This is the seventh article in a series on value-adding critical minerals opportunities in Australia. You can read the previous installations here, here, here, here, here and here.

The global energy transition will drive unprecedented growth opportunities for critical minerals. The rapid acceleration of electric vehicle (EV) uptake and deployment of battery storage systems provides an incredible opportunity for the Australian economy. With the nation’s significant critical minerals resources and mining expertise, Australia can position itself as an integral player in the global new-energy supply chain.

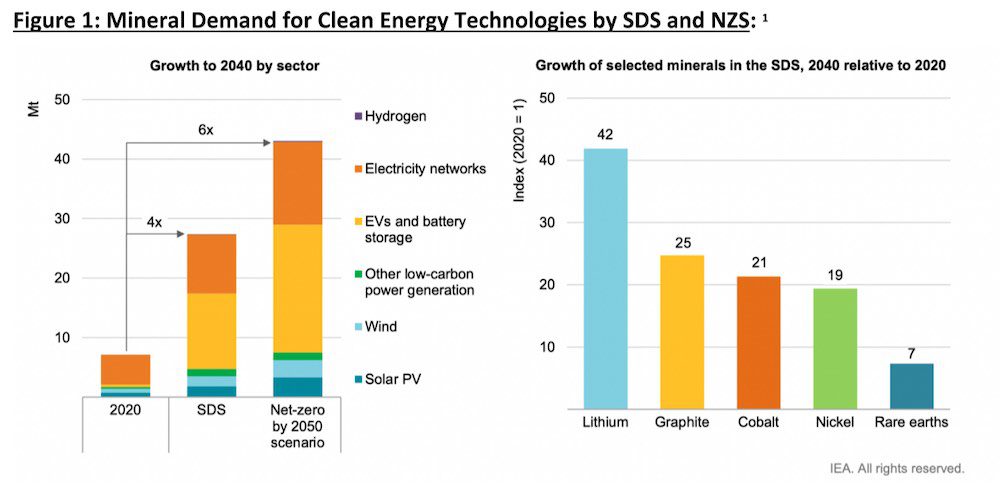

The International Energy Agency’s (IEA) Sustainable Development Scenario (SDS) is a World Energy Outlook model determining the clean energy deployment trajectory necessary to remain in-line with the Paris Agreement. To meet the growth opportunities implied by the SDS in 2040, the lithium market must grow by 42x relative to 2020, with graphite, cobalt, nickel, and rare earths industries expanding by 25x, 21x, 19x, and 7x respectively. The rapid demand expansion primarily driven by the deployment of EVs and energy storage systems, as demonstrated in Figure 1.

Australia dominates global lithium production, and accounts for 25% of global lithium ore reserves. Chile is home to ~41% of the global lithium ore reserve in 2022, with Argentina holding a further ~10% of the world’s reserves. Chile likewise dominates global copper ore reserves, accounting for ~23%, compared to Australia’s 11%. As evident in Figure 2, China accounts for ~80% of the global graphite supply chain in 2022, an essential component in all high-market share battery chemistry anodes.

As a world leading mining country, and to maximise its position in the energy transition value chain, Australian miners are increasingly expanding their involvement across critical mineral industries offshore.

Figure 2: Production and Reserves of Battery Materials 2022:

Beyond the enormous demand growth opportunity, another key theme in 2022 is supply chain security. China has invested heavily over the last decade to become one of the dominant critical minerals processing sources. But with security and diversity of supply sources being increasingly sought, this has highlighted a global opportunity for Australian firms, both in terms of domestic value-adding and offshore investment initiatives.

In August 2022, the Biden Administration issued the executive order for the government’s entire fleet to be replaced by US-made EV. The United States Inflation Reduction Act, passed earlier this year, demands the onshoring of domestic and allied battery infrastructure.

ESG considerations in supply chains are now in focus, with US president Joe Biden’s November 2022 announcement of the proposed Federal Supplier Climate Risks and Resilience Rule, which will require federal contractors to report Scope 1 and 2 emissions and disclose climate-related financial risks. Federal suppliers over US$50m in annual contracts will also be required to set science-based emissions reduction targets.

For Australia to capture the value of strategic trade alliances with North America, Asia and Europe, our companies are starting to enhance their global position, scaling beyond our borders to provide long-term expanded supply for critical minerals in the new age of energy and electric mobility.

CEF has identified key examples of foreign investment by Australian firms expanding their global positions upstream and downstream to become essential suppliers of lithium, copper, nickel, rare earths, and graphite. This builds on our previous work in identifying the scale of the opportunity for Australia in the global context, key onshore mining and refining projects, policy drivers and strategic investments by state and federal governments in the sector.

- BHP (BHP.AX $301.9bn, 50.0% 5Y Growth)

BHP is a globally significant supplier of copper, producing a total of 1,574kt in FY22 across their Chilean (Escondida, Pampa Norte), Australian (Olympic Dam), and Peruvian (Antamina) operations.

BHP’s wholly-owned Pampa Norte copper operation consists of the Spence and Cerro Colorado mines. BHP has invested US$2.46bn in the expansionary Spence Growth Option of Pampa Norte. This is an investment that will prolong the life of the mine by 50 years and upgrade its ore throughput to deliver an additional 185ktpa of copper. BHP plan investments of US$100m over FY2023 to enhance Pampa Norte and fund studies for additional capacity uplifts.

BHP have established a joint venture (JV) with Rio Tinto for their proposed Resolution Copper in Arizona, US. If progressed through its engineering phase, the project has potential to be the largest copper producer in North America.

- Rio Tinto (RIO.AX $166.3bn, 40.7% 5Y Growth)

To meet additional demand created by the global drive to net zero emissions, Rio is prioritising commodities needed for this transition, with an ambition to double growth capex to ~$3bn annually from 2023.

To capture this significant value opportunity, March 2022 saw Rio Tinto acquire the Argentinian Rincon Lithium Project for $825m, a large, undeveloped lithium brine proposal in the Salta Province. Rincon will provide global scale for Rio Tinto’s exposure into battery materials.

Copper is another key commodity in Rio Tinto’s growing global asset portfolio. Copper is essential to the transformation of energy, with EVs containing 4x the volume of copper than internal combustion engines, and solar and wind power systems consuming 3-6 tonne per megawatt installed (compared to 1 tonne thermal power).

Oyu Tolgoi in Mongolia adds to Rio’s world-class greenfield and brownfield copper project pipeline. This is a JV between Rio and Turquoise Hill Resources (TRQ). The US$6.9bn mine is expected to become one the largest copper mines in the world, and a major contributor to the Mongolian economy. Rio made a takeover bid of US$3.3bn for TRQ. However, minority shareholders expressed opposition and November 2022 saw the transaction placed on hold.

Rio Tinto has a 49% non-operating interest in nickel with Canadian-listed Talon Metals. The venture is the high-grade Tamarack Nickel-Copper-Cobalt project in Minnesota, US. The proposed Advanced Domestic Battery Minerals Processing facility will process nickel ore for the US domestic manufacturing of EV batteries. In October 2022 Talon was awarded a US$115m federal grant from the US Department of Energy (DoE), with Talon funding the remaining US$318m of capital cost. Talon has partnered with Tesla to produce nickel, copper, cobalt, and iron from its concentrates for the EV maker’s supply chain, with a supply agreement for 75,000 tonnes of concentrates.

- Allkem (AKE.AX $10.3bn, 171.7% 5Y Growth)

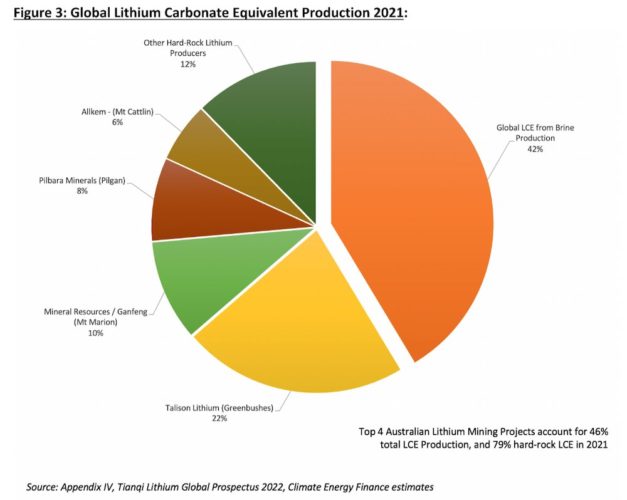

In 2021, Allkem was the 4th largest supplier of hard-rock lithium (spodumene) globally from its Mt Cattlin operations in Western Australia. Allkem accounted for 6% of global spodumene supply, but also contributed substantially to lithium brine output with its Argentinian operations.

Allkem is one of the most globally diversified lithium suppliers, with investments in critical projects across four continents in 2022. The US$286m James Bay Spodumene operation in Canada is the latest addition to Allkem’s dominant hard-rock lithium development pipeline. Utilising one the largest hydroelectric systems in the world, James Bay will provide over 320ktpa of low-cost, low-carbon spodumene concentrate. Targeting commissioning in late H1CY2024, the strategic geographical diversification of upstream lithium production paves the way for Allkem to become a key supplier in the North American and European energy transition value chain.

With a 66.5% effective equity interest, Argentinian Olaroz is Allkem’s flagship lithium brine facility. Commencing production in 2015, and producing a cumulative 77kt lithium carbonate equivalent (LCE) to date, the Olaroz Stage 2 (OS2) expansion will bring total capacity to 25ktpa of technical-grade LCE. With a proposed capex of US$425m, this positions Olaroz as one the largest lithium evaporation pond systems globally.

Allkem’s secondary Argentinian brine operation, Sal De Vida (SDV), is developing a 15ktpa LCE operation with a capex of US$271m, with commissioning expected end of CY2022. In October 2022, Allkem agreed on a proposed US$200m financing facility from the International Finance Corporation to support the development of Stage 1 (SDV S1). The facility is expected to reach financial close by end CY2022.

SDV will undergo a Stage 2 (SDV S2) expansion, adding a further 30ktpa LCE of 80% battery-grade lithium, expanding SDV to a 45ktpa operation. The capex for SDVS2 is estimated at US$524m.

Expanding downstream, Allkem’s partnership with Toyotsu Lithium Corporation (TLC) is constructing the first-of-its-kind lithium hydroxide monohydrate (LHM) facility in Naraha, Japan. The plant is expecting first production in 4QCY2022, utilising offtake of technical grade lithium carbonate from OS2, converting to 9.5ktpa battery-grade lithium hydroxide for the battery supply chain. Allkem has invested US$67m into the project thus far.

- Wyloo Metals

Andrew Forrest’s private family company Wyloo Metals completed the acquisition of Canadian Noront Resources in April 2022 (having significantly overbid BHP ), with the commitment to transform the Eagle’s Nest, Ontario, nickel deposit, one of the largest undeveloped, high-grade nickel sulphide deposits in the world. Upon acquisition, Wyloo rebranded its Canadian-based operations under ‘Ring of Fire Metals’.

The Province of Ontario indicated a commitment of up to C$1bn to infrastructure subject to Federal Government approval. This support demonstrated the economic importance of this project’s development, with studies estimating a C$9.4bn contribution to Canada’s GDP and creation of 5,500 jobs annually.

In August 2022 Wyloo Metals also made a cornerstone investment of $150m into Australia’s rapidly expanding rare earths developer, Hastings Technology Metals. The proceeds were used to acquire a 22% equity interest in TSX-listed Neo Performance Materials, a leading non-Chinese rare earth supplier. The investment highlights Wyloo’s focus on developing Canada’s critical mineral opportunity.

Neo is a leading producer of NdFeB (neodymium, iron, boron) magnets and rare earth materials, operating as the only commercial rare earth separator in Europe. The investment opens Wyloo Metals to an array of key Tier 1 customers in the battery and decarbonisation supply chain, including BOSCH, Samsung, Panasonic, Umicore, LG, and Johnson Matthey. The transaction with Hastings spans the value chain for battery and clean-energy technologies, with the rare earth filled permanent magnets critical inputs into EV and wind turbines.

- Syrah Resources (SYR.AX $1.8bn, 17.1% 5Y Growth)

Syrah’s Balama graphite mine in Mozambique is the largest natural supplier in the world and is the largest imported supplier to the Chinese anode supply chain. Syrah’s Vidalia downstream expansion will produce graphite-based Active Anode Material (AAM) for the lithium-ion battery supply chain. Upon commissioning, the project will be the only vertically integrated, large-scale AAM manufacturer outside of China, creating 220 jobs in the state of Louisiana. Syrah attracted substantial offtake agreements with Tesla and BlueOval SK (Ford and SK On’s battery JV) for supply of AAM. In October 2022, Syrah entered an MoU for the AAM supply for LG Energy Solutions.

Syrah selected Louisiana, US, as the value-added project location, receiving US$102m as a binding loan from US DoE for the initial development of its 11.25ktpa AAM facility. Additionally, Syrah received a US$220m federal grant from the US DoE for its expansion to 45ktpa AAM.

- Lynas Rare Earths (LYC.AX $8.4bn, 369.4% 5Y Growth)

Lynas has confirmed the construction of a US Light Rare Earths (LRE) separation facility in Texas. The LRE plant will receive material directly from their cracking and leaching plant in Kalgoorlie, WA. The plant is designed to produce ~5ktpa of rare earth products, with ~ 1.25ktpa NdPr (neodymium praseodymium). With a capex of US$60m, Lynas received a US$30m grant from the US Department of Defence.

Lynas is jointly developing its Heavy Rare Earth (HRE) separation facility, securing the first domestic supply in the US. HRE’s are essential for the development of robust supply chains for future-facing industries including EVs and wind turbines. With a total capex of US$180m, Lynas will receive a US$120m US Government contract to develop of the commercial HRE Processing Facility.

- Novonix (NVX.AX $1.3bn, 77.5% 5Y Growth)

Novonix is a synthetic graphite anode material manufacturer that will supply low-carbon intensity, high performance, large-scale anode material for US EV and energy storage supply chains. Novonix is currently constructing its first mass-production facility in Tennessee, US, with capacity of 10ktpa of synthetic graphite. The firm aims to also construct a new plant of 30ktpa capacity for the EV industry. The plants will create 1,000 jobs in the process.

Leveraging domestic raw material supply and energy-efficient processes, Novonix states it will be able to supply the US anode supply chain with a 60% reduction in carbon intensity relative to current Chinese synthetic graphite operations. Novonix was awarded a US$150m federal grant from the DoE. Novonix will supply the remaining capex, estimated at US$877m.

- Ioneer (INR.AX $1.3bn, 190.5% 5Y Growth)

Rhyolite Ridge is an advanced lithium project in Nevada, US, processing lithium carbonate from lithium ore for the domestic battery supply chain. The facility is designed to produce 20.5ktpa LCE in its initial phase, with planned investments into downstream refining into lithium hydroxide products. The project has a capex of US$785m. Ioneer have attracted key off-take agreements, including Ford Motor Co., PPES (a Toyota and Panasonic JV) and EcoPro, the 2nd largest cathode producer globally.

- Pilbara Minerals (PLS.AX $16.1bn, 423.9% 5Y Growth)

Pilbara Minerals entered an 18:82 JV with POSCO for the development of a 43ktpa LHM Refinery in Gwangyang, South Korea, utilising 315ktpa spodumene concentrate feedstock from Pilbara’s Pilgangoora operations. The US$750-800m facility is strategically located on the doorstep of South Korean cathode producers.

The global mining and energy system is undergoing a radical repositioning as the world’s economy decarbonises (Figure 4). As a leading mining nation globally, Australian firms are well positioned to leverage this pivot, both in terms of value-adding domestic supplies of critical minerals using renewable energy, as well as a trusted global supplier. The investment opportunities are huge.

Tim Buckley is director of Climate Energy Finance. Matt Pollard is global EV supply chain analyst at Climate Energy Finance.

This analysis is for public interest purposes highlighting the national strategic interests and opportunities for Australia from the global energy transition. It should not be construed in any way as general nor specific financial advice.