Another week, another record-breaking clean energy and green investment result coming out of 2017.

A new report from Bloomberg New Energy Finance has revealed an enormous year for the issuance of green bonds – the relatively new (first issued in 2007) fixed-income investments designed to finance environmentally friendly projects.

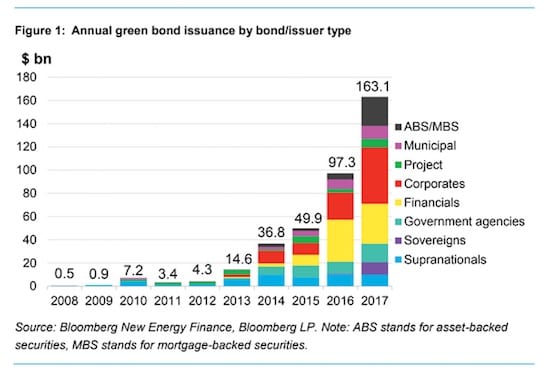

As you can see in the BNEF chart below, a massive total of $163.1 billion worth of green bonds were issued for the year, charting 67 per cent year-on-year growth and marking the fifth consecutive year of record issuance.

The four-year compound annual growth rate, which is used by Bloomberg New Energy Finance as an indication of future issuance, now stands at 64 per cent, BNEF said.

“Annual issuance of green bonds not only passed the $100 billion milestone in 2017, it sailed right past it,” said BNEF green finance specialist Dan Shuey. “As the market expands, the green bond market continues to diversify and innovate across all asset classes and issuer types.”

Shuey explains that the bumper year of market growth was mostly driven by new corporate debt issuance – represented by the big chunk of red in the chart.

“Companies from a diverse sector range – anything from power generation to electronics – sold green bonds to fund corporate sustainability measures, including renewable energy development and energy-efficient retrofits,” the report says.

BNEF also noted that securitised green bonds had “come of age”, with more than $25 billion worth of asset-backed and mortgage-backed green bonds were sold in 2017 – five times the volume issued in 2016.

In Australia, the market has been coming along nicely, too.

Most of the big four banks are now active in the market, and in March last year credit finance group FlexiGroup issued a second green bond to the national market, doubling down on strong investor demand for clean energy assets, and in particular for residential rooftop solar and battery storage.

The $A50 million certified climate bond was issued with an underlying asset base of residential rooftop solar – and with a $20 million cornerstone investment from the Clean Energy Finance Corporation.