New Zealand gen-tailer Meridian Energy has confirmed it is still seriously considering an exit from the Australian market, where it says heavy-handed political and regulatory interventions and the lack of a price on carbon emissions have nobbled renewable energy investment.

In its annual results announcement on Wednesday, the Wellington-based company reported a nearly 30 per cent dip in its underlying net profit across the group, to $NZ232 million ($A222m Australia) – down $84m on the prior year.

And it confirmed the ongoing review of its strategy in Australia, first flagged in June, with any decisions on the sale of its Australian renewable energy and retail assets likely be confirmed before the end of December 2021.

In Australia, where Meridian’s total revenue was also down on the prior year ($NZ333 million, compared to $353 million in 2020) the results reports painted a picture of a “highly politicised” energy market, where government and regulatory interventions were creating “significant uncertainty.”

“In our assessment, intervention in the Australian electricity market and a lack of emissions pricing have led to spiralling and unintended consequences that will hinder investment in renewable generation and limit the overall ability of Australia’s energy sector to mitigate climate change,” the report said.

“By contrast, the New Zealand electricity market continues to incentivise the construction of renewable electricity generation and works well because the government has largely stayed out of operations.

“Accordingly, towards year end we announced we would be revisiting our growth strategy and our ownership of Meridian Energy Australia. This review will consider a full range of options, including accelerated growth as well as partial or full divestment.”

Meridian said that since announcing its possible exit from the Australian renewables market in June, the group had reached out to interested parties in August on the sale of its investment in Meridian Energy Australia, including wind and hydro assets and retail activities under the Powershop brand.

Meridian Energy Australia currently owns and operates 300MW renewable energy assets in Australia, including 201MW of wind farms and 99MW of hydro assets. Another 108MW is under development, at the Rangoon Wind Farm, and works are also underway on the 20MW Hume Battery Storage System.

Including its 185,000 retail and electricity gas customers around the country, through Powershop,

Meridian said the carrying value of the assets and liabilities of the MEA investment as at 30 June 2021 were $778 million and $416 million, respectively.

“If we proceed, any potential transaction will likely be confirmed before the end of December 2021,” the reports said.

Coincidentally or not, December of this year was also named in the report as the departure date of the current CEO of Meridian Australia and Powershop Australia, Jason Stein, who took up the role in late 2019.

(See our new resource: Grid Connections: Who’s going where in Australia’s energy transition)

Meridian was also critical of the current state of Australia’s wholesale and retail electricity markets, which had impacted both the performance of the company’s generation assets and the margins of its otherwise relatively successful retail business.

“While our retail sales volume increased, wholesale prices in the Australian market fell to unsustainably low levels and this impacted the performance of our generation assets,” the report said.

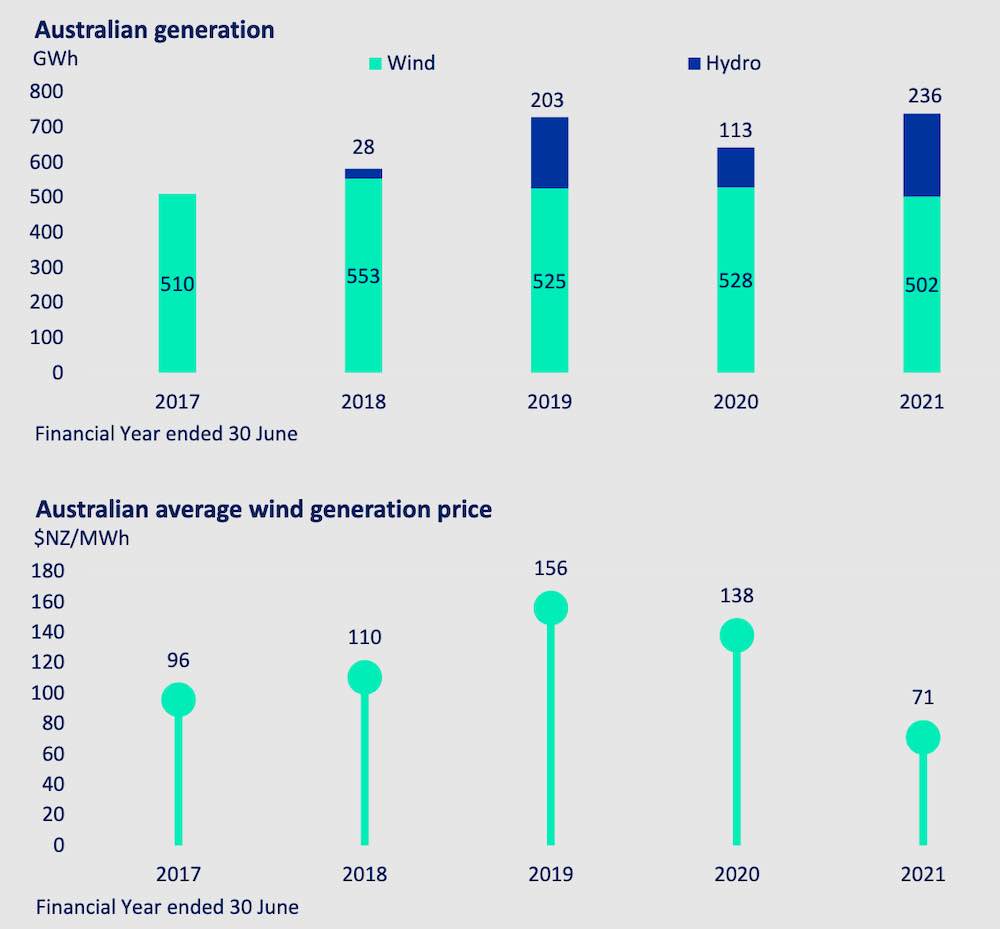

The report notes that while wind generation was down for the year by just 4 per cent, it was being traded at a 49% lower average price compared to over the same period in 2019/2020.

“Overall, the Meridian Energy Australia Group result was down on the prior year even though we had more hydro generation available as the drought conditions, that had been a feature for the last few years, began to ease.”

On the retail side of the Australian equation, Meridian said that the requirement to pass on lower wholesale and input costs coupled with market/default offer prices had led to continued margin pressure.

“In Australia, retail prices have followed wholesale prices down to, in our view, unsustainable lows, while prolonged lockdowns have had pronounced effects on people’s mental health and their ability to earn,” the report said.

And it added: “(On the face of it, low pricing overall may seem a good thing for consumers. Our concern with the wholesale situation in Australia is that, unless prices lift, there will be no incentives to introduce new generation and the country will continue struggling to decarbonise.)”

Meridian said that, given the erosion of retail margins in Australia, its strategic focus going forward would be to lower its cost to serve, “without compromising quality,” and offering a broad range of products, priced competitively.

On a performance basis, Powershop Australia’s electricity customer numbers were 4% higher at the end of the financial year than at the same time last year; and retail sales volumes were 15% higher at an 8% lower average price.

“Our certified carbon-neutral retail gas product, which is currently available in Victoria (and soon to be released in New South Wales), had 43,905 customer connections as at 30 June 2021, up from 37,878 the previous year,” the report said.