Australian lithium miners are enjoying a banner year on the back of soaring prices being paid by EV battery makers stretched to keep up with demand for the key mineral.

Two of Australia’s biggest lithium miners, Pilbara Minerals and Allkem this week posted combined profits of more than $1 billion. A year ago, both companies reported losses.

Strong demand and international prices led Pilbara Minerals to its first-ever annual profit of $561.8 million.

Allkem, renamed after the merger of miners Galaxy Resources and Orocobre in 2021, is enjoying a strong balance sheet, too on the back of robust pricing that led to an 800 per cent leap in revenue and a net profit of $US337.2 million ($A487 million)

Allkem CEO Martin Perez de Solar is now reassuring investors it holds ample funds to complete construction of a second lithium project in Argentina and start another one in Canada after clocking strong profits on hefty lithium selling prices to battery makers.

Allkem already operates lithium mines in Australia and Argentina and is constructing its Sal de Vida Project in Argentina’s Catamarca Province, which lies within the “lithium triangle”, an area encompassing Chile, Bolivia and Argentina, which geologists believe holds a significant portion of the world’s lithium.

The company is also drawing up blueprints to mine lithium in Canada’s Quebec province from its James Bay resource.

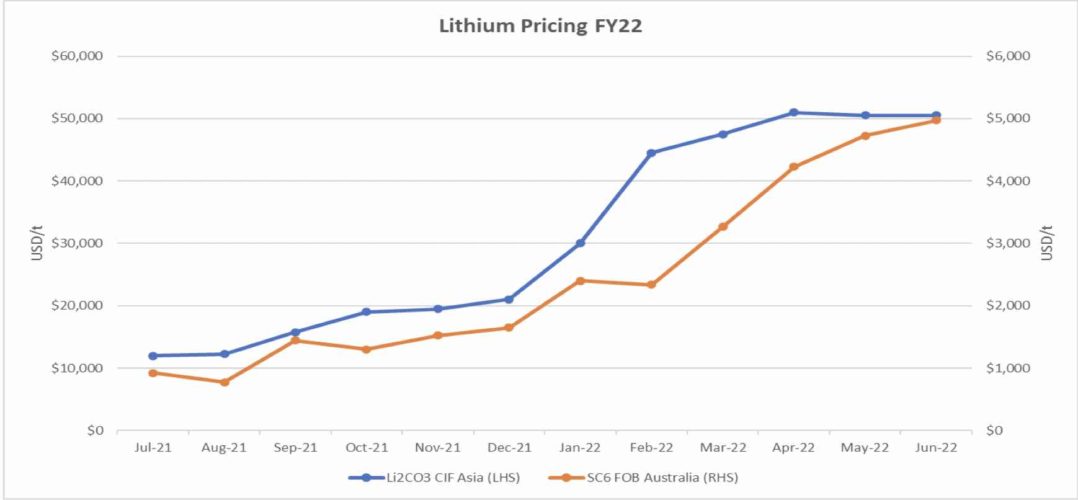

Prices for lithium carbonate — chiefly used in battery making — were up 370 percent in the past year to an average $US23,398 a tonne, according to the company.

They were recently riding close to $US50,000. Allkem is predicting average pricing for lithium carbonate will be $US47,000 in the first half of the 2023 fiscal year, signalling more bumper profits ahead.

Renamed Allkem after the merger of miners Galaxy Resources and Orocobre in 2021, CEO Martin Perez de Solay says the company is enjoying a strong balance sheet on the back of robust pricing that led to an 800 per cent leap in revenue and a net profit of $337.2 million in fiscal 2022.

Last year, the company lost $89.5 million.

“With two revenue-generating operations being supplemented in fiscal 2023 and a strong balance sheet, we are fully funded to complete construction at Sal de Vida and the development of James Bay,” Perez de Solay said.

Allkem already produces a lithium spodemune concentrate at its Mt Cattlin deposit in Western Australia and lithium carbonate from Olaroz in northern Argentina.

The company recently struck a three-year extension to supply China’s Yahua International Investment & Development Co. with 120,000 tonnes of lithium a year.

It also holds a three-year contract to supply Shanghai-based battery material maker Chengxin Lithium Group with 60,000 tonnes annually.

Macquarie Group this week lifted its price forecast for lithium spodumene by 55 percent in 2023 then double over each of the next three years.

Allkem’s Olaroz facility sells primary and purified lithium to around 100 customers in Asia, Europe and North America.

The main customers for primary lithium are the ceramic, chemical and glass markets, while a purified grade is typically sought after by cathode manufacturers for use in battery manufacturing.

Perez de Solay says he expects the company’s business to expand threefold by 2026, with an aim of maintaining 10 per cent share of the global market as the lithium industry grows with the increasing adoption of electric vehicles.

“With two revenue-generating operations being supplemented in fiscal 2023 and a strong balance sheet, we are fully funded to complete construction at Sal de Vida and the development of James Bay,” he said.

Allkem already produces a lithium spodemune concentrate at its Mt Cattlin deposit in Western Australia and lithium carbonate from Olaroz in northern Argentina.

It recently struck a three-year extension to supply China’s Yahua International Investment and Development with 120,000 tonnes of lithium concentrate a year.

It also holds a three-year contract to supply Shanghai-based battery material maker Chengxin Lithium Group with 60,000 tonnes annually.

Macquarie Group this week lifted its price forecast for lithium by 55 percent in 2023 and by more than double the following three years.

Perez de Solay expects Allkem’s business to expand threefold by 2026, with an aim of maintaining 10 per cent share of the global market as the lithium industry grows with the increasing adoption of electric vehicles.

He also sees Allkem benefiting from new U.S. climate laws that require minerals for EV batteries to be sourced in North America or from countries holding a free-trade agreement with the United States, such as Australia.