Victorian Energy Efficiency Certificates (VEECs)

While stronger VEEC pricing across the first half of 2018 has been predicated upon expectations of reductions in supply owing to the introduction of the commercial lighting discount factors, actual VEEC supply has in recent months increased.

During June this was again the case yet the spot price increased regardless.

The explanation for this appears to be based on the argument that the increase in VEEC submissions that occurred across May and June will be short lived and reflects either legacy installations from 2017 or a concentration of installations ahead of the deadline for the implementation of the second tranche of discount factor for commercial lighting.

Specifically, in May the recovery in submissions was put down to the rush to complete commercial lighting installs before 1stMay when the second discount factor would come into operation.

The end of June is the cut-off date for submissions of VEECs with a 2017 vintage activity date, a mechanism used by the regulator to ensure that creators submit their forms in a timely fashion.

With the risk of forfeiting the right to create looming, just over 30% of the total VEECs submitted during June were 2017 vintage certificates.

With these events now out of the way, and with the passage of time ensuring a greater proportion of VEEC submissions coming from installations completed after 1stMay, the argument runs that VEEC supply will now start to fall. Indeed July and August will be a litmus test for this assertion with evidence of a clear reduction being closely watched for.

In terms of market activity the spot spent most of the month in the $23s, with the $24 mark only surpassed in the final week. Once it broke that figure however the market continued on its way to a high of $25.15, before ultimately closing at $24.85 an increase of 5.7% on May’s close.

The month also bore witness to a number of busy periods of forward market activity with trades for settlement across much of 2019 taking place in particular early in the month in the low to mid $24s.

New South Wales Energy Savings Certificates (ESCs)

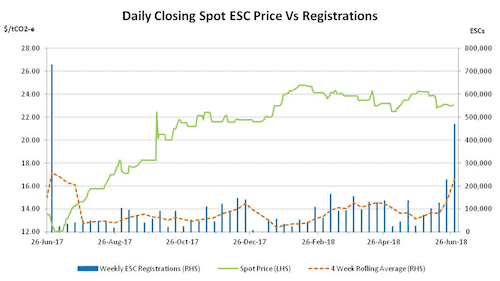

The first half of 2018 had already signalled a substantial reversal of the sharp decline in ESC registrations across the second half of 2017. The months of March and April were consistent and strong and while May saw 3 softer weeks, June was always going to be the big one.

The 30thJune represents the final date by which ESCs of the previous year’s vintage must be registered and hence June tends to see large numbers of ESCs flushed out often at the 11thhour. In 2017 the final week famously yielded a record weekly creation number of 729k.

This time around the market could only manage 469k in the same week, though coming on the back of 227k the previous week it was enough to take a serious chunk out of the 2019 target, given enough ESCs were already available by the middle of June to meet the 2018 target of circa 4.4m.

Yet the 30thJune also provides the market with an opportunity to take a snapshot of the ESC supply/demand balance to compare year on year changes. While compliance takes place in late April, liable parties have until 30thJune to surrender ESCs without the requirement to pay the shortfall penalty.

Given (as mentioned above) the date is also the cut-off for registrations of ESCs from the previous vintage it is a opportune moment to assess the scheme’s surplus.

At 30thJune 2017 the surplus of 2016 (or earlier) vintage ESCs that remained un-surrendered was 3.75m or 92% of the 2017 target. Across the second half of 2017 it appeared that the next time the figure was calculated it was all but guaranteed to have shrunk.

Instead, this time around the number of 2017 (or earlier) vintage ESCs left un-surrendered had grown to 4.3m ESCs or 98% of the 2018.

With this as a back drop the spot ESC market softened across the first half of the month to reach a low of $22.80 before ultimately recovering to spend the back end of the month at $23.10, a drop of 4.5% on May’s close.

The forward market was particularly busy in the early part of the month with forwards for settlement across the latter part of 2018 agreed in the mid $24s, while later the month the activity moderated as prices came down.

Looking to the future, with all the ESC creation in June a quieter period is expected in the immediate short term. Beyond that the question becomes one of impact to supply resulting from the reduction in ESC creation from the new commercial lighting methodology which takes effect on 1stNovember.

On the one hand the changes will ultimately see a substantial reduction in the number of ESCs created per install when compared to the current rules. In truth the presence of this looming change is likely what prevented the large increase in ESC supply over recent months from more dramatically impacting on ESC prices.

Yet it is also possible that the changes will yield a medium term spike in ESC volumes as installers pull forward activity ahead of the deadline to ensure their customers get in before they are worse off. How big any such run of activity will be will likely prove very important for ESC prices across the latter part of 2018.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.