There will be lots more to be said about the National Energy Guarantee (NEG) and we urge those that are interested to read the NEG consultation paper.

Our simple view is that it’s a poor mechanism, being introduced with undue haste.

Fundamentally we simply don’t see that the responsibility for system wide issues should rest with individual retailers or gentailers.

Any reading of the consultation paper will show the complexity of some of the issues. I’d particularly draw attention to the idea that AEMO can be auctioning off offers for dispatchable capacity.

We’ve defended AEMO’s recent forecast record but that’s not to say that we think AEMO has somehow discovered an elixir that lets them see the future better than anyone else.

As such we aren’t sure that their identification of a reliability gap is going to be all that accurate. And we note they have an incentive to forecast a reliability gap. They will be a naturally biased forecaster.

This is not a criticism but simply pointing out their incentive. They suffer no pain if there is too much generation capacity but get into very hot water if there is too little.

The consultation paper has an emphasis on markets and contracts solving the problem, but the very fact that there is a need for a reliability guarantee shows that the current market is not being trusted to deliver the required dispatchable generation despite the price signals that would be delivered in the spot market.

Instead the job is being handed to an individual forecasting body.

In addition there is a proposal for AEMO to have a “central book build process” for dispatchable generation.

In short the basis for and the implementation of the NEG seems to us not clearly thought out and the conflict between a private sector and planned approach to new investment seems to be heightened and not solved by the ESB proposals.

Queensland demand

Queensland grid maximum demand hit records several times in the past week, but for the week overall total grid delivered energy supplied was only 1% higher last year and the average price was just $86/MWh, and the maximum half hourly price $388/MWh.

We see that as a good outcome and shows that all the investment in behind the meter PV is doing something. As Origin noted last week several grid scale PV plants will start in the next few months with Clare the first.

Infigen results – share price up 11%, but for what we don’t know

Infigen these days is being managed by people with more of a background in thermal generation than renewable generation. Two former CEOs of the old Babcock and Brown Power are in senior management at Infigen. This is perhaps a sign of how times change.

A summary of Infigen’s results which shows Ebitda and cashflow is:

The result was good in the sense that ebitda was maintained despite slightly lower wind volumes. Curtailment doesn’t seem to be an issue for IFN.

However, what really caught the eye was IFN’s post reporting date , debt refinancing.

This refinancing provides IFN with $525 m of 5 year debt. The fees paid for this debt were about $25 m or more than 5% of the amount borrowed.

This is a nose bleed fee in your analyst’s opinion, particularly as it is only 5 year debt which will need to be refinanced again.

We would have preferred to see a more balanced debt profile with maturies spread out and obtained not just from one source. In addition IFN is seeking another $80 m of liquidity, if we read the announcement correctly.

Also of note was that IFN’s overall opex works to $27 MWh. Wind farms are expensive to operate in Australia particularly when compared with say $55 MWh PPA prices that the likes of ORG and PARF are receiving.

The weekly numbers

By and large the week was uneventful

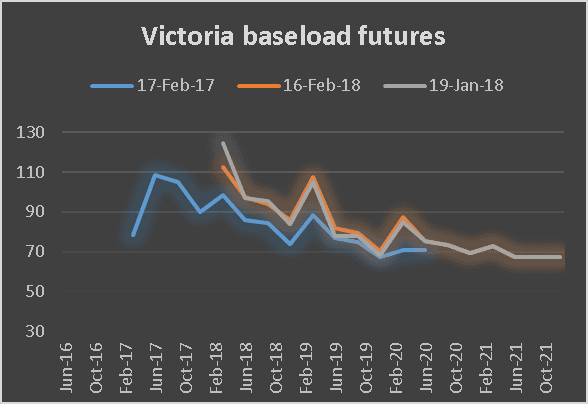

Near term futures fell, but those in South Australia remain higher than the rest of the NEM. In year on year terms the futures curve is now flat, ie futures prices a year ago looking forward were similar to those on offer today.

Consumption has grown in Victoria compared to PCP we attribute this mostly to Portland smelter.

Gas prices were modestly softer, particularly in QLD.

REC prices are unchanged but we wonder how realistic the 2021 indicative price is.

Ten year bonds rose from 2.82% to 2.9% in Australia to be about 50 bps above last year.

Share Prices

Share prices mostly recovered modestly.

Volumes

Base Load Futures, $MWH

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.