The most interesting thing by far at the moment is working out who is going to be short and who is going to be long in retailing space for emissions targets.

The big gentailers have focused on looking after their retail loads and, as a general statement, are likely to have to contract further to meet even the laughably unambitious 26% emissions reduction target for the electricity sector for 2030.

However, if the Queensland and Victorian State Governments have the guts to stick to electorally popular policies they have announced – that is for 50% renewable generation in QLD by 2030 and 40% in Victoria by 2025 – then the Federal target is irrelevant and the target will be over achieved.

Of course we can add to that whatever is done in NSW to replace Liddell.

All of the above needs to be spelt out in more detail, so look out for another note on this topic shortly.

AGL’s Tomago gas plant

Speaking of NSW, AGL confirmed during the week that it will be building a $400 million, 252MW reciprocating engine, gas plant near Newcastle, potentially we believe around Tomago.

The plant consists of 14 reciprocating engines of 18MW each with a target startup date of 2022 calendar year. AGL has good gas storage facilities near Newcastle.

Historically, reciprocating engines (4 strokes) made mainly by Wartsilla and in smaller sizes by Caterpillar have been used mostly in the off grid market in Australia and in smaller sizes.

They are less efficient than combined cycle plants when the latter are run steadily, and also have higher running costs.

However, they seem to be getting a new lease of life in the utility market because of their better ability to run at part capacity.

That is, you only have to have as many machines going as you have demand, and because they can start up from warm condition in 10 minutes.

The efficiency of combined cycle plants deteriorates quickly when they have to start up or shut down quickly or to run at less than full capacity for extended periods.

We expect further gas plant to be built in NSW, EnergyAustralia is on record as saying its interested and even Snowy might want more gas capacity.

The obvious point to make is that there is no way gas plants are going to provide cheap electricity at anything close to current gas prices. This plant, like Snowy 2.0, only makes sense in a market where the energy is coming from cheap renewables.

During the week

Spot prices had several spikes in South Australia. Near term electricity futures continued to drop about 1% a week but we think this is more aimless trading than anything special.

Oil prices continued to climb making contract LNG exports notionally worth over A$12 GJ.

USA 10 year bonds briefly went over 3% before falling back. Australian 10 year bonds are lower than the USA. A low 10 year bond rate is a sign of a well-managed economy, in my opinion.

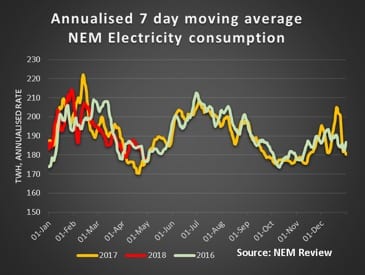

Demand for the week was higher than last year, but basically bang in line with seasonal trends.

We include a new chart showing the REC curve. Renewable investors expecting to get REC returns to supercharge their investment in the 2020s will likely have to replace these with renewables contracts for low emission generation.

There should be a return for the service as the big gentailers will need to sign more contracts.

Gas prices were flat but below last year.

Share prices did not much except in the case of Redflow, which raised more equity.

There appears to be a pause in the selling of the highly volatile lithium shares.

Share Prices

Volumes

Base Load Futures, $MWH

REC Prices

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.