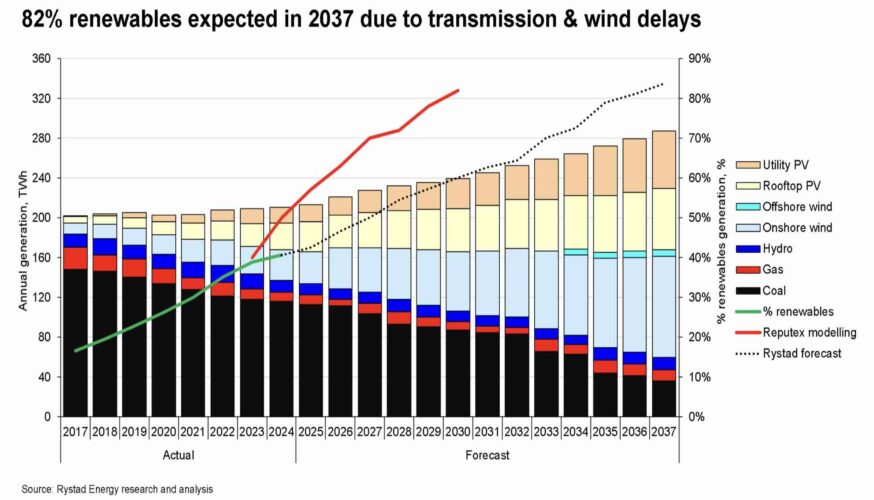

If Australia is to meet its target of 82 per cent renewables by 2030 – double its current level – something is going to have to change pretty quickly.

Rystad Energy, one of the leading energy consulting groups, has issued a particularly bleak assessment of the rollout of renewables in Australia, pointing to the lack of new wind projects, slow transmission, a buyers strike from utilities and corporate customers, and the uncertainty created by the Queensland LNP government.

It says that, based on current scenarios, Australia might only reach 60 per cent renewables by 2030, and may not get to 82 per cent renewables until 2037. And this is despite the federal government working to “supersize” its flagship policy, the Capacity Investment Scheme.

Others have questioned whether the 82 per cent renewables target will be reached on time, but most think it may miss it by just one or two years, and they say the required capacity will at least be contracted or under construction by the end of the decade.

Rystad’s assessment, however, is very downbeat.

Rystad analyst David Dixon says there is no evidence yet that the CIS is actually bringing new projects to the market.

In effect, he is saying the quiet bit out loud – suggesting that the winners of the first round of the CIS generation tender (6.4 gigawatts) bid so low that they cannot yet make the finance work on that underwriting agreement alone.

And no parties – neither corporate buyers nor energy retailers – are buying off-take contracts at the prices asked. The big energy retailers aren’t buying any contracts at all.

See: Wind industry in crisis as utilities and corporate buyers go on investment strike

“What I fear the most here is that because it (the CIS) was so competitive, the winners were those projects that underbid the most and now that delivery is here, the numbers don’t work,” Dixon says.

“Thus they need to go and get a PPA, the problem is those that sign the PPAs also had projects in the CIS and probably weren’t successful because of the underbidding of those projects that were successful.

“I hope I’m wrong on this point and we see some projects moving soon.”

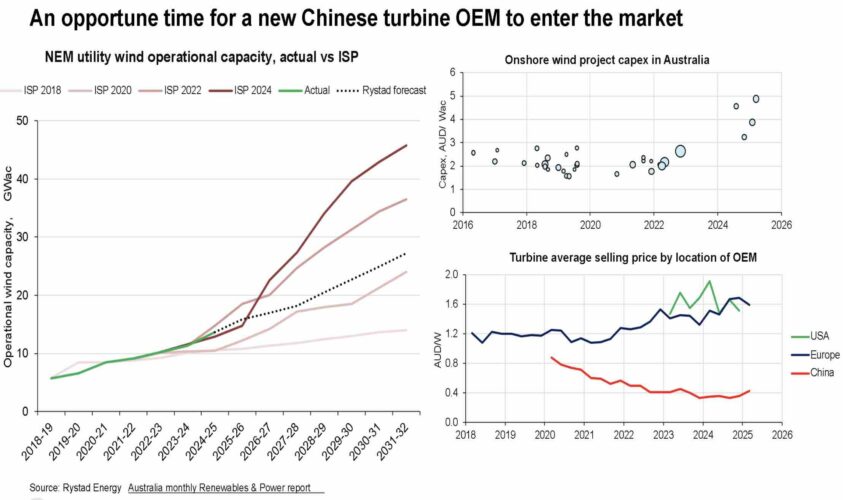

The situation is dire in the wind industry. It has been well reported that no wind projects have reached financial close in 2025, and Dixon says no new wind projects in the National Electricity Market have begun construction this year.

In Victoria, the first planning approval for a major wind project in three years has just been awarded, but it still needs to work through the federal government’s own environmental processes. In Queensland, approved wind farms are being cancelled by the state government.

Wind projects may be facing issues in approvals and social licence, but the biggest challenge at the moment is that the technology is costing more than anyone is willing to pay, with capital costs jumping significantly, translating into a levellised cost of energy of more than $100 a megawatt hour on some estimates.

“At present wind also remains uncompetitive at current project costs, which means no one is signing up for wind PPAs, which means no wind projects are starting construction,” Dixon says. “I cannot stress enough how key this is.”

Dixon says Australia needs to be moving at a pace of around 5 gigawatts a year, yet the track record shows Australia rarely approves more than 3 GW, and construction has never started at more than 2.5 GW a year.

Solar offers hope, because costs have come down. But as the share of renewables grows above 40 per cent, solar farms need to come with a four-hour battery to avoid severe curtailment, adding to the complexity. Thankfully, battery storage costs have also come down.

But transmission projects are also falling behind schedule, and are being hit by a blowout in costs. The Australian Energy Market Operator recently conceded that transmission build costs have risen by at least 50 per cent.

The south-west renewable energy zone in NSW is a case in point of the problems, waiting on a delayed link from South Australia and NSW, and massively undersized, stranding multiple gigawatts of wind projects without grid capacity, and in a region with strong community support. This includes one of the winner of the first CIS tender.

Other CIS winners, including those with relatively deep pockets such as Squadron Energy and Acen Renewables, are waiting for new transmission, such as the Central West Orana renewable zone, to be built.

Federal energy and climate minister Chris Bowen has sought to address the lack of investment by ramping up the size of the CIS to 40 GW from 32 GW, and by fast-tracking the tender process from nine months down to six months.

But analysts say the CIS needs to have more bite, and penalties, for those project owners who fail to deliver because they have bid too low to get a project built, and can’t land a power purchase agreement to finance it. Dixon suggests a bond of $10 million should be required. It would not be returned if the project is not built.

“The delay of new supply is going to cost us money. We have got to stop this underbidding,” Dixon says.

The other problem, identified by many, including ITK principal and Energy Insiders podcast co-host David Leitch, is the buyers strike from the big utilities, who have done little to build or contract new wind and solar projects, despite having made decisions to close some of their coal fired generators in coming years.

Dixon says the rate of new PPAs in Australia is now at a decade low, after being boosted in recent years by the Queensland Labor government, now replaced by an LNP government that is proudly cancelling new projects, and which is also ripping up the state’s renewable energy targets.

See: “Act of bastardry”: Queensland LNP government kills another giant wind project

Dixon says this is having an impact on investment decisions in that state as the industry waits for the new government to release its long term energy plan.

He argues that the six projects with CIS underwriting agreements that have started construction (see table above) would have started anyway regardless of their tender wins. Four are battery storage projects, which seem to have no trouble gaining contracts or finance, and two are solar projects.

ITK’s Leitch has argued that if wind farms are built, corporate buyers and utilities will come with contracts. But few developers have the funds, or the courage, to do that.

The country’s biggest wind project, the half complete 1.33 GW Golden Plains facility in Victoria, reached financial close and began construction before signing a contract. But now it has many agreements. Few, if any, other developers are prepared to “go merchant” on their projects, particularly at that size.

Of course, the big retailers, such as Origin Energy, have kept their hands in their pockets, despite signalling that the country’s biggest coal generator, Eraring, will close in less than two years time (August, 2027).

One hope in the wind industry is that a new wind turbine manufacturer, China’s Envision, can add more competition in the local market and help reverse the recent jump in turbine prices.

However, because Envision is new to the market, it may take time to establish itself for major projects, and it will need to get at least one, potentially smaller project, under its belt to negotiate Australia’s notoriously challenging connection requirements.

The “newbie” curse has caused issued for the likes of battery suppliers Doosan and Powin, and even the country’s biggest single stage wind project, the 923 MW MacIntyre facility in Queensland, is working its way very slowly through the commissioning process.

Energy industry insiders suggest the reason for that is the issues with the rarely used Nordex technology.

Bowen said in an emailed statement to Renew Economy that he remained confident that the 82 per cent renewable target “can and will” be achieved by 2030.

He pointed to the huge pipeline of projects identified in the recent 10-year forecasts released by AEMO, and the success of the battery rebate scheme, and the continued adoption of rooftop solar.

“I believe 82% renewable energy by 2030 can and will be achieved,” Bowen said.

“But it won’t happen automatically or inevitably. A target which everyone agrees will happen automatically is hardly worth having. It’s meant to drive decisions and investment and that’s exactly what it’s doing.

J”ust last week we had what can probably regarded as the positive and optimistic ESOO since they began. It showed a massive pipeline on investment. Of course we need to make sure that pipeline becomes a reality, that’s what things like the CIS are doing

“Meanwhile, Australian households are adding the equivalent of a Hornsdale big battery each and every week, in their garages. All of this gives me confidence that the we will get the job done over the next five years.”

He used the opportunity to criticise “deniers and delayers” such as Nationals MP Barnaby Joyce, who is trying to repeal the country’s net zero target, and has been speaking on the Gina Rinehart and Murdoch media sponsored Bush Summit roadshow that is attacking the rollout of renewables.

“I’m looking forward to speaking to Farmers for Climate Action this week for example,” Bowen said. “I don’t think Barnaby would show his face in that crowd.

“That’s not to say that we haven’t had a huge amount to do to improve consultation, community benefit and social licence. Things like the developer rating scheme would have been better about ten years ago, but the second best time is now and we’re getting on with it.

“There’s a lot more to do with the industry and that’s why community benefit has been made a key criteria for CIS bidders for example.”