Mixed messages emerging from Canberra are effectively masking what is a plain truth – the Morrison government is leaving the door open to the fossil fuel industry to get a foothold in Australia’s fledgling hydrogen sector.

On Monday, the government officially launched a new $300 million Advancing Hydrogen Fund, to be managed by the Clean Energy Finance Corporation (CEFC), which will lend money to, or invest equity in projects looking to boost both Australia’s hydrogen supplies and the use of hydrogen in industry.

The government’s announcement has leaned heavily on the description of “clean hydrogen”, which it is using to encompass both hydrogen produced using renewable electricity supplies, as well as hydrogen produced from fossil fuels.

There are a genuine questions over the ability of the fossil fuel sector to produce “clean” hydrogen, due to its reliance on costly, and still relatively unproven carbon capture and storage technologies. But this is unlikely to stop the Morrison government from trying, given its track record of backing the fossil fuel sector.

Australia’s chief scientist, Dr Alan Finkel, who developed the National Hydrogen Strategy adopted by the government and the COAG Energy Council, told ABC’s Radio National that he believed the focus should be on the outcome of reducing emissions, rather than any particular technology.

“I think the focus should be on clean hydrogen, but there are many ways you can make clean hydrogen,” Finkel told ABC’s RN Breakfast.

“I have consistently said that my focus, and I think the world’s focus, should be on the reduction of emissions of carbon dioxide into the atmosphere, not on a particular technology. You do not solve that problem by getting out of a particular technology or getting into a technology.”

While developing the National Hydrogen Strategy, Finkel took a clear position of advocating that hydrogen produced from fossil fuels and combined with carbon capture and storage, should sit alongside hydrogen produced using renewable electricity.

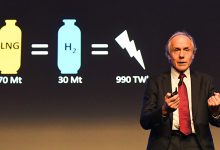

Finkel first flagged the prospect of using coal and gas to produce hydrogen in an address to the Australian Clean Energy Summit in July last year, where the chief scientist raised concerns over the loss of diverse energy supplies if Australia was to abandon the use of its gas and coal resources.

The argument was that coal and gas should still play a part in the Australian energy mix, as they provided additional sources of energy that provides energy security through diversity.

Finkel later reiterated the call in a speech to the National Press Club in February, saying that fossil fuel hydrogen could serve as a means of producing hydrogen at low cost, allowing the Australian industry to get off the ground. Cost competitive renewable hydrogen could then enter the market at a later date, once further cost reductions in electrolyser technologies were achieved.

But on Tuesday, while saying that the focus should be on “clean” hydrogen, Finkel conceded that the choice between fossil or renewable hydrogen might come to naught, as the first inroads into establishing a cost competitive hydrogen industry in Australia would likely come from projects powered by renewable electricity.

“There is no doubt though that the earliest wins will come from renewable electricity to make hydrogen,” Finkel said. “Doing hydrogen from gas or coal capability gasification, requires a massive investment, because you cannot do it at small-scale, you have to build a large plant producing a lot of hydrogen, capturing a lot of carbon dioxide to make the infrastructure to pipe the carbon dioxide to a location where it is permanently stored all worthwhile.

“So, in the short term, the route from solar, wind or hydroelectricity to split water is the most practical place, that I can see, for investment.”

A spokesperson for federal energy and emissions reduction minister Angus Taylor confirmed that the Morrison government expected that the CEFC could draw upon the new $300 million fund to invest in ‘low emissions’ technologies and that this could include hydrogen from gas production.

The updated mandate has been issued to the CEFC (but is not yet publicly available), and asks the CEFC to “support the growth of a clean, innovative, safe and competitive Australian hydrogen industry.”

The re-emergence of hydrogen as a way to facilitate emissions reduction in energy use has been driven by the prospect of low-cost wind and solar supplies that can be used to produce hydrogen through electrolysis.

This is evidenced through major project proposals that seek to link large-scale wind and solar projects with hydrogen production, and studies that highlight the potential for on-site solar to provide the cheapest pathway to zero-emissions hydrogen production.

The use of fossil fuels to produce hydrogen, combined with carbon capture and storage, will almost certainly require dedicated government support, and given the Morrison government’s track record of backing gas and coal projects, suspicions are high about a potential backdoor for channelling funds into the sector.

Additional confusion mounts due to two conflicting messages – while the government anticipates the CEFC will invest in gas to hydrogen projects, the CEFC is expressly forbidden from investing carbon capture and storage projects under its legislation.

While the legislation establishing the Clean Energy Finance Corporation allows it to invest in “low emissions technologies,” in practice, this has never included any form of fossil fuels. The CEFC’s investments have included renewable energy projects, sustainable infrastructure and energy efficiency.

Consistent with this, the CEFC flagged that it would prioritise investment in projects that are also receiving grant funding support from a $70 million fund being administered by the Australian Renewable Energy Agency, which would also have the effect of ruling out investments in projects using fossil fuels.

“CEFC finance remains central to filling market gaps, whether driven by technology, development or commercial challenges. We are confident we can use our capital to help build investor confidence in the emerging hydrogen sector, which is an exciting extension of our investment focus,” CEFC Ian Learmonth said.

The CEFC declined to provide additional comment when approached by RenewEconomy.

RenewEconomy and the Smart Energy Council will be co-hosting a “virtual conference” on May 6, focusing on a renewables-led economic recovery, featuring industry leaders, analysts and advocates. More information and registration here.

RenewEconomy and its sister sites One Step Off The Grid and The Driven will continue to publish throughout the Covid-19 crisis, posting good news about technology and project development, and holding government, regulators and business to account. But as the conference market evaporates, and some advertisers pull in their budgets, readers can help by making a voluntary donation here to help ensure we can continue to offer the service free of charge and to as wide an audience as possible. Thank you for your support.