A report in the AFR states that French company Engie has invited investment banks “seeking pitches around potential sale structures and valuations for the portfolio”.

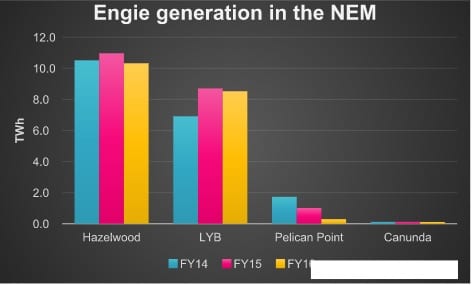

The assets of Engie are its interests in the Loy Yang B and Hazelwood coal generators, the Pelican Point gas plant in SA, the Kwinana gas fired plant in WA, the Canunda 46 MW wind farm and the “Simply Energy” retailing business. Simply has 0.5 m customers. Mitsui owns 28%-30% of the assets.

Engie (the parent company) recently held an investor day, where the institutional shareholders and investment bank analysts are given a “jolly” and the company trots out the senior management team to present on the company’s future strategy and prospects.

There were 159 slides in the presentation but Australia featured in very few of them. Separately Engie presented some pro forma 2015 financials of its revised corporate structure. That document disclosed that in 2015 calendar year Engie Australia earned 233m Euro ebitda out of a consolidated total of 11.2bn euro, or just 2%. In short, there is every reason to think that Engie is a seller in Australia.

A$343 M OF EBITDA, BUT THAT’S PROBABLY BEFORE 28% MINORITY INTEREST

233 m euros is about A$343 m at spot exchange rates. Common rules of thumb, and they are nothing more than that, are ebitda multiples and a % of replacement cost approach. A business of this kind in the absence of a carbon problem, and assuming Pelican Point had a gas supply, would be worth 9-11X ebitda given today’s interest rates, or maybe $3.5 bn.

However, we, and we expect everyone else including Engie, would expect the business to sell for much less.

Understanding how much less though requires being able to break down the profits of the business asset by asset and examining the sustainability, capex requirements, liabilities to build up a cash flow projection. We don’t have access to that information and so we are guessing.

Looking at the main assets we’d summarise the back of the envelope, and that is certainly all it is valuation thoughts as:

Asset discussion

Pelican Point is a key strategic asset in South Australia, but it hasn’t operated much over the past 24 months largely we think because the gas has been sold. However, it’s one of the mysteries of the industry as to where the gas has gone. Pelican Point would likely be attractive to both AGL and ORG and possibly to CLP. AGL would have a trade practices problem but might see value in building a renewable project on the Torrens Island (TIPS) site and swapping TIPS for Pelican Point.

Still, we see Origin as the most natural owner. Any buyer would need to have access to gas to make it work which is why we think it’s a natural for AGL and ORG. ORG in particular only has modest generation capability in South Australia and owns the largest share of the offshore Otway gas fields.

Pelican point is earning very little revenue right now. To operate at say a 65% capacity factor would take about 30 Pj per year of gas. The station was built in 2000. Gas power stations suffer performance degradation over time due to heat, pressure and gas impurity impacts as well as centrifugal forces. The technical life of a CCGT is about 30 years and economic life maybe 25 years. Pelican Point is conceptually about half way through its life span.

New CCGT in Australia probably cost around A$1.6m a Mw with thermal efficiency of 60%. So a replacement would cost around $750m.

The gas supply though is the key. The plant’s variable cost is something like $5 MWh +(7.5*gas price ). Provided the gas is costing less than competitor gas (TIPS B owned by AGL) Pelican Point should be more profitable. Gas generation is the price setter in South Australia when the wind supply drops and the price is broadly set by the highest cost gas generator dispatched. With a competitive gas supply Pelican Point might be worth $350-$450 m (close to its historic cost in nominal $) without it much less.

- Loy Yang B (LYB) is a “relatively” modern 1GW brown coal generator in Victoria. LYB is unique in the Victorian brown coal assets in that it doesn’t have its own coal mine but takes coal from the nearby AGL owned LYA. This raises its variable costs but doesn’t make much difference to total annual cost since LYA has to operate the mine and incur the fixed costs.

- LYB has been the power station responsible for supplying the Portland Aluminium smelter in Victoria but that arrangement comes to an end in November. It’s possible therefore that LYB is relatively uncontracted going into 2017 which in the current Victorian market might be an advantage. It’s very hard to know who would buy LYB. ORG only has the Mortlake open cycle gas fired plant in Victoria and is therefore net short generation in the State but we can’t see them stepping up to the plate here. AGL wont and we doubt CLP will. Therefore we see this asset as most likely going to a foreign buyer or an ambitious local entrepreneur. LYA at 2.1 GW with the coal mine sold for about $3.1 bn only a couple of years ago so on that basis LYB is worth between $0.8 bn and $1 bn.

- Hazelwood seems unsaleable but every asset has a price. Hazelwood earned $420 m of spot revenue in FY16. Its variable operating costs were likely no more than $100 m, even allowing for capital expenditure of $50-$100 m per year and we estimate the operating cash flow after capex but before interest and tax at more than $100 m per year. Although some analysts think there are very large closure costs associated with Hazelwood our research on the topic lead us to believe at this stage that those costs are manageable (<$150 m).

- We base that on the company’s rehabilitation provisions, allowances made in NSW for coal mine rehabilitation and a study of the vastly higher costs of rehabilitating the East German lignite mines. For anyone interested in the East German experience a presentation can be found at East Germany Clean up presentation . That presentation is a great read of what can be done, albeit at vast cost, but we don’t think the same thing would happen in the Latrobe valley. It’s more a case of turing the coal pit into a river and demolishing the power station. Possibly some other generation asset could be built there to take advantage of the transmission infrastructure.

- Simply Energy could be valued on a per customer basis. One of the mysteries of Engie Australia is what happened to Pelican Point gas. Perhaps its sale profits can be found in the Simply Energy segment. The most recent transaction was the acquisition of Lumo by Snowy. In this acquisition Snowy paid $600 m for 0.54 m customers plus 165 mw of peaking generation. If we valued the generation for the sake of argument at $150 m this would suggest around $450 m for the customers or around $1200 each. Lumo had a track record of profitability and we have seen little in the past to indicate that Simply is particularly profitable. Frankly we are surprised it has 0.5 m customers. We guess the retail business might be worth $300-$400 m, maybe more on a good day. As for who might buy it, we’d expect Snowy to have a look, possibly the big retailers, and possibly the NZ gentailers. Possibly for instance Meridian might see it as a way to accelerated its Powershop business in Australia. Generally there are some economies of scale with retail and it comes down to assessment of the actual customer quality and the bad debt outlook as well as the electricity and gas supply contracts the retailer holds.

- Waubra: Installed wind farms are popular assets and easy to sell. Ironic isn’t it. Both the Macarthur wind farm of AGL and the Cullerin Range wind farm of ORG sold for good prices and were keenly contested.

- Kwinana. We think Engie has a net 49% of this 122 MW power station and suspect that the evalue is modest.

An IPO wouldn’t be easy

It’s possible that Engie Australia could be listed on the ASX as a going concern. To do this would require investors to see a gas supply for Pelican Point, a clear plan for Hazelwood and LYB and a credible Board and Management team. As the business looks from the outside today we think it would be difficult to IPO and would certainly sell at a very sharp discount to AGL and ORG.

Acquisition by CLP and separation into good and bad company

CLP Australia, owner of Yallourn, Tallawarra, Mt Piper, various wind farms and the third largest retailer by customers numbers in Australia quite close resembles Engie Australia in terms of asset mix. CLP faces similar problems except that its held on to its gas supply for Tallawarra and has a larger retail base. CLP, at one stage under its former Australian management, looked hard at an IPO, but when it became clear that profits and business performance at that time weren’t up to scratch pulled it. One possibility that could be looked at is combining the CLP and Engie assets, separating them into a good and bad company and floating them both on the ASX.

The bad company (the brown coal generators) would be run to suit those investors who focus mainly on near term cash flows and who don’t worry so much about closure liabilities or future uncertain renewable supply and carbon taxes. It would sell at a low PE ratio but could provide a high dividend yield. The retail business could own the wind farms and the gas generation, would have a higher PE ratio and a lower yield with a bit more focus on investment and growth. Funding for the Engie acquisition could come from the CLP IPO plus some debt. CLP would remain as a major shareholder providing credibility and having a smaller share of a larger business. The retail business would be one of the largest in Australia. Still it’s easier to write these things than to get the numbers to stack up.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.