A decline of investment in fossil fuels is on the cards, as show in a new report from the Centre for Climate Finance & Investment at Imperial College Business School, written in partnership with the International Energy Agency (IEA).

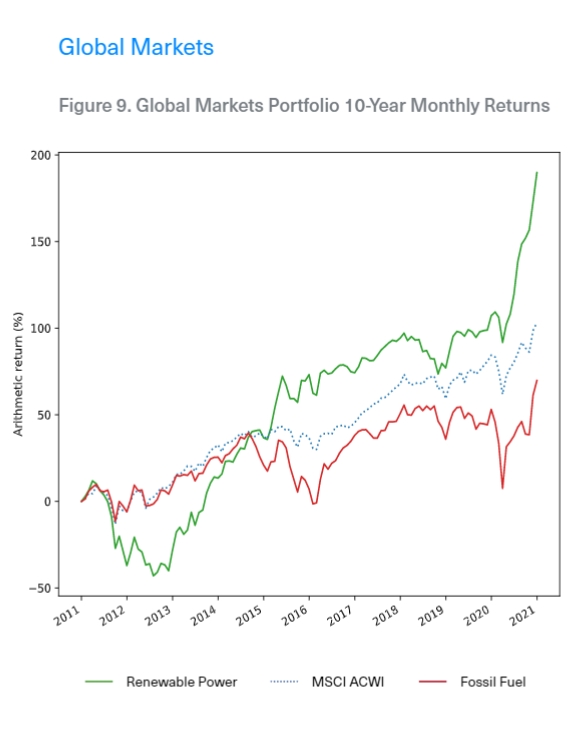

According to the report, renewable power saw significantly higher total returns over the past ten years. It claims annualised volatility was lower than fossil portfolios in both global and advanced economies, but higher than fossil in China and ’emerging markets and developing economies’.

Dr Charles Donovan, Executive Director of the Centre for Climate Finance & Investment at Imperial College Business School, said: “Our research demonstrates that all over the world renewable power has outperformed fossil fuels. It’s been the same story for more than a decade, yet total investment is still lagging. National regulators, particularly in the United States, must get to work on the reforms needed to level the playing field for clean energy investors.”

The report found that renewable energy was resilient to the impacts of COVID19, but that the fossil fuel industry was not. “In normal and volatile market conditions, the renewable power portfolio showcases enhanced diversification benefits due to their lower correlation to the broader market relative to fossil fuel”, the authors found.

“We’re not seeing enough global investment in low-carbon power. Is it that it doesn’t make sense from a financial point of view? The answer is no. It clearly outperforms”, Donovan told Bloomberg, who estimate that the current pace of investment in renewable energy is still badly insufficient to limit global warming to less dangerous levels by 2100.

The study’s scope was limited by variations in sample size across regions, lower market cap and liquidity for renewable companies and key differences between renewable and fossil portfolios that complicate comparisons.