PV solar has been increasing at a rate of 50% a year for the past decade. This has led many utilities to question the impact that continued expansion will have on their investors and ratepayers. Andrew Satchwell et al studied the effects of PV solar penetration on two hypothetical utilities. In Financial Impacts of Net-Metered PV on Utilities and Ratepayers: A Scoping Study of Two Prototypical U.S. Utilities, they concluded the negative impacts of rooftop solar will fall on investors; ratepayers may only feel modest losses.

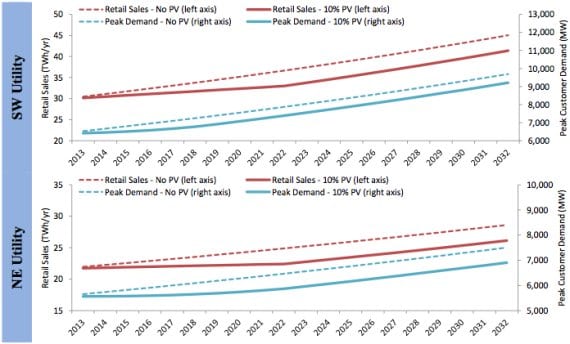

Their hypothetical SouthWestern (SW) utility has a 2013 installed capacity of 4,797 MW of conventional generation and renewable generating capacity of 206 MW. It has “has retail sales of 30,460 GWh and a peak demand of 6,531 MW in 2013 (exclusive of any savings from PV), both of which are forecasted to grow at a compound annual rate of 2.1% per year over the 20-year time horizon.”

The NorthEastern (NE) utility owns less hardware (it is”wires only”), had 2013 retail sales of 21,957 GWh and 5,655 MW of peak demand, which grow at 1.4% and 1.5% per year, respectively.

Both models are based on existing utilities and the authors obviously did not factor in inflation over the 20 years being studied.

They found that a 2.5% increase in PV penetration led to an almost negligible increase in rates, with stronger impacts on shareholders. The SW utility’s return on investment (ROE) dropped 2 basis points and earnings were reduced 4%. Though the reduction to ROE was stronger in the NE, 32 basis points, it also produced a 4% drop in earnings.

Losses were greater in a scenario where PV penetration increases to 10% by 2022. As you can see in the chart above, the NE utilities retail sales almost flat line for a decade. Income from peak demand is somewhat better, but both revenue streams are less than what they would have been without solar. Investors ROE dropped 18% and earnings 15% over a twenty year period. Though the SW utility fared better, there is a definite loss of revenue. Investor’s ROE dropped 3% and earnings 8%. Ratepayers were faced with increases of 2.5% and 2.7%, respectively.

When they factored in differences between utilities operating and regulatory environment, “achieved earnings were reduced by 5% to 13% for the SW utility and by 6% to 41% for the NE utility, with similar ranges in the impacts on achieved ROE.” The impact upon ratepayers during this twenty year period was remained low (0% – 4%).

There are steps utilities can take to mitigate potential losses, depending on their circumstances and “operating and regulatory environment.” The NE utility could mitigate almost all losses if it owned 10% of the PV in its territory. Utilities could also moderate revenue erosion by increasing charges, though in the NE this could actually increase losses “due to the low rate of growth in the number of utility customers relative to growth in sales.”

The author’s concluded that increased PV penetration, alone, will probably not cause utilities to go into a “death spiral” of rate hikes, prompting further customer departures.

All illustrations taken from Financial Impacts of Net-Metered PV on Utilities and Ratepayers: A Scoping Study of Two Prototypical U.S. Utilities

Source: CleanTechnica. Reproduced with permission.