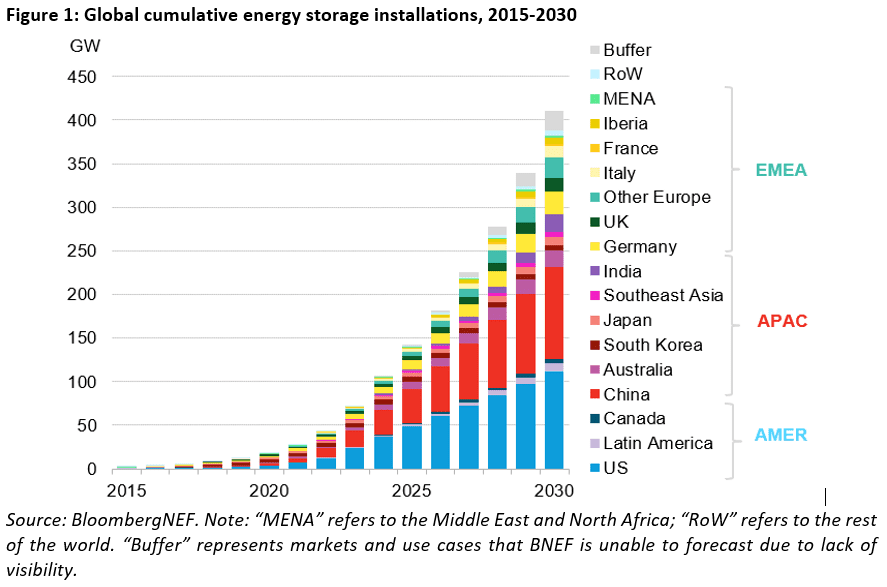

Energy storage installations are expected to accelerate through the remainder of the decade, reaching 411GW/1194GWh by 2030, 15 times the 27GW/56GWh of storage that had been brought online by the end of 2021.

These are the headlines from the most recent Energy Storage Market Outlook report from analysts BloombergNEF (BNEF), which increases its outlook for storage deployment by 13% by 2030.

The good news for the energy storage sector stems from recent policy changes in the United States and Europe which BNEF has calculated equates to an extra 46GW/145GWh by the end of the decade.

Prime amongst the recent policy shifts was the passage of the Inflation Reduction Act (IRA) in the United States which, despite its name, is primarily a climate and clean energy bill that provides in excess of $US369 billion in funding for clean technologies.

The IRA and the REPowerEU

Specifically, BNEF expects the IRA to drive approximately 30GW/111GWh of energy storage through the remainder of the decade. Unfortunately, while the long-term growth is almost guaranteed, ongoing supply chain constraints leave the short-term confused.

Bolstering the long-term growth for the global storage sector was passage of the European Union’s REPowerEU plan, part of the EU’s efforts to squeeze out from continued reliance on gas from Russia.

All told, between 2022 and 2030, an estimated 387GW/1,143GWh will be added around the globe, with the United States and China set to remain the two largest markets. Together, the US and China will represent over half of global storage installations by decade’s end, though Europe will significantly ramp up its own capacity, spurred as it has been by Russia’s invasion of Ukraine.

Just as in the US, though, short-term supply chain constraints – stemming from long-tail effects of the global COVID-19 pandemic and the more recent invasion of Ukraine – have pushed storage prices sky-high.

“The energy storage industry is facing growing pains,” said Helen Kou, an energy storage associate at BNEF and lead author of the report.

“Yet, despite higher battery system prices, demand is clear. There will be over 1 terawatt-hour of energy capacity by 2030. The largest power markets in the world, like China, the US, India and the EU, have all passed legislation that incentivises energy storage deployments.”

Storage focus on energy shifting

One of the key components of energy storage growth over the remainder of the decade will be so-called energy shifting projects. BNEF expects that around 61% of storage megawatts will be dedicated to energy shifting – advancing or delaying the time of electricity dispatch.

Unsurprisingly, then, co-located storage projects with renewable energy projects will become more commonplace, according to BNEF, particularly solar + storage projects.

However, customer-sited batteries will continue to grow through the decade, led by Germany and Australia, who are currently the leaders in this space. BNEF expects that, by 2030, energy storage located in homes and businesses will account for around a quarter of global installations.