Summary – time to roll your own

Despite cooler weather, lower volumes and lower prices FY18 futures went up another 4% last week and have now gained 40 per cent in the last 10 weeks.

It remains very unclear which power stations are going to lift output to supply the market next summer. We think there will be genuine difficulties and that producers will try to exploit the situation.

The forthcoming sharp rise in grid delivered prices provides a renewed incentive for distributed generation, so PV installers and battery sellers should be out there doing the rounds.

Turning to the weekly action

- Volumes : across the NEM volumes in the week to March 3 fell 1% compared to the previous correspond period (PCP), with South Australia and QLD bucking the average. Over the past 30 days NEM wide volumes are now flat on last year as the impact of the really hot weather is averaged down and because Portland aluminium smelter is operating at low levels of capacity. A reduction of 150MW in QLD, when Boyne Island reduces output, will reduce average demand in QLD by about 2.5%. Boyne Island gets 85% of its power from Gladstone power station. RIO Tinto owns 42% of Gladstone power station and Gladstone operates at significantly less than full capacity. So the question is why RIO didn’t just write a contract for the increased output with Gladstone?

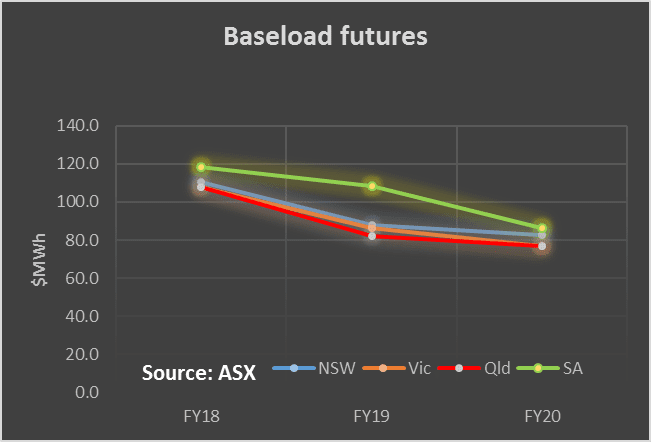

- Future prices:.. 2018 futures prices rose another 4% in the Eastern States to be around $110 MWh. Although the price in South Australia is still higher at $118 MWh there isn’t that much in it. Never mind the price last year, FY18 futures prices are up 40% since January in the East. There is less action in the outer years but that likely reflects uncertainty. Finally, it’s really “never mind the price” where’s the electricity going to come from. That said there is likely an element of squeeze by the thermal generators. They know that no one can magically create any new competition over the next 12 months so they are making the most of their day in the sun.

These prices clearly incentivise new generation particularly in NSW but also Victoria. At the same time the price increases that businesses and households are going to see are going to provide an even better outlook for distributed energy and storage. Roll your own over the next 12 months may be the way to go. Businesses for instance may see not just energy tariffs but also demand tariffs with big increases as volatility increases.

- Spot electricity prices. Were relatively low this week other than in South Australia

- REC Unchanged.

- Gas prices fell in Brisbane but remain around $11-$12 Gj in Adelaide and Sydney. High gas demand in Sunmer for peak generation also means that building up reserves for the traditional winter heating peak is going to be more of a challenge this year. Winter prices could be higher than ever. We shall see.

- Utility share prices: Utilities have had a bad run in the sharemarket recently, save for AGL and APA. Orocobre has done particularly poorly. It reported that its lithium brine ponds weren’t working the way they were modelled. Apparently the pond model is 20 Megabytes and it has a bug in it. There’s a surprise. The brine ponds gradually concentrate the brine via evaporation until its sufficiently concentrated to enter the production plant. Management say that fixing the problem requires producing less (50% less) over the next six months. This didn’t make shareholders happy.

Share Prices

Volumes

Base Load Futures

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.