Two things were interesting this past week: (i) NSW thermal outages and their impact and (ii) the reduction of solar subsidies and new solar plants in China.

China drives world markets, cuts new generation build – kills PV

The NDRC, Ministry of Finance and NEA jointly announce there would “no new general solar capacity planned” for 2018 except for projects to lift poverty in rural areas.

Last year, China’s solar PV build was about 58 GW out of a global total of between 90-100GW. This year’s build is now expected to be something between 20-35GW. Solar tariffs were also cut by Rmb 50/MW. Most solar panel makers have been taken private and but JinkoSolar’s share price has fallen by 1/3 this year.

Naturally, the cut in China demand will lead to an oversupply of panel production. We expect China companies to cut production plans and fire workers very aggressively but even so there should be some excellent prices on panels by the end of this year.

I am guessing panel prices in US$ achieved by panel manufacturers could be something like US$0.25-US$0.35/watt. This compares with Australian utility-scale, single axis tracking plant EPC costs of around A$1.10/w.

In other words panels are only a component of costs and installed costs in Australia might see say a 10% reduction.

It’s also likely that in a fragmented China panel manufacturing industry some players will exit.

In the medium term a reduction in panel demand in China is bad, yes bad news, for prices. Price reductions are mainly sourced from the learning rate, the 15% or so unit cost reduction that comes from a doubling of installed capacity. A slow down in growth means a slow down in learning rate cost reduction.

China coal growth also cut

On May 24 the NEA/NDRC announced an update to its “Risk warning system” for evaluating new coal projects and designated 20/31 provinces representing 66% of the entire country as “red zones”. This means new coal-fired plants are unlikely to be allowed in those provinces.

In general China has moved to increase capacity utilization of the entire generation fleet as opposed to the expansion of new capacity.

However, you can’t decarbonize without having new renewable capacity replace existing thermal capacity. You can stop growing emissions but you can’t reduce them much that way.

Are the NSW outages a portent?

For a year now we have been standing on a soapbox complaining that NSW wasn’t taking its electricity futures seriously enough.

A very backwards looking group of NSW politicians have prevented NSW from taking the same action to protect its manufacturing base and general population from high electricity prices and supply risks as Victoria and Queensland have taken with their renewable energy targets and State guaranteed reverse auctions.

This is despite the fact that NSW has

- by far the most expensive coal supply,

- the easiest to forecast closures of thermal power stations and

- the least access to conventional gas and is

- a net importer of power.

- And new transmission will take years to build. Again this is well known and we have been talking about it for a year.

NSW also has access to a vast solar resource and some reasonable wind resources. Of course, the wind and solar PV will not be enough on their own.

Not even the most ardent supporter of renewable energy has ever doubted that some way to firm up the variable renewable energy [VRE] will need to be employed.

However, just as equally lots more VRE can be firmed up by the remaining coal generation for another 15 years. There is plenty of time to build better firming than coal in that time and more transmission.

A policy, or even a signal, from the NSW Government is what’s needed

New VRE though can provide much energy and can be built quickly. As Transgrid reports regularly, there are literally several GW of solar PV farms waiting to be built.

It’s true that current prices are less attractive in NSW that anywhere other than Queensland. It’s also true that Transgrid would have to get very busy to facilitate the work. However, to some extent there is a lack of confidence in NSW.

That lack of confidence comes from the lack of NSW Govt commitment, the lack of a plan to replace the NSW generation that is going to close, the lack of a NSW Govt policy for future electricity supply in NSW.

If Don Harwin, the current Energy Minister was given is druthers there probably would be a plan, but the NSW National party and its supporters and allies in the Liberal Party stand like a gigantic speed hump.

Despite the message coming from the South Australian Liberal Government about taking the best policies of the ALP and continuing with the renewable course, NSW continues with its same old message that the future is coal.

Of course coal royalties are very important, but only 14% of those thermal coal royalties comes from sales to NSW electricity generators and arguably coal mining is not very politically popular.

In fact the industry is largely foreign-owned. In any case coal royalties and coal loyalties can hardly be considered more important than a secure and cost-effective electricity system for the State.

NSW actually managed ok anyway

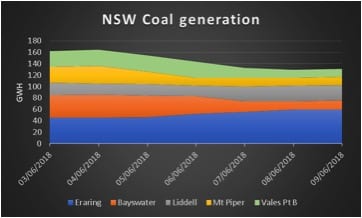

In any case NSW managed the outages reasonably well. The following figures provide a few pictures of the week in NSW. One feature was how little help gas was during the week.

The market action

Despite the difficulties in NSW and the flow on impacts to spot electricity prices in Qld it was overall a relatively standard week in the NEM.

Consumption overall was basically bang on the level of last year and the year before, although Tomago having to cut consumption on at least 2 occasions didn’t help demand.

Futures prices clearly reflect a jump in NSW and QLD in 2022 following the Liddell closure. There is little or no trading in these contracts but we don’t disagree with the price outlook.

Gas prices drifted upwards and the slow-moving 3o day STTM 3 city average is getting up to last year. This, in our view, reflects higher international gas prices. We cannot see LNG shipped from W.A. to the East coast having a cost advantage but we could nevertheless see lower prices due to competition for market share.

Coal price hit A$150 /t this week, we presume on continued strength in China but also the global economy is relatively robust just now. That’s something like a $60/MWh coal cost at the margin for a NSW coal generator. A new wind plant’s all up cost is less than that.

Brent oil is over A$ 100/b and that will translate over the next few months into higher contracted LNG prices, conceptually over A$12 GJ. Spot LNG data will be added to Fig 7 when I get round to sourcing it.

Bond rates in Australia and the USA rose 10 BPS.

Share prices

Lithium shares took a hit this week, unsurprising on the back of the China PV subsidies.

Volumes

Base load futures, $MWh

Figure 15: Baseload futures financial year time weighted average

REc prices

Gas prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.