Australia’s wholesale electricity market continues to see transmission constraints stuffing up prices.

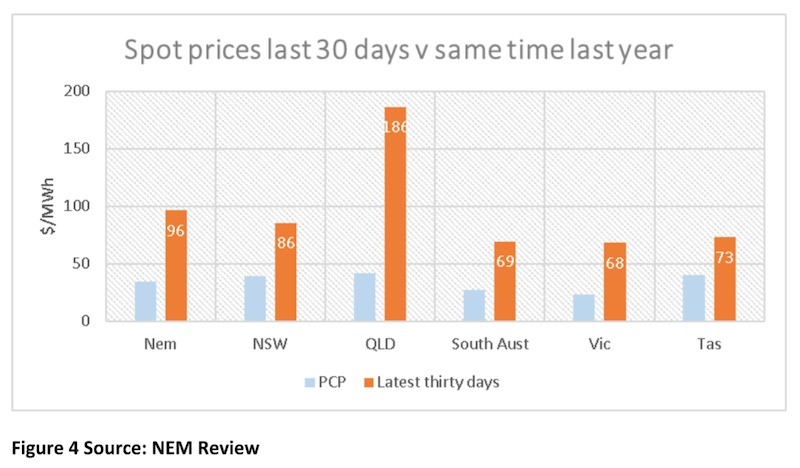

Somehow or other, a combination of developments and constraints on Victoria-New South Wales transmission and the Callide failure have driven a huge wedge between power prices in NSW and Queensland on one hand and Victoria/South Australia/Tasmania on the other.

See: Australia’s north-south divide: Electricity price jumps in coal dependent states

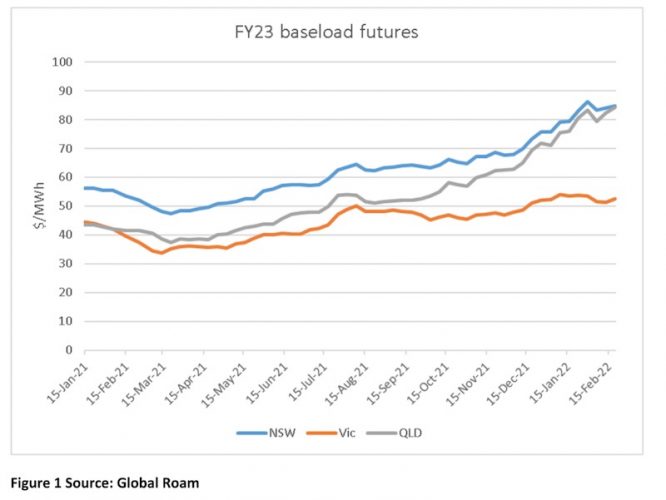

The figure below shows year to June 2023 baseload futures for the three large consuming states.

Market traders expect a greater $30/MWh between what a customer in NSW has to pay, if they bought at spot, and what one in Victoria has to pay. That’s an absolute indictment of transmission planning.

And that gap is expected to persist in FY24.

NSW prices are because Liddell is closing and NSW is exposed to export thermal coal prices which are at levels that would have been as impossible two years ago.

Victorians, Tasmanians and South Australians would bust a gut to get access to NSW and Queensland coal prices but at the moment, thanks to transmission constraints, the NEM is a farce.

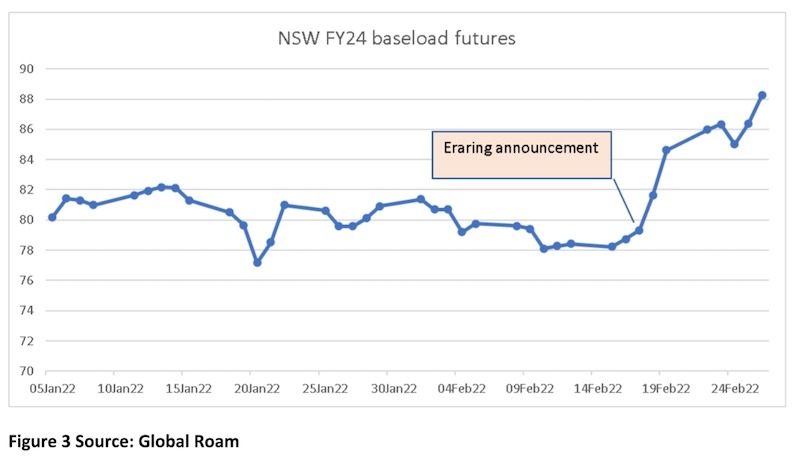

Futures for FY24 baseload have risen 10% or $8/MWh since the Origin announcement that Eraring will be closed seven years ahead of schedule, in 2025. This must reflect a market view that the power station will already be winding down that year, although not really scheduled to close prior to FY25

Project EnergyConnect is not currently scheduled to be fully operational until FY26, although it does appear that about 12 months of the back-end of the schedule is devoted to testing of one sort or another.

Gas and spot electricity prices are way up

Coal prices remain at stratospheric levels. This will concern not just Eraring and Vales point management but also AGL, because Bayswater’s low-cost contracts run out in about five years.

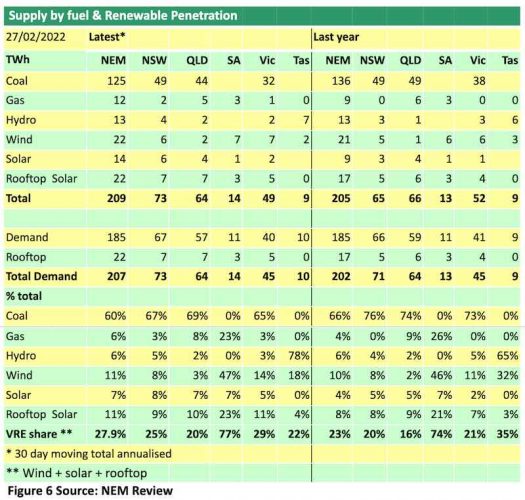

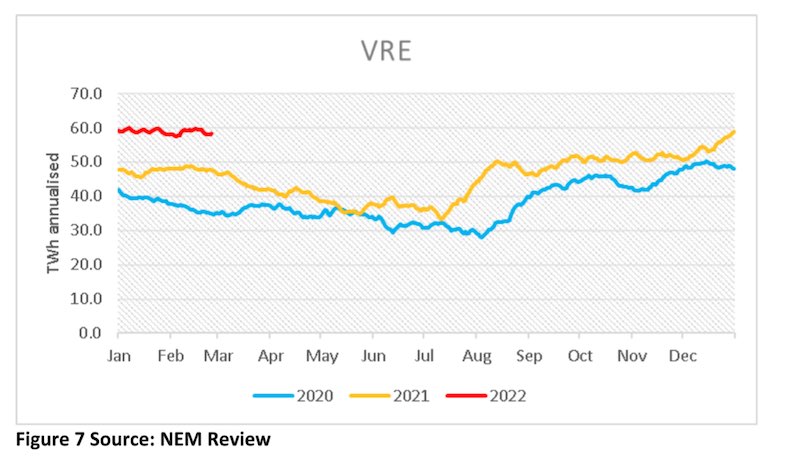

And finally, the variable renewable energy share continues at around 30%, although no doubt solar is down a bit due to weather.

Gas production has been up on last year, recently, mostly in NSW. But what’s encouraging is the big increase in utility-scale solar; up to 14TWh of annualised summer production compared to 9TWh this time last year.

In absolute terms, though, it’s rooftop solar that continues to shock and awe, currently running at a summer annualised rate of 22TWh, with the NSW leading the increase and in total competing with Queensland for largest in the NEM.