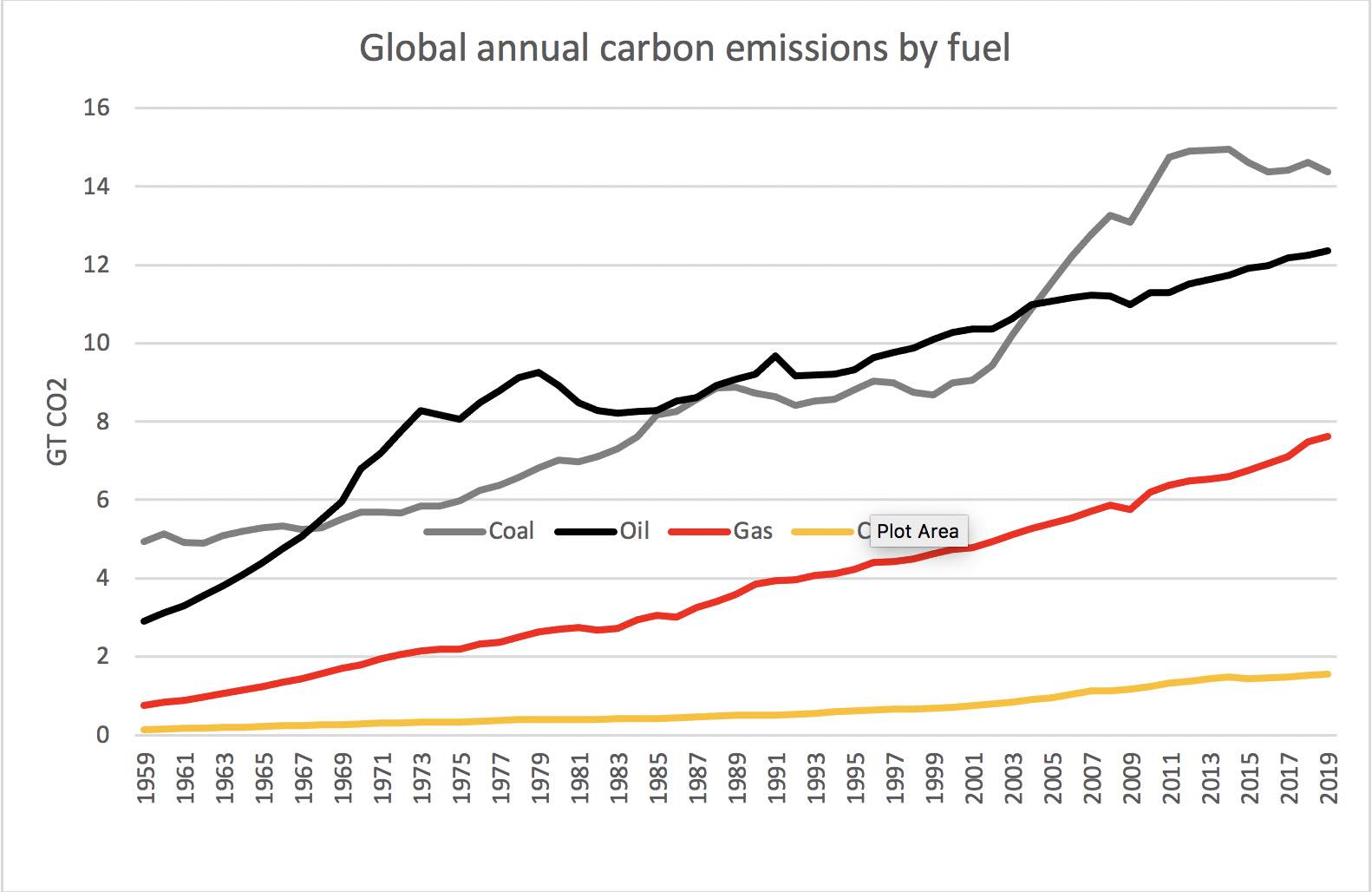

Carbon

Examples of Europe utilities pivoting away from gas

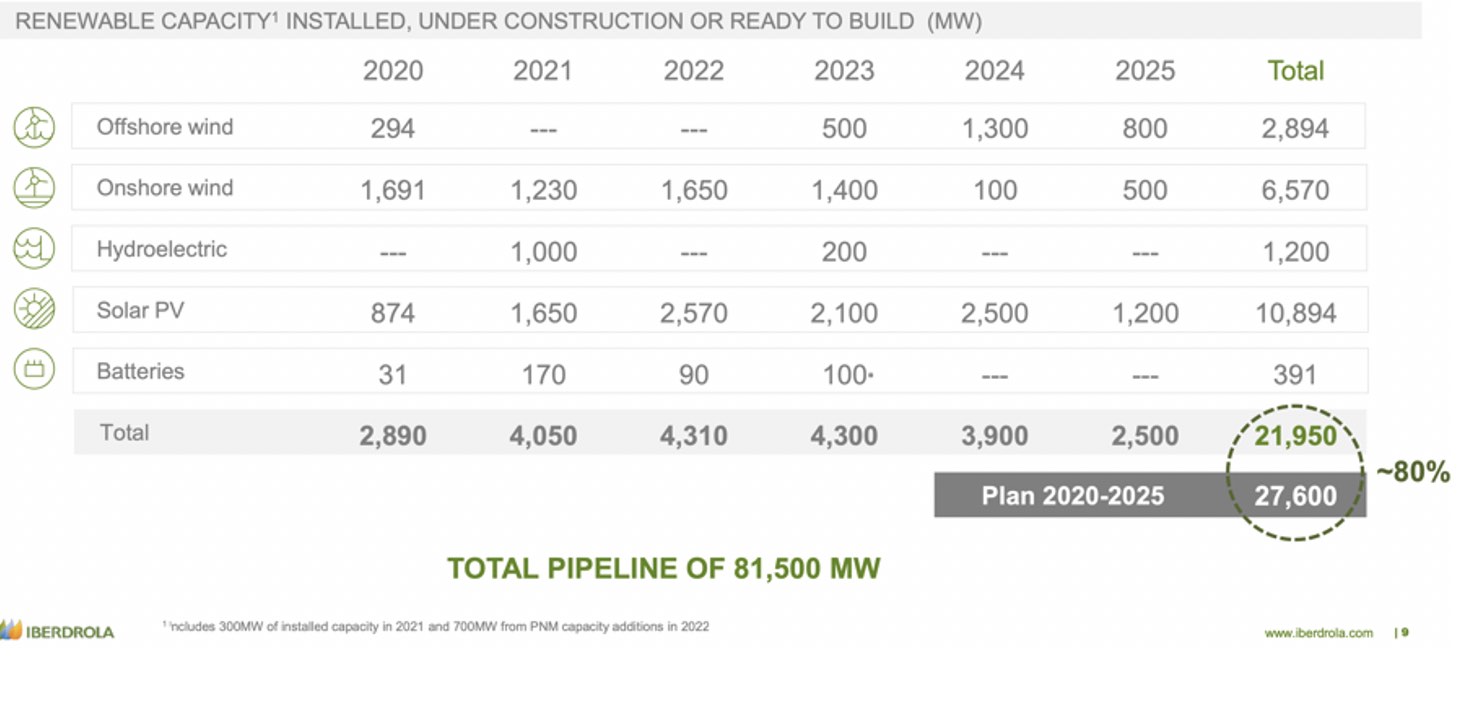

- Iberadola

National Grid, major UK and USA network business

Siemens (big gas turbine supplier as well as Siemens Gamesa wind)

Orsted

A few relevant Origin tables from ITK analysis

First, we show a value of Origin’s share of APLNG of about $8 billion today even with a highly uncertain and distant clean up liability.

Then the essentially carbon heavy nature of ORG’s electricity.

Gas retailing has done well. Easier to sell?

Electricity has done poorly, in ITK’s view because of a lack of brand quality, focusing on gas generation, and unwillingness to invest in low cost VRE (variable renewable energy, or wind and solar), as well as the reduction in consumption per point of presence.

Octopus is, in our view, unlikely to help much. The move to the Octopus IT system may well run over budget and be late.

Then we show how the current big three Gentailers by essentially downplaying, denying and resisting the industry change in a standard incumbent fashion are providing space for new entrants to eat their lunch.

The full report has a discussion of outlook for hydrogen, a discussion of Octopus and ORG branding, a quick glance at Beetaloo and further analysis.