Chief scientist Alan Finkel says it is clear that investors in the energy market prefer wind and solar because they are cheaper to build than traditional generation such as hydro and coal.

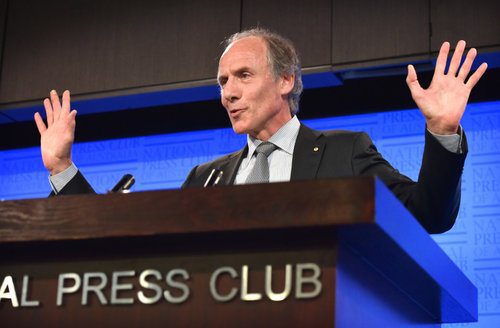

Speaking to the National Press Club 12 days after the release of his Finkel Review into energy security, and a day after the Coalition flagged their interest in a new “state-of-the-art” coal plant, Finkel said wind and solar are clearly the preference of investors, even without subsidies.

“Investors also like wind and solar because they can be rolled out in small steps, say 100 megawatts at a time, then scaled up to meet demand,” Finkel said in his prepared speech. “This minimises the risk that by the time a much larger project is finished the increased demand might not have materialised.”

Finkel’s comments came as the biggest owner of coal fired generation in Australia, AGL Energy, ridiculed the Coalition push for new coal generation, with CEO Andy Vesey saying that the only “baseload” he could see in the future would come from renewables.

Finkel also took note of the huge amount of rooftop solar generation in Australia, and its impact on the grid, and the “stunning improvements” in battery storage capacity and cost.

“This is a grassroots revolution. It’s driven by billions of people wanting their smart phones and laptop computers to last longer between charges,” he said.

“To meet that market pull, global manufacturers have invested massively to improve the performance and lower the price of rechargeable batteries.

“Re-purposing these batteries has enabled manufacturers to configure grid scale batteries. These are now being installed internationally at a level and cost that were unimaginable five years ago.”

he also spoke of pumped hydro, smart software, “sharing” models such as Uber, and the onset of electric vehicles.

“For the past eight months, I have observed our electricity supply struggling to cope with these disruptive changes.

“But I don’t want to exaggerate. The system is not broken. It is, however, at a critical turning point. We must improve on what we have, to prepare for the growing wave of disruptive changes sweeping electricity markets here and around the world.”

Finkel also addressed one of the more controversial aspects of his energy blueprint, the generator security obligation, which could require individual wind and solar farms to provide a certain amount of “dispatchable” energy.

Although many wind and solar farms are considering adding storage to their power plants, the need for every new plant to do so is seen as over-reach by many, inefficient, and could add un-necessarily to costs. Energy minister Josh Frydenberg has described it as an attempt to “level the playing field” with coal.

Finkel said the measure was designed to obligate “new generators” to be able to dispatch electricity to meet the extreme demand that occurs during Australia’s hot summer afternoons (although he doesn’t mention coal and gas plants that have failed to deliver at exactly those moments on repeated occasions last summer).

“The specifics of the requirement will be calculated for each state, looking at present and future needs, while avoiding heavy capital expenditures that would drive up end-user prices,” he said.

“As an example, in a state like Queensland, the initial obligation on a 100 MW wind farm might be a requirement to provide power, even when the wind is not blowing, at the 10 MW level for 4 hours.

“The additional capital expenditure would be 10% or less, meaning that the new wind farm would still be cheaper than a wind farm of the same capacity built just a year ago.

“There are many means by which this capability to produce power when needed could be provided. It could come from on-site batteries or liquid fuel generators, or it could come from a contract with new sources such as a pumped hydro facility or an off-site gas generator.

Finkel said that he did not believe the federal government had ruled out his proposed clean energy target, despite its support for a new coal plant, and the fact that it was the one exclusion among the 50 recommendations he made that the Coalition says it will take to COAG energy ministers.