Victorian Energy Efficiency Certificates (VEECs)

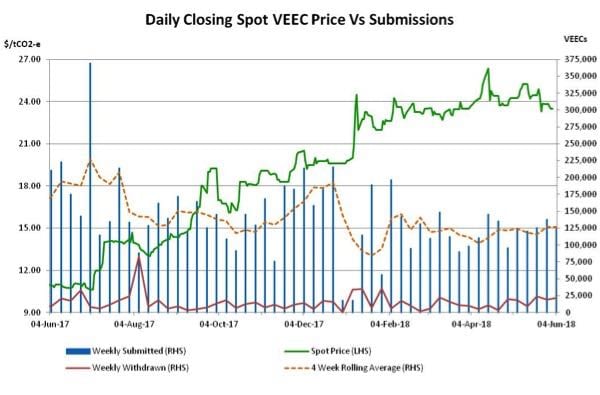

The final step in the commercial lighting transition, a recovery in VEEC submissions as well as speculation surrounding the impacts of the renewal of the scheme’s regulations brought volatility and ultimately, lower prices in the VEEC market during May.

As the transition in the VEEC market’s prime creation methodology continues, so too does the unpredictability of the results it yields.

On 1st May, the deadline for installation for the second and final tranche of the commercial lighting methodology discount factor changes took effect.

All installs completed after that date will see a doubling of the discount rate, which will result in a 20% reduction in the number of VEECs per install for T8 and T12 replacements and a 30% reduction for high intensity discharge lamps when compared to the original rules.

Unsurprisingly, installers did their best to get as many jobs completed by this date as possible.

As a result, the decline in submissions which was seen across February and March has been replaced by stability across April and May with the 4 week rolling average sitting up at 125k by late May.

Indeed in recent weeks the trend has almost been one of increasing submissions and with the deadline for the uploading of 2017 vintage VEECs looming on 30th June which may yet cause a further increase in the coming month.

It therefore appears to be another case of the pipeline of VEECs having been bigger than what was previously thought. Equally as important however is where supply will go from here.

The anecdotal evidence is that commercial lighting sales for high bays have been in decline and even if they were not, once a greater proportion of post 1st May installs begins to flow through to the submissions numbers there will be a natural decline in the number of VEECs created even if installs remain constant.

In terms of trade activity it was an active month in the VEEC market, with the spot opening at $24 before trading steadily up to a high of $25.25.

Maintaining the range seen across most of the early part of 2018 a downward trend then ensued, resulting in the market bottoming out at $23.30.

The spot ultimately closed at $23.50, down 2% on April’s close.

The forward market was also well frequented with the bulk of activity taking place in the first half of the month between the high $24s and the high $25s, before more sellers emerged in the $24-24.50 range toward month end.

May also saw a consultation kicked off by the relevant department (Energy, Land, Water and Planning) for the renewal of the scheme’s regulations which will sunset later this year after being in place for 10 years.

Along with many changes aimed at improving efficiency and simplifying the scheme’s administration, a number of key changes have been proposed which are worthy of consideration for those mulling over supply considerations moving forward.

Perhaps top of the list are proposed changes to the commercial lighting methodology aimed at discouraging the modification of luminaires and instead at encouraging full replacement lighting options.

This is particularly relevant in the case of office buildings where the installation of two LED tubes with a modification is an option as opposed to the complete replacement of the luminaire with an LED panel.

In the example outlined the proposed reduction for modifications was in the order of 45% of the number of VEECs created, whilst in the case of replacement of luminaires an increase in the order of 15% was proposed.

Another major change was the proposal of a ‘fresh start’ or ‘clean slate’ for the number of times an activity had been undertaken at a premises.

This change is aimed at addressing the issue of duplications which currently sees an installer enter a premises and undertake eligible activities without knowing that such activities may have already been undertaken in the past with the new products having been removed at some point.

As a result, the installation can be rendered invalid costing the installer product and wages. It is important to note that the proposed changes will still require all the scheme’s other rules to apply, i.e. it does not allow for lighting that was installed last year to be removed and replaced with newer versions of the same lights.

The proposed changes would take effect in December and in this sense are more of a medium to long term consideration for VEEC supply.

Any conclusions will need to be balanced against the shorter term changes that are likely to result from the commercial lighting discount factor changes.

New South Wales Energy Savings Certificates (ESCs)

Some respite from the persistently strong ESC registration figures seen across the early part of this year was enough to see the ESC market rally during May. Yet eyes remain firmly on ESC supply leading into the 30 June cut off date for 2017 vintage certificates, particularly after the highlights experienced at the same time last year.

I have previously noted the solid run of ESC registrations which took place from February to late April and undermined the previously apparent thesis that there had been a significant downturn in activity in the market.

During May, with many participants back in audit, there were a number of slower registration weeks which allowed the 4 week rolling average to fall from above 120k to just below 70k by the end of the month.

The market began the month by softening with the spot opening at $22.95 on its way to a low $22.50 amid healthy forward market activity around the $23.00 mark.

With ESC registrations having taking a breather the market then recovered with the spot trading progressively higher, breaching the $24 mark in the middle of the month.

The market was quiet stable across the second half of May with the spot ultimately closing at $24.20, a 4% increase on April’s close.

The forward market was definitely where the lion’s share of volume took place with plenty of action around the mid $24s for settlements in late 2018 and early 2019.

While things appeared quite positive across May, in the back of many minds remained the looming 30th June deadline for registration of 2017 vintage ESCs.

In previous years the vintage deadline has flushed out many ESCs and often impacted on price, with 2017s record week of 728k the most notable example of this.

It is important to note however that the 30th June 2017 was a special case with the vintage deadline aligning with the cut-off date for registrations under an older set of compliance rules.

Whilst there are few who believe that anything like last year will take place again, it certainly appears likely that June’s registration figures will be strong. Just how strong is the question.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.